Vistaprint 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Vistaprint annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

Table of contents

-

Page 1

-

Page 2

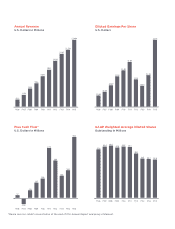

Annual Revenue

U.S. Dollars in Millions

$1,494

Diluted Earnings Per Share

U.S. Dollars

$2.73

$1,270 $1,167...FY06

FY07 FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

Free Cash Flow*

U.S. Dollars in Millions

$144

GAAP Weighted Average Diluted Shares

Outstanding in...Annual Report and proxy statement.

-

Page 3

... our supervisory and management boards, our executive leaders and our team members as we make decisions and about the many subsidiary strategies and tactics to achieve our top-level priorities. In addition to operating and growing our business, a significant portion of our long-term intrinsic value...

-

Page 4

... 30, 2015, we employed over 6,500 team members in more than 20 different locations across 19 countries. Without their talents we could never have grown into this company, and we could never achieve the objectives set out above. Sincerely,

Robert S. Keane Chairman of the Management Board, President...

-

Page 5

... of intangible assets not related to acquisitions, and capitalization of software and website development costs, plus payment of contingent consideration in excess of acquisition-date fair value. Steady-state free cash flow is defined as free cash flow as defined above, adjusted for the pro-forma...

-

Page 6

-

Page 7

... 31, 2014 (the last business day of the registrant's most recently completed second fiscal quarter) based on the last reported sale price of the registrant's ordinary shares on the NASDAQ Global Select Market. As of August 7, 2015, there were 32,449,801 of Cimpress N.V. ordinary shares, par value...

-

Page 8

...

Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accountant Fees and Services...

-

Page 9

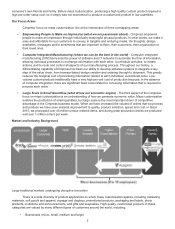

... creates value in many ways, not just lower cost. Other advantages can include faster production, more personal relevance, elimination of obsolete stock, better design, flexible shipping options, more product choice, and higher quality. Mass customization delivers a breakthrough in customer value...

-

Page 10

... ability to develop software systems to integrate every step of the value chain, from browser-based design creation and ordering through to shipment. This greatly reduces the marginal cost of processing information related to each individual, customized order. Lowvolume custom products traditionally...

-

Page 11

... large number of orders and fulfill them in large, centralized and automated production facilities, such as those we describe above. According to a 2012 PRIMIR market research study conducted by InfoTrends, the dollar value of product shipments of North American online printing companies are...

-

Page 12

... delivery often required long lead times. Graphic designs were limited and it was rarely possible to incorporate full color photography into the design. We serve the home and family market through the Vistaprint brand, as well as through our Albumprinter business unit, which in turn operates through...

-

Page 13

... design services in order to create great looking, customized products like flyers, catalogs, packaging, posters, presentation folders, signs, banners, logo apparel, business cards, labels, corporate gifts and more. These Cimpress brands focus on serving graphic professionals: local printers, print...

-

Page 14

... process and with the global scale of our production facilities, located in Canada, the Netherlands, Austria, Australia, France, Italy, Norway, and India, we can produce and ship an order the same day we receive it, which results in minimal inventory levels and reduced working capital requirements...

-

Page 15

...the assistance of our design support staff, to design and create high quality marketing materials from their homes or offices. • Our document model architecture and technology employs Internet-compatible data structures to define, process and store product designs as a set of separately searchable...

-

Page 16

incorporating the customer's initial design, facilitating the cross-sale of related products and services. In addition, through a global content management system, we ensure that changes and updates to our site experience are reflected across our network of localized Vistaprint websites in multiple ...

-

Page 17

... printers and graphic design providers; online printing and graphic design companies, many of which provide printed products and services similar to ours; office superstores, drug store chains, food retailers and other major retailers targeting small business and consumer markets; wholesale printers...

-

Page 18

... worldwide. Corporate Information Cimpress N.V. was incorporated under the laws of the Netherlands on June 5, 2009 and on August 30, 2009 became the publicly traded parent company of the Cimpress group of entities. We maintain our registered office at Hudsonweg 8, 5928 LW Venlo, the Netherlands. Our...

-

Page 19

... growth in relatively mature markets; our failure to promote, strengthen, and protect our brands; the failure of our current and new marketing channels to attract customers; our failure to realize expected returns on our capital allocation decisions; unanticipated changes in our business, current...

-

Page 20

...: • concerns about buying graphic design services and marketing products without face-to-face interaction with sales personnel; the inability to physically handle and examine product samples; delivery time associated with Internet orders; concerns about the security of online transactions and the...

-

Page 21

...and support operations; costs to produce and deliver our products and provide our services, including the effects of inflation; our pricing and marketing strategies and those of our competitors; investments in our business in the current period intended to generate or support revenues and operations...

-

Page 22

...and subject us to additional risks. We are a global company with production facilities, offices, and localized websites in multiple countries across six continents. We expect to establish operations, acquire or invest in businesses, and sell our products and services in additional geographic regions...

