Wacom 2016 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2016 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1615

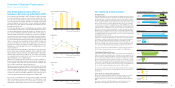

Financial Section Five-Year Summary

For the fiscal year:

Net sales

Gross profit

Operating income

Income before income taxes

Net income

Comprehensive income

At fiscal year-end:

Cash and cash equivalents

Total assets

Total net assets

Net income per share

Basic

Diluted

Equity ratio(%)

Return on equity (%)

The number of employee(person)

$688,392

272,772

32,520

31,927

20,496

12,758

$127,485

457,638

275,971

$0.12

0.12

Thousands of

U.S. dollars

Year ended

March 31

2016

¥40,705,578

18,040,993

4,067,475

3,504,537

2,181,341

2,007,351

¥11,969,873

34,129,398

18,917,895

¥13.66

13.65

55.2

11.7

785

¥61,068,078

24,235,314

7,915,051

7,545,8 05

4,770,485

5,870,100

¥21,596,429

50,124,193

29,211,533

¥29.81

29.69

58.1

19.9

930

¥74,557,460

30,050,300

6,142,669

5,106,695

3,473,144

3,821,345

¥16,686,619

51,456,857

33,858,970

¥20.86

20.82

65.4

10.5

1,072

¥77,568,014

30,735,985

3,664,362

3,597,489

2,309,514

1,437,540

¥14,365,031

51,566,632

31,096,396

¥14.00

13.99

60.0

7.1

1,055

Thousands of yen

Years ended March 31

2012 2014 2016

¥78,615,309

29,931,103

8,663,092

8,268,645

5,248,762

6,799,072

¥15,393,939

50,859,157

32,799,328

¥31.31

31.13

64.2

17.0

1,035

20152013

Note 1: The translation of Japanese yen amounts into U.S. dollar amounts is included solely for the convenience of the readers outside Japan and has been calculated at the rate

of JP¥112.68 = U.S.$1.00, the approximate rate of exchange on March 31, 2016.

Note 2: Net Income from 2016. 3 F. Y. is equivalent to Net Income Attributable to Owners of Parent.

Note 3: The Company conducted a 400-for-1 share split based on the resolution of the Board of Directors held on April 30, 2013, resolved to adopt the stock split and the unit

share system, effective as of June 1, 2013. Net income per share and diluted net income per share have been calculated assuming that the stock split was conducted at

the beginning of the year ended March 31, 2012.

18,041

24,235

(Millions of yen)

’12 ’13 ’12

(Millions of yen) (Millions of yen)

’13

(%) (%)

5

0

10

15

’12

(For the years ended March 31) (For the years ended March 31) (For the years ended March 31)

Net sales Operating income/Operating margin

Gross profit/Gross profit margin

40,706

’13 ’14

4,067

61,068

’14

78,615

’15

74,557

’16

77,568

44.0

39.7

29,931

’14

30,050

’15

40.3

30,736

’16

39.6

10.0

13.0

11.0

Wacom Co., Ltd. and its subsidiaries

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

0

2,000

4,000

6,000

8,000

10,000

8,663

’15

8.2

6,143

’16

4.7

3,664

7,915

0

10,000

20,000

30,000

5,000

15,000

25,000

35,000

30

40

50

35

45

38.1

SBP - 2019

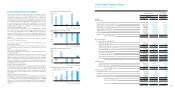

Wacom Strategic Business Plan

Evolve the business model toward mobile and cloud for

reaching new customers as well as expanding existing

business. In addition, improve the speed and profitability

by leveraging our global business infrastructure.

Basic Strategy

● Evolve the business toward mobile, cloud and ecosystems.

● Accelerate the growth with a new global business organization and enhanced global integration.

● Accelerate creative business with mobile product line expansion, 3D penetration and emerging market investment.

● Reach new consumer users with Digital Stationery and cloud.

● Expand the Technology Solution (former Component) Business with AES and WILLTM (Wacom Ink Layer Language).

● Enhance business workflow and security solutions by leveraging WILLTM and digital signature solutions.

● Leverage global business system for efficiency, speed and profitability.

’15(actual) ’16(actual) ’17(forecast) ’18(plan) ’19(plan)

Operating income/Net incomeNet Sales

For the years ended/ending March 31

’15(actual) ’16(actual) ’17(forecast) ’18(plan) ’19(plan)

For the years ended/ending March 31

Financial Goals by the fiscal year ending March, 2019

• Consolidated sales: 120 billion JPY

• Consolidated operating profit margin: 12%

• Consolidated ROE: 20% or higher

Unit: Millions of yen Unit: Millions of yen

Other Business

Technology Solution Business

Brand Business Operating income

Net income

6,143

3,664

2,310

4,200

3,473 3,000

14,400

9,800

0

5,000

10,000

15,000

0

120,000

100,000

80,000

60,000

40,000

20,000

74,557 77,568 82,000

120,000

The target for the fiscal year ending March 2019 is maintained as we

expect Brand Business to exceed the original plan, hedging risks of the

underperformance of Technology Solution Business.

Raise profitability by significant improvement of operational efficiency and

quick decision-making through leveraging global IT Infrastructure.

Assumed foreign exchange rate: 1USD =110JPY, 1EURO = 130JPY

The financial goals in SBP-2019 were announced on April 30, 2015.

The financial forecasts in the fiscal year ending March 2017 were announced on May 11, 2016.