U-Haul 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

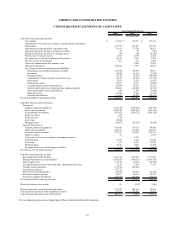

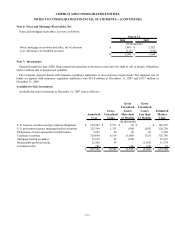

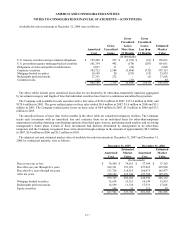

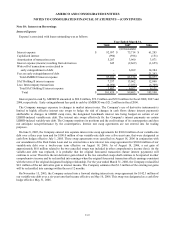

Available-for-sale investments at December 31, 2006 were as follows:

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

More than

12 Months

Gross

Unrealized

Losses

Less than

12 Months

Estimated

Market

Value

U.S. treasury securities and government obligations $ 159,490 $ 975 $ (2,353) $ (81) $ 158,031

U.S. government agency mortgage-backed securities 101,354 442 (578) (207) 101,011

Obligations of states and political subdivisions 2,027 11 (33) - 2,005

Corporate securities 385,723 5,588 (3,464) (732) 387,115

Mortgage-backed securities 16,149 50 (233) (13) 15,953

Redeemable preferred stocks 17,331 272 - (2) 17,601

Common stocks 112 - (27) - 85

$

682

,

186

$

7,

338

$

(6

,

688)

$

(1

,

03

5

)

$

681

,

801

(In thousands)

The above tables include gross unrealized losses that are not deemed to be other-than-temporarily impaired, aggregated

by investment category and length of time that individual securities have been in a continuous unrealized loss position.

The Company sold available-for-sale securities with a fair value of $134.6 million in 2007, $113.4 million in 2006, and

$170.6 million in 2005. The gross realized gains on these sales totaled $0.4 million in 2007, $1.6 million in 2006 and $5.1

million in 2005. The Company realized gross losses on these sales of $0.4 million in 2007, $1.9 million in 2006 and $3.3

million in 2005.

The unrealized losses of more than twelve months in the above table are considered temporary declines. The Company

tracks each investment with an unrealized loss and evaluates them on an individual basis for other-than-temporary

impairments including obtaining corroborating opinions from third party sources, performing trend analysis and reviewing

management’ s future plans. Certain of these investments had declines determined by management to be other-than-

temporary and the Company recognized these write-downs through earnings in the amounts of approximately $0.5 million

in 2007, $1.4 million in 2006 and $5.3 million in 2005.

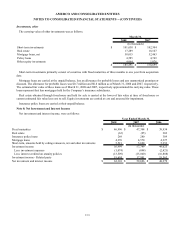

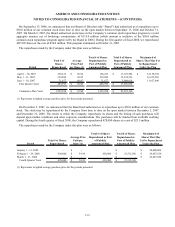

The adjusted cost and estimated market value of available-for-sale investments at December 31, 2007 and December 31,

2006, by contractual maturity, were as follows:

Amortized

Cost

Estimated

Market

Value

Amortized

Cost

Estimated

Market

Value

Due in one year or less $ 74,500 $ 74,615 $ 57,304 $ 57,183

Due after one year through five years 189,321 191,073 227,023 225,926

Due after five years through ten years 117,726 118,815 166,473 165,477

After ten years 218,162 222,342 197,794 199,576

599,709 606,845 648,594 648,162

Mortgage backed securities 15,618 15,512 16,149 15,953

Redeemable preferred stocks 12,509 11,374 17,331 17,601

Equity securities 106 53 112 85

$ 627,942 $ 633,784 $ 682,186 $ 681,801

December 31, 2007 December 31, 2006

(In thousands)

F-17