-

Page 23

... a larger, publicly traded company like Cimpress, and if we fail to implement adequate training, controls, and monitoring of the acquired companies, we could also be liable for post-acquisition legal violations.

Form 10-K

•

•

•

•

The accounting for our acquisitions requires us to make...

-

Page 24

... due to higher sales of home and family products such as holiday cards, calendars, photo books, and personalized gifts. Our operating income during the second fiscal quarter represented 62%, 61%, and 72% of annual operating income in the years ended June 30, 2015, 2014, and 2013, respectively. In...

-

Page 25

... printers and graphic design providers; online printing and graphic design companies, many of which provide printed products and services similar to ours; office superstores, drug store chains, food retailers and other major retailers targeting small business and consumer markets; wholesale printers...

-

Page 26

... the use of stolen credit card numbers. To date, quarterly losses from payment fraud have not exceeded 1% of total revenues in any quarter, but we continue to face the risk of significant losses from this type of fraud. We rely heavily on email to market to and communicate with customers, and email...

-

Page 27

... our ability to successfully grow our business. We are highly dependent upon the continued service and performance of our senior management team and key technical, marketing, and production personnel, any of whom may cease their employment with us at any time with minimal advance notice. We face...

-

Page 28

... requirements; • requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, acquisitions, and other general corporate purposes; • increasing...

-

Page 29

... derived more than half of our annual revenue. If we experience difficulty or delays shipping products into the United States or other key markets, or are prevented from doing so, or if our costs and expenses materially increased, our business and results of operations could be harmed. 21

Form 10-K

-

Page 30

... to pay significant damages and attorney's fees, and we could be restricted from using certain technologies important to the operation of our business. Our business is dependent on the Internet, and unfavorable changes in government regulation of the Internet, e-commerce, and email marketing could...

-

Page 31

... customers. As we offer new payment options to our customers, we may be subject to additional regulations, compliance requirements and fraud risk. For some payment methods, including credit and debit cards, we pay interchange and other fees, which may increase over time and raise our operating costs...

-

Page 32

... prices for production, marketing, management, technology development and other services performed by these subsidiaries for other group companies. Transfer prices are prices that one company in a group of related companies charges to another member of the group for goods, services or the use...

-

Page 33

...of capital management and certain corporate transactions. Dutch law requires shareholder approval for the issuance of shares and grants preemptive rights to existing shareholders to subscribe for new issuances of shares. In November 2011, our shareholders granted our supervisory board and management...

-

Page 34

... facts relating to each investor, and are not necessarily the same as the rules for determining beneficial ownership for SEC reporting purposes. For taxable years in which we are a CFC for an uninterrupted period of 30 days or more, each of our 10% U.S. Shareholders will be required to include...

-

Page 35

...contains technology development, marketing and administrative employees and is included in the Vistaprint Business Unit, although also used by Corporate and Global Functions. In the first quarter of fiscal 2016 we will commence an eleven year lease and will move our Lexington operations to a new 302...

-

Page 36

... 15 holders of record of our ordinary shares, although there is a much larger number of beneficial owners. The following table sets forth, for the periods indicated, the high and low sale price per share of our ordinary shares on the NASDAQ:

High Low

Fiscal 2014: First Quarter ...$ Second Quarter...

-

Page 37

... is tracked through June 30, 2015.

Form 10-K

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Cimpress N.V., the NASDAQ Composite Index and the RDG Internet Composite Index

Year Ended June 30, 2010 2011 2012 2013 2014 2015

Cimpress N.V. NASDAQ Composite RDG Internet Composite

$ 100.00 100.00...

-

Page 38

...

As of June 30, 2015 (a) 2014 (b)(c) 2013 (c) (In thousands) 2012 (d) 2011

Consolidated Balance Sheet Data: Cash, cash equivalents and marketable securities (e) ...$ Working capital (e) ...Total assets...Total long-term debt, excluding current portion (f) ...Total shareholders' equity..._____

110...

-

Page 39

...that we file from time to time with the United States Securities and Exchange Commission. Executive Overview On November 14, 2014, pursuant to our shareholders' approval, we amended our articles of association to change our name to Cimpress N.V. and began trading on The Nasdaq Stock Market under the...

-

Page 40

... revenue primarily from the sale and shipping of customized manufactured products, as well as providing digital services, website design and hosting, email marketing services, and order referral fees. We recognize revenue arising from sales of products and services, net of discounts and applicable...

-

Page 41

... taxes. Software and Website Development Costs. We capitalize eligible salaries and payroll-related costs of employees who devote time to the development of our websites and internal-use computer software. Capitalization begins when the preliminary project stage is complete, management with the...

-

Page 42

... financial results, estimated customer renewal rates, projected operating costs and discount rates. We estimate the fair value of contingent consideration at the time of the acquisition using all pertinent information known to us at the time to assess the probability of payment of contingent amounts...

-

Page 43

... the sale and shipping of customized manufactured products, and by providing digital services, website design and hosting, email marketing services, as well as a small percentage from order referral fees and other third-party offerings. Total revenue by reportable segment for the fiscal years ended...

-

Page 44

...Promoter Score. Revenue for the year ended June 30, 2014 increased 5% to $1,144.0 million compared to the year ended June 30, 2013 due to increases in sales across our product and service offerings. During the third quarter of 2014, we rolled out significant pricing changes in two of our top markets...

