United Healthcare 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 50 }

UnitedHealth Group

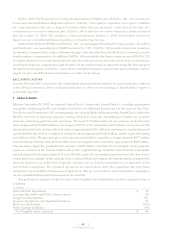

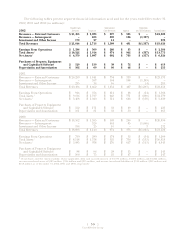

5CASH, CASH EQUIVALENTS AND INVESTMENTS

As of December 31, the amortized cost, gross unrealized gains and losses, and fair value of cash, cash

equivalents and investments were as follows (in millions):

Amortized Gross Unrealized Gross Unrealized Fair

2002 Cost Gains Losses Value

Cash and Cash Equivalents $ 1,130 $ – $ – $ 1,130

Debt Securities — Available for Sale 4,742 238 (8) 4,972

Equity Securities — Available for Sale 150 5 (5) 150

Debt Securities — Held to Maturity 77 – – 77

Total Cash and Investments $ 6,099 $ 243 $ (13) $ 6,329

2001

Cash and Cash Equivalents $1,540 $– $– $1,540

Debt Securities — Available for Sale 3,806 121 (20) 3,907

Equity Securities — Available for Sale 201 16 (46) 171

Debt Securities — Held to Maturity 80 ––80

Total Cash and Investments $5,627 $137 $(66) $5,698

As of December 31, 2002 and 2001, respectively, debt securities consisted of $1,439 million and

$1,073 million in U.S. Government and Agency obligations, $2,475 million and $1,684 million in state

and municipal obligations, and $1,135 million and $1,230 million in corporate obligations. At

December 31, 2002, we held $677 million in debt securities with maturities of less than one year,

$1,442 million in debt securities maturing in one to five years, and $2,930 million in debt securities with

maturities of more than five years.

During 2001 and 2000, respectively, we contributed UnitedHealth Capital investments valued at

approximately $22 million and $52 million to the United Health Foundation, a non-consolidated,

not-for-profit organization. The realized gains of approximately $18 million in 2001 and $51 million in

2000 were offset by related contribution expenses of $22 million in 2001 and $52 million in 2000. The net

expenses of $4 million in 2001 and $1 million in 2000 are included in Investment and Other Income in

the accompanying Consolidated Statements of Operations.

In a separate disposition of UnitedHealth Capital investments during 2000, we realized a gain

of $27 million.

We recorded realized gains and losses on sales of investments, excluding the UnitedHealth Capital

dispositions described above, as follows: For the Year Ended December 31,

(in millions) 2002 2001 2000

Gross Realized Gains $ 57 $30 $12

Gross Realized Losses (75) (19) (46)

Net Realized Gains (Losses) $ (18) $11 $(34)