United Healthcare 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 19 }

UnitedHealth Group

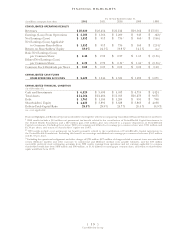

For the Year Ended December 31,

(in millions, except per share data) 2002 2001 2000 1999 1998

CONSOLIDATED OPERATING RESULTS

Revenues $ 25,020 $23,454 $21,122 $19,562 $17,355

Earnings (Loss) From Operations $ 2,186 $1,566 $1,200 $943 $(42)

3

Net Earnings (Loss) $ 1,352 $913 $736

1

$568

2

$(166)

Net Earnings (Loss) Applicable

to Common Shareholders $ 1,352 $913 $736 $568 $(214)

3

Return on Shareholders’ Equity 33.0 % 24.5 % 19.8 %

1

14.1 % na

3

Basic Net Earnings (Loss)

per Common Share $ 4.46 $2.92 $2.27 $1.63 $(0.56)

Diluted Net Earnings (Loss)

per Common Share $ 4.25 $2.79 $2.19

1

$1.60

2

$(0.56)

3

Common Stock Dividends per Share $ 0.03 $0.03 $0.02 $0.02 $0.02

CONSOLIDATED CASH FLOWS

FROM OPERATING ACTIVITIES

$ 2,423 $1,844 $1,521 $1,189 $1,071

CONSOLIDATED FINANCIAL CONDITION

(As of December 31)

Cash and Investments $ 6,329 $5,698 $5,053 $4,719 $4,424

Total Assets $ 14,164 $12,486 $11,053 $10,273 $9,675

Debt $ 1,761 $1,584 $1,209 $991 $708

Shareholders’ Equity $ 4,428 $3,891 $3,688 $3,863 $4,038

Debt-to-Total-Capital Ratio 28.5 % 28.9 % 24.7% 20.4 % 14.9 %

na – not applicable

Financial Highlights and Results of Operations should be read together with the accompanying Consolidated Financial Statements and Notes.

12000 results include a $14 million net permanent tax benefit related to the contribution of UnitedHealth Capital investments to

the United Health Foundation and a $27 million gain ($17 million after tax) related to a separate disposition of UnitedHealth

Capital investments. Excluding these items, 2000 net earnings and diluted net earnings per common share were $705 million and

$2.10 per share, and return on shareholders’ equity was 19.0%.

21999 results include a net permanent tax benefit primarily related to the contribution of UnitedHealth Capital investments to

the United Health Foundation. Excluding this benefit, net earnings and diluted net earnings per common share were $563 million

and $1.59 per share.

3Excluding the operational realignment and other charges of $725 million, $175 million of charges related to contract losses associated with

certain Medicare markets and other increases to commercial and Medicare medical costs payable estimates, and the $20 million

convertible preferred stock redemption premium from 1998 results, earnings from operations and net earnings applicable to common

shareholders would have been $858 million and $509 million, or $1.31 diluted net earnings per common share, and return on shareholders'

equity would have been 11.9%.

FINANCIAL HIGHLIGHTS