-

Page 45

...in support of digital marketing service offerings, shipping, handling and processing costs, third-party production costs, costs of free products and other related costs of products sold by us. Cost of revenue as a percent of revenue increased during the year ended June 30, 2015, as the operations we...

-

Page 46

... in marketing, sales, customer support and public relations activities; amortization of certain acquired intangible assets, including customer relationships and trade names; and third-party payment processing fees. The increase in our marketing and selling expenses of $49.4 million during the year...

-

Page 47

... Webs acquisition were fully vested at December 31, 2013. This reduction in expense was partially offset by increased payroll and facility-related costs of $6.9 million as we continued to expand our marketing organization and our customer service, sales and design support centers. At June 30, 2014...

-

Page 48

...

9,387 23.0%

For the year ended June 30, 2015, our effective tax rate is 10.5% as compared to the prior year effective tax rate of 18.7%. The main causes for this decrease are higher tax benefits in fiscal 2015 related to changes to our corporate entity operating structure as described in further...

-

Page 49

... $19.2 million; Internal costs for software and website development that we have capitalized of $17.3 million; and Payments for capital lease arrangements of $5.8 million.

Additional Liquidity and Capital Resources Information. During the year ended June 30, 2015, we financed our operations and...

-

Page 50

..., payments of dividends, corporate acquisitions and dispositions, investments in joint ventures or minority interests, and consolidated capital expenditures that we may make. These limitations can include annual limits that vary from year-to-year and aggregate limits over the term of the credit...

-

Page 51

... competitive position or support growth, such as costs to develop new products and expand product attributes, production and IT capacity expansion, VBU related advertising costs and the continued investment in our employees. Share purchases Corporate acquisitions and similar Investments Reduction of...

-

Page 52

... require security deposits in the form of bank guarantees and a letter of credit in the amount of $1.7 million and $0.6 million, respectively. Build-to-suit lease. In July 2013, we executed a lease for an eleven-year term to move our Lexington, Massachusetts, USA operations to a new facility...

-

Page 53

... Disclosures About Market Risk

Form 10-K

Interest Rate Risk. Our exposure to interest rate risk relates primarily to our cash, cash equivalents and debt. As of June 30, 2015, our cash and cash equivalents consisted of standard depository accounts which are held for working capital purposes. We...

-

Page 54

... functional currencies at the balance sheet dates to compute the impact these changes would have had on our income before taxes in the near term. A hypothetical decrease in exchange rates of 10% against the functional currency of our subsidiaries would have resulted in an increase of $18.8 million...

-

Page 55

Item 8.

Financial Statements and Supplementary Data CIMPRESS N.V. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Form 10-K

Reports of Independent Registered Public Accounting Firms ...Consolidated Balance Sheets ...Consolidated Statements of Operations ...Consolidated Statements of Comprehensive ...

-

Page 56

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Supervisory Board and Shareholders of Cimpress N.V. In our opinion, the accompanying consolidated balance sheet as of June 30, 2015 and the related consolidated statements of operations, of comprehensive income (loss), of shareholders' ...

-

Page 57

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Supervisory Board and Shareholders of Cimpress N.V. We have audited the accompanying consolidated balance sheet of Cimpress N.V. (formerly known as Vistaprint N.V.) as of June 30, 2014, and the related consolidated statements of operations, ...

-

Page 58

CIMPRESS N.V. CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share data)

June 30, 2015 June 30, 2014

Assets Current assets: Cash and cash equivalents ...Marketable securities ...Accounts receivable, net of allowances of $372 and $212, respectively ...Inventory ...Prepaid expenses ...

-

Page 59

... OF OPERATIONS (in thousands, except share and per share data)

Form 10-K

Year Ended June 30, 2015 2014 2013

Revenue ...$ 1,494,206 $ 1,270,236 $ 1,167,478 Cost of revenue (1) ...568,599 451,093 400,293 Technology and development expense (1) ...194,360 176,344 164,859 Marketing and selling expense...

-

Page 60

CIMPRESS N.V. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in thousands)

Year Ended June 30, 2015 2014 2013

Net income ...$ Other comprehensive income (loss), net of tax: Foreign currency translation gain (loss), net of hedges ...Net unrealized loss on derivative instruments designated ...

-

Page 61

... instruments designated and qualifying as cash flow hedges ...Adjustment to contributed capital of noncontrolling interest ...Unrealized gain on marketable securities ...Foreign currency translation ...Unrealized loss on pension benefit obligation, net of tax...Balance at June 30, 2014 ...Issuance...

-

Page 62

... ...Business acquisitions, net of cash acquired ...(Purchases of) proceeds from the sale of intangible assets, net ...Purchase of available-for-sale securities ...Capitalization of software and website development costs ...Investment in equity interests ...Other investing activities ...Net cash used...

-

Page 63

...) (in thousands)

Year Ended June 30, 2015 2014 2013

Form 10-K

Supplemental disclosures of cash flow information: Cash paid during the period for: ...Interest ...$ Income taxes ...Supplemental schedule of non-cash investing and financing activities: Capitalization of construction costs related to...

