Vistaprint 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 Vistaprint annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

• Hobbyists and consumers (home and family)

• Teams, associations and groups (TAG)

• Administration and governmental bodies

• Educational institutions

• Low-volume producers using mass customization products as an input to their own product

• Resellers and advisors who serve customers in the above groups

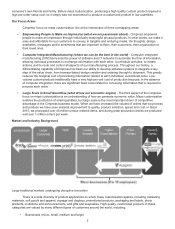

The product categories and customers listed above represent a large market opportunity that is highly

fragmented. Though we believe Cimpress is the largest single player in this market, and there are many other

sizeable companies who are pursuing mass customization via an e-commerce approach, we believe that a vast

majority of the markets to which mass customization applies are still served by traditional business models that

force customers to produce in large quantities per order, or to pay a very high price per unit.

Cimpress and other competitors who have built their business around a mass customization model are

“disruptive innovators” to these large markets because we enable small volume production of personalized high

quality products at an affordable price. Disruptive innovation, a term of art coined by Harvard Business School

professor Clayton Christensen, describes a process by which a product or service takes root initially in simple

applications at the bottom of a market (such as free business cards for the most price sensitive of micro-

businesses) and then moves up market, eventually displacing established competitors (such as the markets

mentioned above).

We believe there is a shift taking place in the large and fragmented printing market, with printing jobs

moving away from small traditional printers that fulfill a relatively small number of customer orders as they are

placed, toward companies with an online presence, such as ourselves, that use the reach of the Internet to

aggregate a relatively large number of orders and fulfill them in large, centralized and automated production

facilities, such as those we describe above. According to a 2012 PRIMIR market research study conducted by

InfoTrends, the dollar value of product shipments of North American online printing companies are growing against

a backdrop of a decline in the number of North American printing companies. We believe this trend is also taking

place in Europe.

We believe this opportunity to disrupt very large traditional industries can translate into tremendous future

opportunity for growth for the companies who execute this model well over a long period of time. To date, we have

primarily focused on a narrow set of customers within the list above (micro businesses, hobbyists and consumers).

With recent acquisitions, we have extended our ability to serve these microbusiness, hobbyists and consumers, and

have also added an ability to serve low-volume producers and resellers, who in turn serve micro, small and medium

businesses.

As we continue to evolve as a business, our understanding of these markets and their relative

attractiveness will also evolve. Below are descriptions of the marketplaces in which we have traditionally competed.

The marketplace for micro business marketing products and services

The primary market for our Vistaprint brand is the micro business market, generally businesses or

organizations with fewer than 10 employees and usually 2 or fewer. We believe that there are approximately

60 million businesses with fewer than 10 employees in the United States, Canada, and the European Union and

that these micro businesses undergo frequent changes with many forming and dissolving each year, creating a

large market for business identity and marketing products and services. We estimate that these micro businesses

spend approximately $30 billion per year on marketing products and services. We also believe that, in response to

the growth of the Internet and the emergence of digital production technologies, many micro businesses are shifting

from traditional suppliers of customized marketing products and media toward online alternatives.

Through customer research, we have analyzed the market opportunity related to micro businesses with

fewer than 10 employees into three conceptual market segments:

Form 10-K