U-Haul 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 34

Moving and Storage continues to hold significant cash and has access to additional liquidity. Management may

invest these funds in our existing operations, expand our product lines or pursue external opportunities in the self-

moving and storage market place.

Property and Casualty Insurance

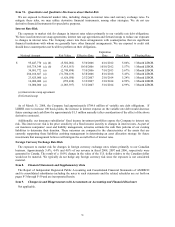

State insurance regulations restrict the amount of dividends that can be paid to stockholders of insurance

companies. As a result, RepWest’ s assets are generally not available to satisfy the claims of AMERCO or its legal

subsidiaries.

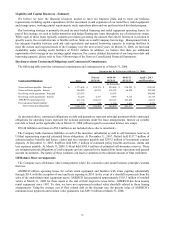

Stockholder’ s equity was $148.6 million, $142.4 million, and $137.4 million at December 31, 2007, 2006, and

2005, respectively. The increase resulted from earnings of $5.9 million and an increase in other comprehensive

income of $0.2 million. RepWest paid $27.0 million in dividends to its parent during 2005; payment was effected by

a reduction in intercompany accounts. RepWest does not use debt or equity issues to increase capital and therefore

has no direct exposure to capital market conditions other than through its investment portfolio.

Life Insurance

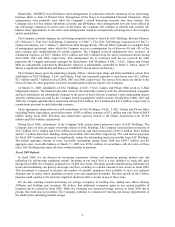

Oxford manages its financial assets to meet policyholder and other obligations including investment contract

withdrawals. Oxford’ s net withdrawals for the year ending December 31, 2007 were $47.4 million. State insurance

regulations restrict the amount of dividends that can be paid to stockholders of insurance companies. As a result,

Oxford’ s funds are generally not available to satisfy the claims of AMERCO or its legal subsidiaries.

Oxford’ s stockholder’ s equity was $150.7 million, $136.4 million, and $127.3 million at December 31, 2007,

2006 and 2005, respectively. The increase resulted from earnings of $13.6 million, a $1.7 million increase in other

comprehensive income and a decrease of $1.0 million in beginning retained earnings related to the application of

FIN 48. Oxford does not use debt or equity issues to increase capital and therefore has no direct exposure to capital

market conditions other than through its investment portfolio.

Cash Provided from Operating Activities by Operating Segments

Moving and Self-Storage

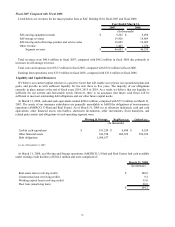

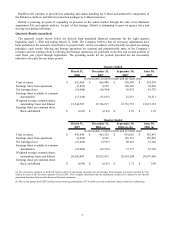

Cash provided by operating activities was $324.4 million, $331.7 million and $276.1 million in fiscal 2008, 2007

and 2006, respectively. Operating cash flows for the Moving and Storage segment decreased $7.3 million primarily

from the decrease in operating income.

Property and Casualty Insurance

Cash provided (used) by operating activities was ($4.0) million, $5.4 million, and ($28.9) million for the years

ending December 31, 2007, 2006, and 2005, respectively. The decrease in cash used by operating activities was the

result of RepWest’ s increasing its gross insurance reserves by $15.0 million, which was offset by $6.0 million

increase in net earnings.

RepWest’ s cash and cash equivalents and short-term investment portfolios amounted to $79.3 million, $71.9

million, and $106.2 million at December 31, 2007, 2006, and 2005, respectively. This balance reflects funds in

transition from maturity proceeds to long term investments. This level of liquid assets, combined with budgeted cash

flow, is adequate to meet periodic needs. Capital and operating budgets allow RepWest to schedule cash needs in

accordance with investment and underwriting proceeds.

Life Insurance

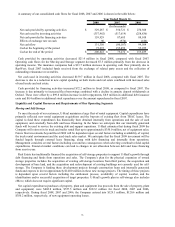

Cash provided (used) by operating activities from Oxford were $7.1 million, $11.4 million and ($0.7) million for

the years ending December 31, 2007, 2006 and 2005, respectively. The decrease from 2007 compared with 2006

was the result of a $5.0 million principal payment in July 2007 to AMERCO on an intercompany surplus note issued

in 1998, as well as $0.7 million in interest. In 2005, the decrease includes the $10.6 million settlement payment

related to a lawsuit.

In addition to cash flows from operating activities and financing activities, a substantial amount of liquid funds are

available through Oxford’ s short-term portfolio. At December 31, 2007, 2006 and 2005, cash and cash equivalents

and short-term investments amounted to $37.7 million, $41.4 million and $37.0 million, respectively. Management

believes that the overall sources of liquidity will continue to meet foreseeable cash needs.