-

Page 64

... businesses with differentiated service needs, and consumers purchasing products for themselves and their families. On November 14, 2014, pursuant to our shareholders' approval, we amended our articles of association to change our name to Cimpress N.V. and began trading on The Nasdaq Stock Market...

-

Page 65

... lives of the assets. Software and Web Site Development Costs We capitalize eligible salaries and payroll-related costs of employees who devote time to the development of websites and internal-use computer software. Capitalization begins when the preliminary project stage is complete, management...

-

Page 66

... years ended June 30, 2015, 2014 or 2013. Business Combinations We recognize the assets acquired and liabilities assumed in business combinations on the basis of their fair values at the date of acquisition. We assess the fair value of assets, including intangible assets, using a variety of methods...

-

Page 67

... terms of the respective financing arrangement using the effective interest method, or on a straight-line basis through the maturity date for our revolving credit facility. During the years ended June 30, 2015 and 2014, we capitalized debt issuance costs related to our senior secured credit facility...

-

Page 68

... of shareholders' equity. We reissue treasury shares as part of our share-based compensation programs, and upon issuance we determine the cost using the average cost method. Effective January 28, 2013, 5,869,662 of our ordinary shares issued and held in our treasury account were canceled and...

-

Page 69

...in capital and retained earnings for the year ended June 30, 2013.

Form 10-K

Revenue Recognition We generate revenue primarily from the sale and shipping of customized manufactured products, as well as providing digital services, website design and hosting, email marketing services, order referral...

-

Page 70

... to currency exchange rate volatility primarily due to changes in our corporate entity operating structure, effective October 1, 2013, which required us to alter our intercompany transactional and financing activities. The net currency related gains for the year ended June 30, 2015 are partially...

-

Page 71

... following table sets forth the reconciliation of the weighted-average number of ordinary shares:

Year Ended June 30, 2015 2014 2013

Form 10-K

Weighted average shares outstanding, basic ...Weighted average shares issuable upon exercise/vesting of outstanding share options/RSUs/RSAs ...Shares used...

-

Page 72

...the adoption method and effect that ASU 2014-09 will have on our consolidated financial statements but do not expect it to have a material impact. 3. Fair Value Measurements The following table summarizes our investments in available-for-sale securities:

June 30, 2015 Amortized Cost Basis Unrealized...

-

Page 73

... and are categorized using the fair value hierarchy:

June 30, 2015

Form 10-K

Total

Quoted Prices in Active Markets for Identical Assets (Level 1)

Significant Other Observable Inputs (Level 2)

Significant Unobservable Inputs (Level 3)

Assets Available-for-sale securities ...$ Currency forward...

-

Page 74

...table represents the changes in fair value of Level 3 contingent consideration:

Total contingent consideration

Balance at June 30, 2013 ...$ Fair value at acquisition date ...Fair value adjustment ...Foreign currency impact ...Balance at June 30, 2014 (1) ...$ Fair value adjustment ...Cash payments...

-

Page 75

... Financial Instruments Hedges of Interest Rate Risk

Form 10-K

We enter into interest rate swap contracts to manage variability in the amount of our known or expected cash payments related to our debt. Our objective in using interest rate derivatives is to add stability to interest expense and...

-

Page 76

... dates through December 2016

436

Various

Financial Instrument Presentation The table below presents the fair value of our derivative financial instruments as well as their classification on the balance sheet as of June 30, 2015 and 2014:

June 30, 2015 Asset Derivatives Balance Sheet line item...

-

Page 77

... Net Income Gain/(Loss) Year Ended June 30, In thousands 2015 2014 2013 Affected line item in the Statement of Operations

Currency contracts that hedge revenue...Currency contracts that hedge cost of revenue . . Currency contracts that hedge technology and development expense ...Currency contracts...

-

Page 78

...and $218, for the years ended June 30, 2015 and June 30, 2014, respectively:

Gains (losses) on cash flow hedges Gains (losses) on available for sale securities Losses on pension benefit obligation Translation adjustments, net of hedges (1)

Total

Balance as of June 30, 2013 ...$ Other comprehensive...

-

Page 79

... simplified joint stock company, for a purchase price of â,¬91,305 ($97,012 based on the exchange rate as of the date of acquisition), plus an estimated post-closing adjustment of â,¬4,549 ($4,832 based on the exchange rate as of the date of acquisition) based on Exagroup's working capital and debt...

-

Page 80

... ...Deferred tax liability ...Other long term liabilities ...Identifiable intangible assets: Customer relationships ...Trade name ...Developed technology ...Noncontrolling interest ...Goodwill ...Total purchase price ...$

(1) Includes real estate assets classified as held for sale of $1,971.

18,991...

-

Page 81

....at), a web-to-print business focused primarily on the Austrian market. This acquisition supports our strategy to leverage a common platform across multiple brands like druck.at, which offers a wide variety of high quality printed products. We paid â,¬20,000 ($21,537 based on the exchange rate as of...

-

Page 82

... to working capital and other adjustments, and a sliding-scale earn-out of up to â,¬9,600 ($13,208 based on the exchange rate as of the date of acquisition) in cash on or after December 31, 2014 based upon the acquired business achieving certain revenue and EBITDA targets for calendar year 2014. The...

