U-Haul 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

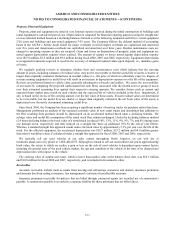

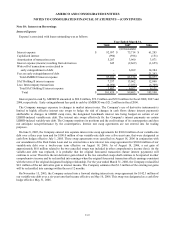

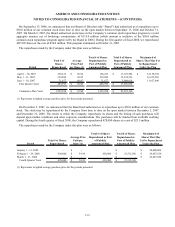

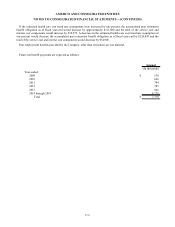

Note 10: Interest on Borrowings

Interest Expense

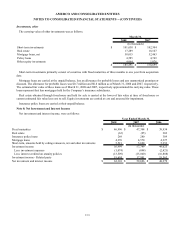

Expense’ s associated with loans outstanding was as follows:

2008 2007 2006

Interest expense $ 92,997 $ 75,714 $ 61,285

Capitalized interest (996) (596) (151)

Amortization of transaction costs 5,287 3,960 3,871

Interest expense (income) resulting from derivatives 645 (2,669) (1,655)

Write-off of transactions costs related to

early extinguishment of debt - 6,969 14,384

Fees on early extinguishment of debt - - 21,243

Total AMERCO interest expense 97,933 83,378 98,977

SAC Holding II interest expense 7,537 13,062 12,840

Less: Intercompany transactions (4,050) (7,035) (6,709)

Total SAC Holding II interest expense 3,487 6,027 6,131

Total $ 101,420 $ 89,405 $ 105,108

Year Ended March 31,

(In thousands)

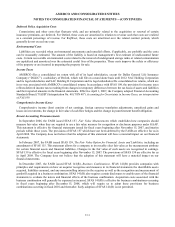

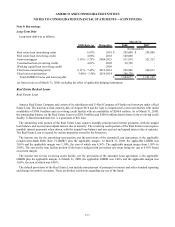

Interest paid in cash by AMERCO amounted to $89.8 million, $72.9 million and $59.8 million for fiscal 2008, 2007 and

2006, respectively. Early extinguishment fees paid in cash by AMERCO was $21.2 million in fiscal 2006.

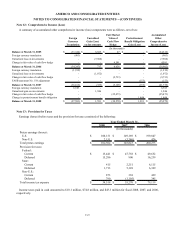

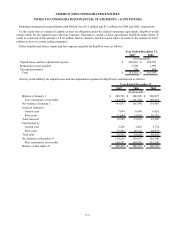

The Company manages exposure to changes in market interest rates. The Company’ s use of derivative instruments is

limited to highly effective interest rate swaps to hedge the risk of changes in cash flows (future interest payments)

attributable to changes in LIBOR swap rates, the designated benchmark interest rate being hedged on certain of our

LIBOR-indexed variable-rate debt. The interest rate swaps effectively fix the Company’ s interest payments on certain

LIBOR-indexed variable-rate debt. The Company monitors its positions and the credit ratings of its counterparties and does

not anticipate non-performance by the counterparties. Interest rate swap agreements are not entered into for trading

purposes.

On June 8, 2005, the Company entered into separate interest rate swap agreements for $100.0 million of our variable-rate

debt over a three year term and for $100.0 million of our variable-rate debt over a five-year term, that were designated as

cash flow hedges effective July 1, 2005. These swap agreements were cancelled on August 18, 2006 in conjunction with

our amendment of the Real Estate Loan and we entered into a new interest rate swap agreement for $300.0 million of our

variable-rate debt over a twelve-year term effective on August 18, 2006. As of August 18, 2006, a net gain of

approximately $6.0 million related to the two cancelled swaps was included in other comprehensive income (loss). As the

variable-rate debt was replaced, it is probable that the original forecasted transaction (future interest payments) will

continue to occur. Therefore the net derivative gain related to the two cancelled swaps shall continue to be reported in other

comprehensive income and be reclassified into earnings when the original forecasted transaction affects earnings consistent

with the term of the original designated hedging relationship. For the year ended March 31, 2008, the Company reclassified

$2.1 million of the net derivative gain to interest income. The Company estimates that $1.3 million of the existing net gains

will be reclassified into earnings within the next 12 months.

On November 15, 2005, the Company entered into a forward starting interest rate swap agreement for $142.3 million of

our variable-rate debt over a six-year term that became effective on May 10, 2006. This swap was designated as a cash flow

hedge effective May 31, 2006.

F-22