U-Haul 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

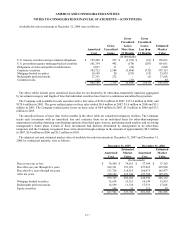

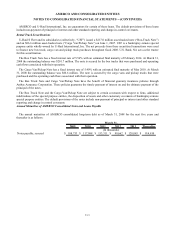

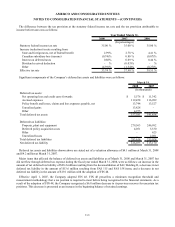

On June 21, 2006, the Company entered into a forward starting interest rate swap agreement for $50.0 million of our

variable-rate debt over a seven-year term that became effective on July 10, 2006. On June 9, 2006, the Company entered

into a forward starting interest rate swap agreement for $144.9 million of a variable-rate debt over a six-year term that

became effective on October 10, 2006. On February 9, 2007, the Company entered into an interest rate swap agreement for

$30.0 million of our variable-rate debt over a seven-year term that became effective on February 12, 2007. On March 8,

2007, the Company entered into two separate interest rate swap agreements each for $20.0 million of our variable-rate debt

over seven-year terms that became effective on March 10, 2007. These interest rate swap agreements were designated as

cash flow hedges on their effective dates.

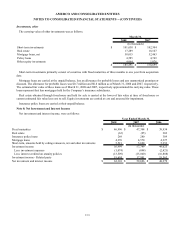

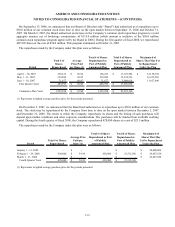

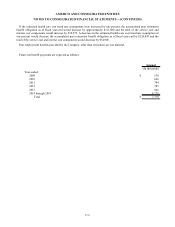

On May 13, 2004, the Company entered into separate interest rate cap agreements for $200.0 million of our variable-rate

debt over a two year term and for $50.0 million of our variable rate debt over a three year term; however, these agreements

were dedesignated as cash flow hedges effective July 11, 2005 when the Real Estate Loan was paid down by $222.4

million. The $200.0 million interest rate cap agreement expired on May 17, 2006 and the $50.0 million interest rate cap

agreement expired on May 17, 2007. Subsequent to July 11, 2005, all changes in the interest rate caps fair value (including

changes in the option’ s time value), were charged to earnings as the original forecasted transaction was cancelled. Prior to

July 11, 2005 the change in each caplets’ respective allocated fair value amount was reclassified out of accumulated other

comprehensive income into earnings when each of the hedged forecasted transactions (the quarterly interest payments)

impact earnings and when interest payments are either made or received.

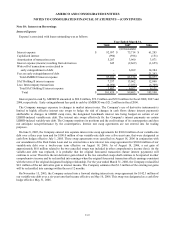

For the year ended March 31, 2008, the Company recognized net losses of $2.5 million from highly effective cash flow

hedges, which are attributable to the portion of the change in the fair value of the hedges’ excluded from the assessment of

the effectiveness of the hedges. The hedging relationship of certain interest rate swap agreements is not considered to be

perfectly effective in which an effectiveness test is performed for each reporting period. The net losses attributable to the

portion of the change in the fair value representing the amount of the hedges’ ineffectiveness recognized in earnings during

the reporting period was $0.3 million included in interest expense. All forecasted transactions currently being hedged are

expected to occur by 2018.

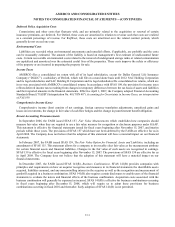

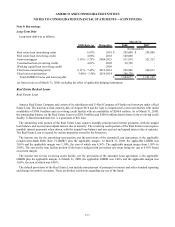

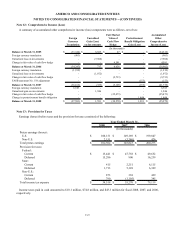

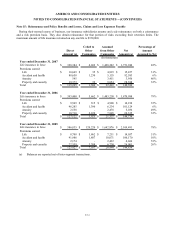

Interest Rates

Interest rates and Company borrowings were as follows:

2008 2007 2006

Weighted average interest rate during the year 6.25% 6.76% 5.95%

Interest rate at year end 4.80% - 6.45%

Maximum amount outstanding during the year $ 150,783 $ 90,000 $ 158,011

Average amount outstanding during the year $ 85,522 $ 70,027 $ 96,710

Facility fees $ 419 $ 300 $ -

(In thousands, except interest rates)

Revolving Credit Activity

Year Ended March 31,

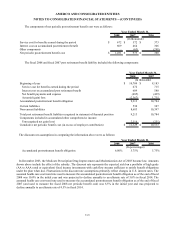

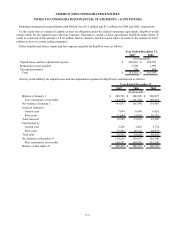

Note 11: Stockholders’ Equity

The Serial common stock may be issued in such series and on such terms as the Board of Directors (the “Board”) shall

determine. The Serial preferred stock may be issued with or without par value. The 6,100,000 shares of Series A, no par,

non-voting, 8½% cumulative preferred stock that are issued and outstanding are not convertible into, or exchangeable for,

shares of any other class or classes of stock of AMERCO. Dividends on the Series A preferred stock are payable quarterly

in arrears and have priority as to dividends over the common stock of AMERCO.

F-23