-

Page 83

... known as People & Print Group B.V.), an online Dutch printing company focused primarily on the Dutch and Belgian markets. At the closing, we paid â,¬20,545 ($28,300 based on the exchange rate as of the date of acquisition) in cash, subject to working capital and other adjustments, and an additional...

-

Page 84

... approach to value the trade names, customer relationships and customer network and a replacement cost approach to value developed technology. The income approach calculates fair value by discounting the forecasted after-tax cash flows back to a present value using an appropriate discount rate. The...

-

Page 85

... short-term as of June 30, 2015, as well as the working capital and net debt adjustment relating to our Exagroup acquisition of $5,090, partially offset by a contingent consideration payment during the period. (3) The increase is primarily due to the vesting of certain liability based equity awards...

-

Page 86

...and our senior secured credit facility and for general corporate purposes. The Notes bear interest at a rate of 7.0% per annum and mature on April 1, 2022. Interest on the Notes is payable semi-annually on April 1 and October 1 of each year, commencing on October 1, 2015, to the holders of record of...

-

Page 87

... at a variable rate of interest that may change from time to time. As of June 30, 2015 the weighted-average interest rate on outstanding borrowings of $4,500 was 1.35%. 12. Shareholders' Equity Share purchases On December 11, 2014, we announced that our Supervisory Board authorized the purchase...

-

Page 88

... model with compensation expense recorded on an accelerated basis over the requisite service period. Weighted-average values used for option grants in fiscal 2015, 2014 and 2013 were as follows:

Year Ended June 30, 2015 2014 2013

Risk-free interest rate ...Expected dividend yield ...Expected term...

-

Page 89

.... The total intrinsic value of RSUs vested during the fiscal years ended June 30, 2014, 2013 and 2012 was $19,846, $20,629 and $12,397, respectively. Restricted share awards In conjunction with the December 2011 acquisition of Webs, we granted RSAs to the founding shareholders of Webs that vested 50...

-

Page 90

... LLC. Share-based compensation costs capitalized as part of software and website development costs were $477, $254 and $130 for the years ended June 30, 2015, 2014 and 2013, respectively. As of June 30, 2015, there was $40,272 of total unrecognized compensation cost related to non-vested, share...

-

Page 91

...tax rate:

Year Ended June 30, 2015 2014 2013

U.S. federal statutory income tax rate ...State taxes, net of federal effect ...Tax rate differential on non-U.S. earnings...Compensation related items ...Increase in valuation allowance ...Nondeductible (taxable) acquisition-related payments ...Notional...

-

Page 92

... consist of the following at June 30, 2015 and 2014:

Year Ended June 30, 2015 2014

Deferred tax assets: Net operating loss carryforwards ...$ Depreciation and amortization ...Accrued expenses ...Share-based compensation ...Credit and other carryforwards ...Derivative financial instruments ...Other...

-

Page 93

... tax assets on non-U.S. net operating losses due to currency exchange rate changes.

Form 10-K

6,890 7,940 1,782 16,612

The deferred tax liabilities increased by $28,010 in fiscal 2015 as a result of intangible and other assets from our fiscal 2015 acquisitions. As of June 30, 2015, we had gross...

-

Page 94

.... We conduct business in a number of tax jurisdictions and, as such, are required to file income tax returns in multiple jurisdictions globally. The years 2012 through 2014 remain open for examination by the United States Internal Revenue Service ("IRS") and the years 2006 through 2014 remain open...

-

Page 95

... following table presents the reconciliation of changes in our noncontrolling interests:

Redeemable noncontrolling interests Noncontrolling interest

Form 10-K

Balance as of June 30, 2013 ...Capital contribution from noncontrolling interest ...Adjustment to noncontrolling interest ...Acquisition of...

-

Page 96

... of fiscal 2014, we disposed of our investment in Namex Limited and its related companies, as discussions with management identified different visions in the execution of the long-term strategic direction of the business. We sold all of our Namex shares to Namex's majority shareholder and recognized...

-

Page 97

... meet the definition of an operating segment. During the fourth quarter of fiscal 2015, we transferred a group of software and manufacturing engineers from the corporate and global functions cost center to the Vistaprint Business Unit due to changes in our internal organizational structure. We have...

-

Page 98

...,393 All Other Business Units ...299,813 Total revenue ...$ 1,494,206

$ 1,144,030 126,206 $ 1,270,236

$ 1,091,900 75,578 $ 1,167,478

Year Ended June 30, 2015 2014 2013

Income (loss) from operations: Vistaprint Business Unit ...$ All Other Business Units ...Corporate and global functions ...Total...

-

Page 99

...sublease income for the years ended June 30, 2015, 2014 and 2013 was $16,926, $14,151 and $11,720, respectively. We also lease certain machinery and plant equipment under both capital and operating lease agreements that expire at various dates through 2020. The aggregate carrying value of the leased...

-

Page 100

...7.5 year term and has been classified as a deferred tax liability in our consolidated balance sheet as of June 30, 2015. Other obligations also include the remaining fixed contingent consideration payment related to our fiscal 2014 acquisition of Printdeal of $7,833 payable during the fourth quarter...

