U-Haul 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

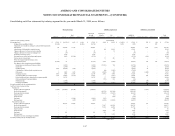

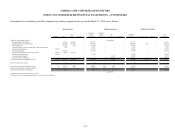

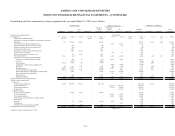

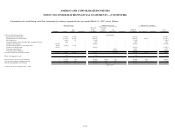

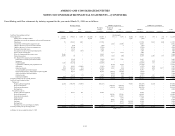

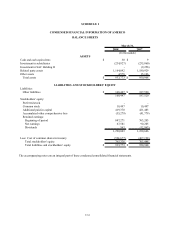

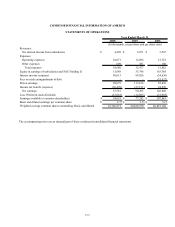

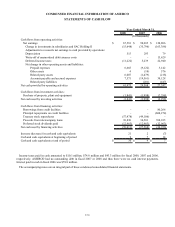

CONDENSED FINANCIAL INFORMATION OF AMERCO

STATEMENTS OF CASH FLOW

2008 2007 2006

Cash flows from operating activities:

Net earnings $ 67,581 $ 90,205 $ 120,806

Change in investments in subsidiaries and SAC Holding II (15,648) (35,796) (163,388)

Adjustments to reconcile net earnings to cash provided by operations:

Depreciation 515 293 79

Write-off of unamortized debt issuance costs - - 13,629

Deferred income taxes (11,222) 5,239 22,940

Net change in other operating assets and liabilities:

Prepaid expenses 6,665 (9,122) 3,142

Other assets 4 (10) 576

Related party assets 6,007 (1,479) (218)

Accounts payable and accrued expenses 7,571 (19,561) 30,128

Related party liabilities - (201) (447)

Net cash provided by operating activities 61,473 29,568 27,247

Cash flows from investment activities:

Purchase of property, plant and equipment (1,841) (1,998) (2,298)

Net cash used by investing activities (1,841) (1,998) (2,298)

Cash flows from financing activities:

Borrowings from credit facilities - - 80,266

Principal repayments on credit facilities - - (860,274)

Treasury stock repurchases (57,478) (49,106) -

Proceeds from intercompany loans 10,830 34,501 768,015

Preferred stock dividends paid (12,963) (12,963) (12,963)

Net cash used by financing activities (59,611) (27,568) (24,956)

Increase (decrease) in cash and cash equivalents 21 2 (7)

Cash and cash equivalents at beginning of period 9 7 14

Cash and cash equivalents at end of period $ 30 $ 9 $ 7

Year Ended March 31,

(In thousands)

Income taxes paid in cash amounted to $10.1 million, $74.8 million and $43.3 million for fiscal 2008, 2007 and 2006,

respectively. AMERCO had no outstanding debt in fiscal 2007 or 2008 and thus there were no cash interest payments.

Interest paid in cash in fiscal 2006 was $59.8 million.

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-56