Vistaprint 2015 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2015 Vistaprint annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Investor:

This year, we celebrated the 20th anniversary of our company’s founding. We have much to be proud

of, much to be excited about, and much still to learn as we strive to build an enduring and

transformational business that serves the mutual interests of our customers, our team members, our

society and our long-term shareholders. We seek to do this through two objectives:

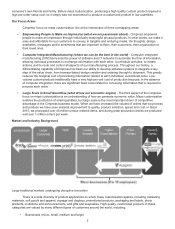

x Strategically, to be the world leader in mass customization

By mass customization, we mean producing, with the reliability, quality and affordability of mass

production, small individual orders where each and every one embodies the personal relevance

inherent to customized physical products.

x Financially, to maximize intrinsic value per share

This is our uppermost financial objective, to which we subordinate all other financial objectives.

We define intrinsic value per share as (a) the unlevered free cash flow per share that, in our

best judgment, will occur between now and the long-term future, appropriately discounted to

reflect our cost of capital, minus (b) net debt per share.

This annual report and its associated proxy statement are important documents: they provide extensive

detail and information about our company. But if you are considering investing your capital with us I

encourage you to also study my letter to investors of July 29, 2015 and the documents from our annual

investor day held on August 5, 2015. Those documents explain and illustrate, qualitatively and

quantitatively, how we think about our business. Below, I summarize some important parts of these

more detailed documents, which are available at ir.cimpress.com.

A central objective of our strategy since the inception of the company has been the pursuit of greater

scale because we believe that it is the single biggest driver of competitive advantage for our business

model and that the market opportunity for mass customization remains enormous.

Looking back at the past several years, our execution against the goals we outlined in 2011 has been

mixed. Our successes and our failures during the past four years taught us a great deal about how to

operate as a larger company, what we do well, how we believe we can win, the competitive landscape

beyond our traditional business model, where we want to play and what capabilities we need to build

and/or acquire.

As we enter fiscal 2016, Cimpress is in a position of strength in terms of our technology, our

manufacturing and supply chain operations, our international operations, the reputation of our brands, a

pipeline of strategically attractive and reasonably-priced M&A targets, and the talent of our team

members. Very importantly, we are also in a position of strength due to the clarity of our strategic and

financial objectives: this drives strong alignment of our supervisory and management boards, our

executive leaders and our team members as we make decisions and about the many subsidiary

strategies and tactics to achieve our top-level priorities.

In addition to operating and growing our business, a significant portion of our long-term intrinsic value

per share will come from intelligent capital allocation. With our significant steady state after tax-free

cash flow discussed below and our borrowing capacity, we have substantial capital at our disposal. We

endeavor to invest large amounts of capital into a portfolio of investments that we believe will generate

returns that are, on average, well above our weighted average cost of capital which, for fiscal 2016, we