-

Page 101

... quarterly basic and diluted per share information may not equal annual basic and diluted net income per share.

Form 10-K

20. Subsequent Event Pursuant to the share repurchase authorization approved on December 11, 2014 we have purchased 1,027,625 of our ordinary shares subsequent to June 30, 2015...

-

Page 102

... designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company's management, including its chief executive officer and chief financial officer, as appropriate to allow timely...

-

Page 103

... accounting firm, has audited the effectiveness of our internal control over financial reporting as of June 30, 2015, as stated in their report included on page 48. Item 9B. None. PART III Item 10. Directors, Executive Officers and Corporate Governance Other Information

The information required...

-

Page 104

.... (b) List of Exhibits. See the Exhibit Index attached to this Report. (c) Financial Statement Schedules. All schedules have been omitted because the information required to be set forth therein is not applicable or is shown in the accompanying consolidated financial statements or notes thereto...

-

Page 105

... 2015 Cimpress N.V. By: /s/ Robert S. Keane

Robert S. Keane Chief Executive Officer

Form 10-K

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated...

-

Page 106

... Vistaprint N.V.) and Robert S. Keane dated as of October 23, 2009 is incorporated by reference to our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2009 (File No. 000-51539) Executive Retention Agreement between Cimpress N.V. and Ernst Teunissen dated as of March 1, 2011...

-

Page 107

...between Cimpress N.V. and Robert S. Keane dated May 6, 2010 is incorporated by reference to our Annual Report on Form 10-K for the fiscal year ended June 30, 2010 (File No. 000-51539) Employment Agreement between Cimpress USA Incorporated and Ernst Teunissen effective July 1, 2011 is incorporated by...

-

Page 108

-

Page 109

Proxy Statement

Cimpress

NOTICE AND PROXY STATEMENT

2015

-

Page 110

-

Page 111

..., November 17, 2015 at 7:00 p.m. Central European Time at the offices of Cimpress N.V. Hudsonweg 8 5928 LW Venlo The Netherlands MATTERS TO BE ACTED UPON AT THE ANNUAL GENERAL MEETING: (1) Reappoint Eric C. Olsen to our Supervisory Board to serve for a term of four years ending on the date of our...

-

Page 112

... can change your vote and revoke your proxy by following the procedures described in this proxy statement. All shareholders are cordially invited to attend the annual general meeting. By order of the Management Board,

Chairman of the Management Board, President and Chief Executive Officer October...

-

Page 113

... statement and our Annual Report on Form 10-K for the fiscal year ended June 30, 2015, as filed with the United States Securities and Exchange Commission, or SEC, to any shareholder who requests it in writing to Cimpress N.V., c/o Cimpress USA Incorporated, Attention: Investor Relations, 275 Wyman...

-

Page 114

... Standard Time on the last business day before the meeting. If your shares are held in street name by a bank or brokerage firm, then you will need to follow the directions your bank or brokerage firm provides to you in order to vote your shares. Many banks and brokerage firms offer the option of...

-

Page 115

... date and delivering the new proxy card to our Chief Legal Officer at the offices of our subsidiary Cimpress USA Incorporated, 275 Wyman Street, Waltham, MA 02451 USA no later than 4:00 p.m. Eastern Standard Time on the last business day before the meeting; • delivering to our Chief Legal Officer...

-

Page 116

... Report on Form 8-K that we will file with the SEC. How and when may I submit a shareholder proposal, including a shareholder nomination for a Supervisory Board position, for the 2016 annual general meeting? Because we are a Dutch limited company whose shares are traded on a U.S. securities exchange...

-

Page 117

...statement and annual report to shareholders may be sent to multiple shareholders in your household. We will promptly deliver a separate copy of either document to you if you contact us at the following address or telephone number: Investor Relations, Cimpress, 275 Wyman Street, Waltham, MA 02451 USA...

-

Page 118

...our named executive officers who are listed in the Summary Compensation Table in this proxy statement; and • all of our Supervisory Board members and executive officers as a group.

Number of Ordinary Shares Beneficially Owned(2) Percent of Ordinary Shares Beneficially Owned(3)

Name and Address of...

-

Page 119

... 1% Unless otherwise indicated, the address of each executive officer, Supervisory Board member, and nominee for Supervisory Board listed is c/o Cimpress N.V., Hudsonweg 8, 5928 LW Venlo, the Netherlands. For each person or entity in the table above, the "Number of Shares Beneficially Owned" column...

-

Page 120

... managed account.

Section 16(a) Beneficial Ownership Reporting Compliance Section 16(a) of the Exchange Act requires our Supervisory Board members, executive officers, and the holders of more than 10% of our ordinary shares, referred to as reporting persons, to file reports with the SEC disclosing...

-

Page 121

... to Cimpress. The Management Board is accountable to the Supervisory Board and to our shareholders. Our Management Board consists of five members of our senior management team who serve on the Management Board for four-year terms: • • The term of Robert S. Keane, our President, Chief Executive...

-

Page 122

...Robert Keane, our Chief Executive Officer, may not exercise these options unless our share price on Nasdaq is at least $75.00 on the exercise date. Our Supervisory Board passed resolutions that, until fiscal 2016 at the earliest, we will not grant any additional long-term incentive award in any form...

