Westjet 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

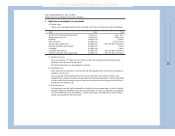

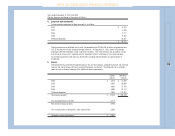

Years ended December 31, 2001 and 2000

(Tabular Amounts are Stated in Thousands of Dollars)

1. Significant accounting policies (continued):

(l) Stock-based compensation plans:

The Corporation has stock option plans, which are described in note 6. No compensation expense is

recognized for these plans when the options are issued. Any consideration received on exercise of

the stock options is credited to share capital.

(m) Financial instruments:

The Corporation manages its foreign exchange exposure through the use of options, forward

contracts and cross currency swaps. Resulting gains and losses are accrued as exchange rates

change to offset gains and losses resulting from the underlying hedged transactions. Premiums and

discounts are amortized over the term of the contracts.

The Corporation manages its exposure to jet fuel price volatility through the use of fixed price and

fixed ceiling price agreements. Premiums and discounts are amortized over the term of the contracts.

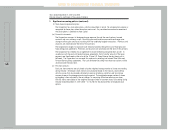

The Corporation has entered into an agreement to lease ten Boeing next generation aircraft. In

accordance with these aircraft operating lease agreements, the U.S. dollar amount of the lease

payments are fixed based on the value of the 10-year U.S. Swap Rate on the day the aircraft is

delivered. The Corporation has managed this exposure by entering into Interest Rate Collar and

Forward Starting Swap agreements. Any cash settlement resulting from these transactions will be

amortized over the lease term.

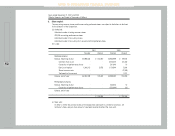

(n) Per share amounts:

Basic per share amounts are calculated using the weighted average number of shares outstanding

during the year. Diluted per share amounts are calculated based on the treasury stock method,

which assumes that any proceeds obtained on exercise of options would be used to purchase

common shares at the average price during the period. The weighted average number of shares

outstanding is then adjusted by the net change. In computing diluted net earnings per share,

879,455 shares were added to the weighted average number of common shares outstanding during

the year ended December 31, 2001 (2000 – 2,115,738) for the dilutive effect of employee stock

options.

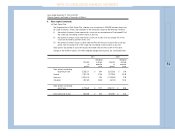

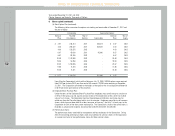

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS