United Healthcare 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 33 }

UnitedHealth Group

Under our board of directors’ authorization, we maintain a common stock repurchase program.

Repurchases may be made from time to time at prevailing prices, subject to certain restrictions on volume,

pricing and timing. During 2002, we repurchased 22.3 million shares at an aggregate cost of approximately

$1.8 billion. As of December 31, 2002, we had board of directors’ authorization to purchase up to an

additional 16.5 million shares of our common stock.

As a limited part of our share repurchase activities, we had entered into purchase agreements with an

independent third party to purchase shares of our common stock at various times and prices. In May 2002,

the share purchase agreements were terminated, and we elected to receive shares of our common stock

from the third party as settlement consideration. The favorable settlement amount was not material and

was recorded through additional paid-in capital. We currently have no outstanding purchase agreements

with respect to our common stock.

On February 11, 2003, the board of directors approved an annual dividend for 2003 of $0.03 per share.

The dividend will be paid on April 17, 2003, to shareholders of record at the close of business on April 1, 2003.

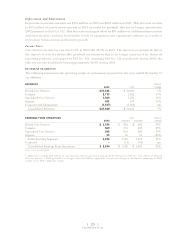

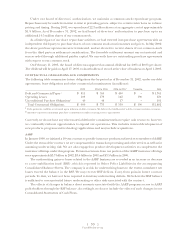

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

The following table summarizes future obligations due by period as of December 31, 2002, under our debt

agreements, lease obligations and other commercial commitments (in millions):

2003 2004 to 2005 2006 to 2007 Thereafter Total

Debt and Commercial Paper

1

$811 $550 $400 $–$1,761

Operating Leases 109 179 142 190 620

Unconditional Purchase Obligations

2

40 44 17 –101

Total Contractual Obligations $960 $773 $559 $190 $2,482

1Debt payments could be accelerated upon violation of debt covenants. We believe the likelihood of a debt covenant violation is remote.

2Amounts represent minimum purchase commitments under existing service agreements.

Currently, we do not have any other material definitive commitments that require cash resources; however,

we continually evaluate opportunities to expand our operations. This includes internal development of

new products, programs and technology applications and may include acquisitions.

AARP

In January 1998, we initiated a 10-year contract to provide insurance products and services to members of AARP.

Under the terms of the contract, we are compensated for transaction processing and other services as well as for

assuming underwriting risk. We are also engaged in product development activities to complement the

insurance offerings under this program. Premium revenues from our portion of the AARP insurance offerings

were approximately $3.7 billion in 2002, $3.6 billion in 2001 and $3.5 billion in 2000.

The underwriting gains or losses related to the AARP business are recorded as an increase or decrease

to a rate stabilization fund (RSF), which is reported in Other Policy Liabilities in the accompanying

Consolidated Balance Sheets. The company is at risk for underwriting losses to the extent cumulative net

losses exceed the balance in the RSF. We may recover RSF deficits, if any, from gains in future contract

periods. To date, we have not been required to fund any underwriting deficits. We believe the RSF balance

is sufficient to cover potential future underwriting or other risks associated with the contract.

The effects of changes in balance sheet amounts associated with the AARP program accrue to AARP

policyholders through the RSF balance. Accordingly, we do not include the effect of such changes in our

Consolidated Statements of Cash Flows.