-

Page 123

As required by Dutch law, we have a shareholder-approved Remuneration Policy that applies to our Management Board members, which you can find on the Corporate Governance page in the Investor Relations section of www.cimpress.com, and the compensation of our named executive officers is in accordance ...

-

Page 124

... would be in the best interests of Cimpress and our shareholders. Our Supervisory Board and Management Board will analyze many factors relating to a repurchase decision, including share price relative to our anticipated future cash flows, our ability to use operating cash flow or debt to repurchase...

-

Page 125

... law and our articles of association require us to seek the approval of our shareholders each time we wish to issue new shares from our authorized share capital, unless our shareholders have previously authorized our Management Board, with the approval of our Supervisory Board, to issue shares. This...

-

Page 126

...our fiscal year ended June 30, 2014 and previous fiscal years. Upon reviewing the proposals we received in this process, our Audit Committee selected PwC as our independent registered accounting firm for our fiscal year ended June 30, 2015 and dismissed Ernst & Young. The reports of Ernst & Young as...

-

Page 127

... the independent registered public accounting firm report to the Audit Committee regarding services actually provided to Cimpress. During our fiscal year ended June 30, 2015, PwC did not provide any services to Cimpress other than in accordance with the pre-approval policies and procedures described...

-

Page 128

... in finance within an international business context. Member of our Supervisory Board whose term expires at this 2015 Annual General Meeting: PETER GYENES, Director since February 2009 Mr. Gyenes, age 70, has served as the Chairman of Sophos Plc, a global security software company, from May 2006 to...

-

Page 129

... LoJack Corporation, a publicly traded provider of tracking and recovery systems, during the period from 2005 until 2013, including Chairman of the Board of Directors from November 2006 to May 2012; Chief Executive Officer from November 2006 to February 2008 and again from May 2010 to November 2011...

-

Page 130

... on the boards and compensation committees of other publicly traded companies. Member of our Supervisory Board whose term will expire at our 2019 annual general meeting: NADIA SHOURABOURA, Director since January 2015 Dr. Shouraboura, age 45, has served as the Founder and Chief Executive Officer of...

-

Page 131

...Board member on November 4, 2015. Mr. Teunissen, age 49, served as our Executive Vice President and Chief Financial Officer from March 2011 to October 2015 and as our Vice President of Strategy from October 2009 through February 2011. Before joining Cimpress, Mr. Teunissen was a founder and director...

-

Page 132

..., non-employee director, and the Chairman of our Management Board is Mr. Keane, who is also our Chief Executive Officer and President. Governance Guidelines We believe that good corporate governance is important to ensure that Cimpress is managed for the long-term benefit of our stakeholders...

-

Page 133

...our Supervisory Board, officers, and employees, a current copy of which is posted on the Corporate Governance Page in the Investor Relations section of our website, www.cimpress.com. In addition, we intend to post on our website all disclosures that are required by law or Nasdaq stock market listing...

-

Page 134

... or group of shareholders making the recommendation has beneficially owned more than 5% of our ordinary shares for at least a year as of the date such recommendation is made, to Nominating and Corporate Governance Committee, c/o Chief Legal Officer, Cimpress USA Incorporated, 275 Wyman Street...

-

Page 135

... for compensation committee members. The Compensation Committee met three times during fiscal 2015. The Compensation Committee's responsibilities include: • reviewing and approving, or making recommendations to the Supervisory Board with respect to, the compensation of our Chief Executive Officer...

-

Page 136

... registered public accounting firm. Based on its discussions with, and its review of the representations and information provided by, management and PwC, the Audit Committee recommended to the Supervisory Board that the audited financial statements be included in Cimpress' Annual Report on Form 10...

-

Page 137

... to which Cimpress may receive repetitive or duplicative communications. Shareholders who wish to send communications on any topic to our Supervisory Board should address such communications to: Supervisory Board c/o Corporate Secretary Cimpress N.V. Hudsonweg 8 5928 LW Venlo The Netherlands

Proxy...

-

Page 138

... of the annual and long-term cash incentives are based on financial goals that the Compensation Committee believes are highly challenging, but achievable. The charts below show the breakdown of the fiscal 2015 compensation of Robert Keane, our Chief Executive Officer, by type, length, and form:

26

-

Page 139

...revenue during the last two fiscal years. As a result of the 2012 redesign, we granted to our executive officers multiyear, premium-priced share options designed to emphasize Cimpress' long-term performance and our growth strategy using share price as the primary performance metric. The Compensation...

-

Page 140

... used in determining our executive officers' fiscal 2015 compensation, the financial criteria included annual revenue in the range of $1.1 billion to $3.0 billion and market capitalization between $1.5 billion and $4.0 billion. The Compensation Committee also considered companies with high growth...

-

Page 141

... following services to Cimpress and the Compensation Committee Competitive analysis and recommendations to the Compensation Committee with respect to the compensation of our executive officers; Competitive analysis and recommendations to our Compensation Committee and Chief Executive Officer with...

