Wacom 2016 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2016 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

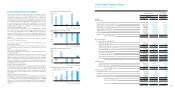

2019

Current assets -

Cash and deposits

Notes and accounts receivable-trade

Merchandise and finished goods

Work in process

Raw materials and supplies

Deferred tax assets

Others

Allowance for doubtful accounts

Total current assets

Noncurrent assets -

Property, plant and equipment:

Buildings and structures

Accumulated depreciation

Buildings and structures, net

Machinery, equipment and vehicles

Accumulated depreciation

Machinery, equipment and vehicles, net

Tools, furniture and fixtures

Accumulated depreciation

Tools, furniture and fixtures, net

Land

Total property, plant and equipment

Intangible assets:

Software

Software in progress

Others

Total intangible assets

Investments and other assets:

Investment securities

Deferred tax assets

Others

Allowance for doubtful accounts

Total investments and other assets

Total noncurrent assets

Total assets

Wacom Co., Ltd. and its subsidiaries

Consolidated Balance Sheet

Assets:

¥16,686,619

9,875,726

7,701,8 01

400,084

2,114,966

1,229,497

2,220,080

(41,268)

40,187,505

3,382,821

(1,696,836)

1,685,985

1,104,298

(397,792)

706,506

3,937,461

(2,912,270)

1,025,191

1,190,703

4,608,385

1,823,371

3,259,519

358,946

5,441,836

587,290

55,678

654,045

(77,882)

1,219,131

11,269,352

¥51,456,857

$127,485

90,184

73,032

2,400

14,182

12,945

16,817

(929)

336,117

31,578

(15,848)

15,730

9,443

(4,152)

5,291

38,975

(30,216)

8,759

10,497

40,277

25,603

42,800

3,760

72,163

2,140

805

6,826

(690)

9,081

121,521

$457,638

March 31 March 31

Thousands of yen Thousands of

U.S. dollars

2016 20162015

¥14,365,031

10,161,958

8,229,212

270,483

1,598,066

1,458,666

1,894,900

(104,672)

37,873,644

3,558,171

(1,785,737)

1,772,434

1,064,058

(467,822)

596,236

4,391,719

(3,404,725)

986,994

1,182,748

4,538,412

2,884,895

4,822,758

423,719

8,131,372

241,167

90,677

769,109

(77,749)

1,023,204

13,692,988

¥51,566,632

Consolidated financial position

(For the years ended March 31)

0

Cash Dividends per Share / Payout Raito

’12

Cash Dividends per share(yen)

Pay out Raito(%)

10

5

’13 ’14

(Millions of yen)

(Millions of yen)

’12

(For the years ended March 31)

(For the years ended March 31)

(For the years ended March 31)

Cash flows from operating activities

Cash flows from investing activities

(Millions of yen)

Cash flows from financing activities

-1,697

’12

-1,611

’13

-4,416

-3,278

’14 ’15

-4,878

’16

’15

’15

4,881

5,895

-1,627

’13

4,337

’14

Total assets as of March 31, 2016 increased by ¥110 million to ¥51,567

million compared to the end of the previous fiscal year. The main factors

contributing to this were an increase of ¥1,062 million in software, an

increase of ¥1,563 million in software in progress, and a decrease of

¥2,322 million in cash and deposits. Total liabilities as of March 31, 2016

increased by ¥2,872 million to ¥20,470 million compared to the end of the

previous fiscal year. The main factors contributing to this were an

increase of ¥3,400 million in short-term loans payable, an increase of

¥2,000 million in long-term loans payable, and a decrease of ¥3,101 in

notes and accounts payable - trade .

Total net assets decreased by ¥2,762 million to ¥31,096 million compared

to the end of the previous fiscal year. The main contributing factors were

an increase of ¥2,310 million in net profit attributable to shareholders, a

decrease of ¥893 million in foreign currency translation adjustment, a

decrease of ¥2,999 million in the payment for shareholder’s dividends and

an increase of ¥1,121 million in treasury shares as deductions of net

assets.

As a result, the capital ratio decreased by 5.4 points to 60.0% compared

to the end of the previous fiscal year.

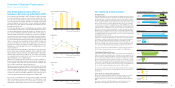

Consolidated cash and cash equivalents for the fiscal period ended

March 31, 2016 totaled

¥14,365 million, a ¥2,322 million decrease from the end of the previous

fiscal year. (A ¥1,293 million increase over the same previous fiscal

period)

(Cash Flow from Operating Activities)

Cash flow from operating activities during the fiscal period ended March

31, 2016 was ¥2,009

million (¥6,782 million generated in the same previous fiscal period). The

main factors contributing to cash inflow were an increase of ¥3,597

million in income before income taxes and minority, an increase of ¥2,004

million in depreciation, and an increase of ¥422 million in provision for

bonuses. The main factors contributing to cash outflow were a decrease

of ¥2,781 million in notes and accounts payable – trade and a decrease of

¥1,635 million in income taxes paid.

(Cash Flow from Investing Activities)

Cash flow from investing activities during the fiscal period ended March

31, 2016 was ¥4,878 million (compared to ¥3,278 million used in the previ-

ous comparable period). The primary contributing factors were a ¥1,167

million purchase of tangible assets such as equipment, and a ¥3,295

million purchase of system software and other such items for the global IT

infrastructure.

(Cash Flow from Financing Activities)

Cash flow from financing activities during the fiscal period ended March

31, 2016 was ¥1,209 million (compared to ¥2,850 million used in the previ-

ous comparable period). The primary contributing factor were a ¥5,400

million income from short-term loans payable, ¥1,245 million payment for

treasury stock acquisition, and a ¥2,992 million payment for shareholders’

dividends.

’12 ’13

734

6,782

’14 ’15

2,009

’16

0

-1,000

-2,000

-3,000

-4,000

-5,000

-4,000

-3,000

-2,000

-1,000

0

1,000

2,000

3,000

4,000

5,000

-3,255 -2,850

’16

1,209

54.9

37.7

11. 25

15

20 17.50 18.0

86.3

7.5 0

55.9

0

1,000

2,000

3,000

4,000

5,000

6,000

7,0 0 0

’16

18.0

128.6

60

90

120

150