Wacom 2016 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2016 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1817

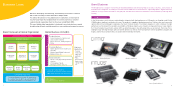

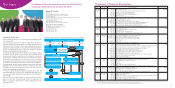

Our results by business sector

Brand business

In the Creative Business, sales of Pen tablets exceeded the previous fiscal year

owing to a significant increase in sales of Intuos in the Chinese market, as well

as favorable sales of new Intuos products released in September. In Mobile

products, Cintiq Companion 2, launched previous fiscal year, continued to

receive positive market reception. Overall sales greatly exceeded the same

period of the previous fiscal year. In Display products, at the end of the previ-

ous fiscal year we launched our flagship models, Cintiq 27QHD series, which

sold well and opened up a new market of production tools for 3D works. The

other lineups also contributed to an increase in overall sales compared to the

previous fiscal year. In Consumer products, to open up a new category of

digital stationery, in September we launched our new product, Bamboo Spark,

which digitalizes handwritten notes on paper to enable data sharing via cloud

computing and has been selling strongly. As a result, overall sales significantly

exceeded the previous fiscal year.

In the Business Solution, overall sales were below the previous fiscal year,

mainly due to a strong yen against the euro, a decrease in sales in Europe as a

consequence of large-scale deals in the previous fiscal year, and a postpone-

ment of capital investment driven by uncertainties in the global economy.

By region, overall sales exceeded the previous fiscal year in Japan, the U.S.,

Europe, Asia and Oceania, owing to steady sales of Creative Business prod-

ucts, especially in China with the rapid expansion in digital content creation.

As a result, overall sales in the Brand Business segment increased 12.2% to

¥48,931 million, and operating income increased 34.7% to ¥8,036 million.

Technology Solution Business

In pen sensor systems for tablets, a large-scale order from the government of

Turkey for an educational tablet project contributed to sales expansion. We

also increased the commercial production of our Active-ES pen sensor system.

These factors supported an increase in overall sales compared to the same

period of the previous fiscal year. However, in pen sensor systems for smart-

phones, overall sales fell below the previous fiscal year due to smaller orders

for Samsung’ s new Galaxy Note 5 compared with their previous model. Also in

pen sensor systems for notebook PCs, overall sales decreased dramatically

due to a shift in demand for digital pens from notebook PCs to tablets.

As a result, overall sales in the Technology Solution Business segment

decreased 7.6% to ¥27,974 million, and operating income decreased 32.6% to

¥3,130 million.

Other Business (Engineering Solution)

Overall sales slightly exceeded the previous fiscal year owing to a recovery in

demand for replacements in response to the termination of Windows XP

support, and the launch of the new products ECAD dio DCX R2 and ECAD dio

2016.

As a result, overall sales in the Other Business segment increased 1.2% to

¥663 million, and operating income decreased 35.1% to ¥36 million.

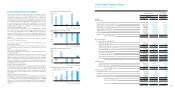

48,931’16

43,625’15

(For the years ended March 31)

(For the years ended March 31)

(Millions of yen)

(For the years ended March 31)

(Millions of yen)

Sales

Operating

income

Brand Business

UP 12.2%

UP 34.7%

8,036’16

5,965’15

Operating

income

Operating

income

3,130’16

4,642’15

27,974’16

30,227’15

Sales

Technology Solution Business

DOWN 7.6%

DOWN 32.6%

663’16

655’15

Sales

Other Business

UP 1.2%

DOWN 35.1%

36’16

55’15

Technology Solution Business 40.6%

(For the years ended March 31)

(Millions of yen)

Sales Breakdown by Business

Brand Business 58.5%

Other Business 0.9%

Technology Solution Business 36.1%

Brand Business 63.1%

Other Business 0.8%

2016

¥77,568

2015

¥74,557

Overview of Business Performance

How did the global economy effect our

business in the fiscal year ended March 2016?

Wacom Co., Ltd. and its subsidiaries

In the current fiscal year (April 1, 2015 to March 31, 2016), the global

economy maintained a slow recovery, mainly in developed coun-

tries. Since the fourth quarter, however, uncertainties in the global

economy have been increasing, driven by a worsening situation with

unsolved refugees issues in Europe. The yen strengthened against

the dollar in the fourth quarter. It remained strong against the euro

throughout the fiscal year.

In the Creative Business area in our Brand Business segment, digital

content creation for the movie, comic and game application sectors

has been expanding into emerging countries. In developed coun-

tries, we are seeing the spread of interest in 3D content, which is

directing significant attention to digital pens. In the Consumer Busi-

ness area, we have opened up a new digital stationery market,

featuring a product that can harmonize analog and digital informa-

tion, transforming hand-written analog ideas on paper into digital

data on screen via cloud computing, ready for editing, sharing, and

storing. In the Business Solution area, demand for cost-effective

paperless procedures and improved digital signature security is

growing across a broad range of sectors, including medicine, edu-

cation and finance.

In the Technology Solution Business segment, the high-end smart-

phone market saw a slowdown, leading to fierce competition and a

rapid change in industry structure. The tablet market continued to

stagnate due to weak sales of Android OS. The notebook PC market

also experienced slow sales due to factors such as an increasing

shift in demand to a ‘2 in 1’ tablet market.

Against this background, Wacom Group has further solidified its

position as a global leader and pursued investment strategies not

only to expand our product line-up in each business segment, but

also to enhance the Group’s future business base.

We have focused on restructuring the global supply chain and

developing global IT infrastructures from a long-term perspective in

response to rapid globalization and e-commercialization. Simultane-

ously, in order to pursue growth in our global business, we shifted

our previous region-based Global Business Unit structure into a

customer segment-based global organization from April 2015.

As a result, consolidated net sales increased 4.0% to ¥77,568

million, operating income decreased 40.3% to ¥3,664 million, ordi-

nary income decreased 37.7% to ¥3,777 million, and net profit

attributable to shareholders decreased 33.5% to ¥2,310 million.

0

10

5

15

20

25

30

0

5

10

15

20

25

30

40

50

60

70

80

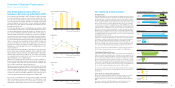

(Yen)

’12

(For the years ended March 31)

Net income per share (basic)

ROE/ROA

Equity ratio

13.66

’13

29.81

’14

31.31

’15 ’16

20.86

14.00

11.7

7.1

Note: ROA equals net income/average total assets.

55.2 58.1

(ROE)

(ROA)

19.9

11.3

(%)

’12

(For the years ended March 31)

’13 ’14 ’15

(%)

(For the years ended March 31)

’12 ’13

64.2

’14

65.4

’15

60.0

’16

6.8

10.5

’16

4.5

7.1

17.0

10.4