-

Page 142

... long-term cash incentives, share options, and restricted share units, which reward executives based on Cimpress' achievement of longer term financial objectives and the creation of value for our shareholders as reflected in our share price Standard health and welfare benefits that are applicable...

-

Page 143

... inaccurate reflections of management-driven performance. The fiscal 2015 performance goals set by the Compensation Committee for our executive officers' annual cash incentive awards were adjusted EPS of $2.53 - $2.77 (calculated using $2.65 as the target) and constant currency revenue of $1,572,100...

-

Page 144

...term company and shareholder value creation. The last of these long-term cash incentive awards held by our executive officers were originally granted in fiscal year 2012 with a performance cycle of four fiscal years, payable 25% for each of our fiscal years ending June 30, 2012, 2013, 2014, and 2015...

-

Page 145

... and other benefit plans, as those offered to other employees in their location. We do, however, from time to time enter into arrangements with some of our named executive officers to reimburse them for living and relocation expenses relating to their work outside of their home countries. U.S. based...

-

Page 146

... we enter into with new executives after August 1, 2012. The following table sets forth information on the potential payments to named executive officers upon their termination or a change in control of Cimpress, assuming that a termination or change in control took place on June 30, 2015.

34

-

Page 147

... price of our ordinary shares on Nasdaq on June 30, 2015, the last trading day of our fiscal year 2015. Amounts reported in this column represent the estimated cost of providing employment related benefits (such as insurance for medical, dental, and vision) during the period the named executive...

-

Page 148

... share options, with a value, based on the two-year trailing average of the closing prices of Cimpress' ordinary shares on Nasdaq, equal to or greater than a multiple of the executive officer's annual base salary or the Supervisory Board member's annual retainer, as follows Chief Executive Officer...

-

Page 149

... ...2015 Executive Vice President and Chief Operating Officer 2014 2013

Ernst J. Teunissen(3)(8) ...2015 Executive Vice President and Chief Financial Officer 2014 2013

_____

(1) The amounts reported in these columns represent a dollar amount equal to the grant date fair value of the share awards...

-

Page 150

... our adjusted EPS and constant currency revenue goals for fiscal 2015. You can find more information on the amounts actually paid to our executive officers under their fiscal 2015 annual cash incentive awards above in the Compensation Discussion and Analysis section of this Supervisory Board Report...

-

Page 151

... in October 2015.

(7)

Outstanding Equity Awards at June 30, 2015 The following table contains information about unexercised share options and unvested restricted share units as of June 30, 2015 for each of our named executive officers.

Option Awards Share Awards Number Market of Shares Value of or...

-

Page 152

... named executive officers.

Option Awards Number of Shares Acquired on Exercise (#) Value Realized on Exercise ($)(1) Share Awards Number of Shares Acquired on Vesting (#) Value Realized on Vesting ($)(2)

Name

Robert S. Keane ...Katryn S. Blake ...Donald R. Nelson ...Ernst J. Teunissen(3) ...

700...

-

Page 153

..., with an exercise price equal to the fair market value of our ordinary shares on the date of grant. The Supervisory Board's options vest at a rate of 8.33% per quarter over a period of three years from the date of grant, so long as the director continues to serve as a director on each such vesting...

-

Page 154

Summary Compensation Table The following contains information with respect to the compensation earned by our Supervisory Board members in the fiscal year ended June 30, 2015:

Fees Earned or Paid in Cash ($)

Name

Share Awards ($)(1)

Option Awards ($)(1)

Total ($)

Paolo De Cesare ...John J. Gavin...

-

Page 155

... has an exercise price equal to the fair market value of our ordinary shares on the date of grant and becomes exercisable at a rate of 8.33% per quarter over a period of three years from the date of grant, so long as the Supervisory Board member continues to serve as a director on each such vesting...

-

Page 156

... fiscal 2015, no member of our Compensation Committee was an officer or employee of Cimpress or of our subsidiaries or had any relationship with us requiring disclosure under SEC rules. During fiscal 2015, none of our executive officers served as a member of the board of directors or compensation...

-

Page 157

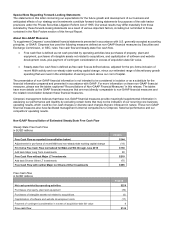

... provided by operating activities Purchase of property, plant, and equipment Purchases of intangible assets not related to acquisitions Capitalization of software and website development costs Payment of contingent consideration in excess of acquisitiondate fair value Free Cash Flow 2014 2015 $140...

-

Page 158

... impact of excess tax benefit on equity awards attributable to current period Less: installment payment related to the transfer of IP in a prior year Cash taxes attributable to current period $13.7 (0.5) 2.9 $1.4 $(3.4) $14.0 2014 $18.5 (6.5) 6.0 $5.6 $(3.4) $20.1 2015 $14.3 (5.5) 6.7 12.9 (3.4) $25...

-

Page 159

CORPORATE INFORMATION

Management Board

Robert Keane President & Chief Executive O cer Chairman, Management Board

(Executive O cer)

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP 125 High Street Boston, MA 02110 USA Phone: +1-617-530-5000

Will Jacobs Senior Vice President ...

-

Page 160

CIMPRESS N.V. | HUDSONWEG 8 | 5928 LW VENLO | THE NETHERLANDS