U-Haul 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

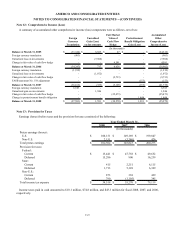

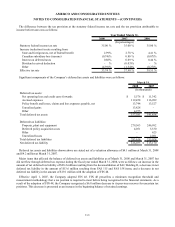

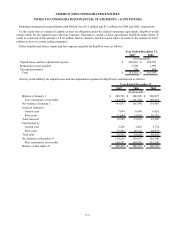

Note 12: Comprehensive Income (Loss)

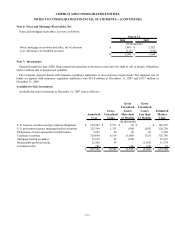

A summary of accumulated other comprehensive income (loss) components were as follows, net of tax:

Foreign

Currency

Translation

Unrealized

Gain (Loss)

on Investments

Fair Market

Value of

Cash Flow

Hedge

Postretirement

Benefit Obligation

Gain (Loss)

Accumulated

Other

Comprehensive

Income (Loss)

Balance at March 31, 2005 $ (33,344) $ 8,685 $ 47 $ - $ (24,612)

Foreign currency translation (903) - - - (903)

Unrealized loss on investments - (7,968) - - (7,968)

Change in fair value of cash flow hedge - - 4,581 - 4,581

Balance at March 31, 2006 (34,247) 717 4,628 - (28,902)

Foreign currency translation (1,919) - - - (1,919)

Unrealized loss on investments - (1,072) - - (1,072)

Change in fair value of cash flow hedge - - (9,733) - (9,733)

FASB statement No. 158 adjustment - - - (153) (153)

Balance at March 31, 2007 (36,166) (355) (5,105) (153) (41,779)

Foreign currency translation 8,583 - - - 8,583

Unrealized gain on investments - 1,946 - - 1,946

Change in fair value of cash flow hedge - - (25,473) - (25,473)

Change in postretirement benefit obligation -

- - 1,444 1,444

Balance at March 31, 2008 $ (27,583) $ 1,591 $ (30,578) $ 1,291 $ (55,279)

(In thousands)

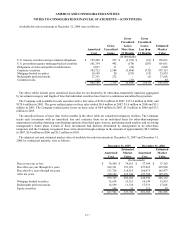

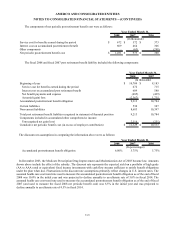

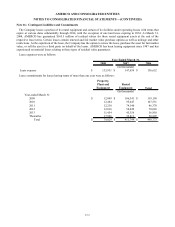

Note 13: Provision for Taxes

Earnings (losses) before taxes and the provision for taxes consisted of the following:

2008 2007 2006

Pretax earnings (losses):

U.S. $ 100,151 $ 149,169 $ 199,847

Non-U.S. 2,151 (3,346) 426

Total pretax earnings $ 102,302 $ 145,823 $ 200,273

Provision for taxes:

Federal:

Current $ 15,441 $ 47,758 $ 49,652

Deferred 15,286 900 16,239

State:

Current 415 2,251 6,115

Deferred 1,713 5,128 6,329

Non-U.S.:

Current 873 338 439

Deferred 790 (1,105) 345

Total income tax expense $ 34,518 $ 55,270 $ 79,119

Year Ended March 31,

(In thousands)

Income taxes paid in cash amounted to $10.1 million, $74.8 million, and $43.3 million for fiscal 2008, 2007, and 2006,

respectively.

F-25