U-Haul 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 19

In February and March 2004 SAC Holding Corporation triggered a requirement to reassess AMERCO’ s

involvement in it, which led to the conclusion SAC Holding Corporation was not a VIE and AMERCO ceased to be

the primary beneficiary.

In November 2007, Blackwater contributed additional capital to its wholly-owned subsidiary, SAC Holding II.

This contribution was determined by us to be material with respect to the capitalization of SAC Holding II;

therefore, triggering a requirement under FIN 46(R) for us to reassess the Company’ s involvement with those

subsidiaries. This required reassessment led to the conclusion that SAC Holding II has the ability to fund its own

operations and execute its business plan without any future subordinated financial support; therefore, the Company

was no longer the primary beneficiary of SAC Holding II as of the date of Blackwater’ s contribution.

Accordingly, at the date AMERCO ceased to have a variable interest and ceased to be the primary beneficiary of

SAC Holding II and its current subsidiaries, it deconsolidated these entities. The deconsolidation was accounted for

as a distribution of SAC Holding II’ s interests to the sole shareholder of the SAC entities. Because of AMERCO’ s

continuing involvement with SAC Holding II and its subsidiaries, the distribution does not qualify as discontinued

operations as defined by SFAS 144.

It is possible that SAC Holdings could take actions that would require us to re-determine whether SAC Holdings

has become a VIE or whether we have become the primary beneficiary of SAC Holdings. Should this occur, we

could be required to consolidate some or all of SAC Holdings with our financial statements.

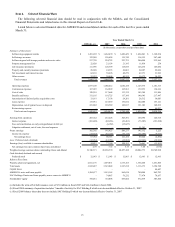

The consolidated balance sheet as of March 31, 2008 includes the accounts of AMERCO and its wholly-owned

subsidiaries. The consolidated balance sheet as of March 31, 2007 includes the accounts of AMERCO and its

wholly-owned subsidiaries and SAC Holding II and its subsidiaries. The March 31, 2008 statements of operations

and cash flows include AMERCO and its wholly-owned subsidiaries for the entire year, and reflect SAC Holding II

and its subsidiaries for the seven months ended October 31, 2007. The March 31, 2007 and 2006 statements of

operations and cash flows include the accounts of AMERCO and its wholly-owned subsidiaries and SAC Holding II

and its subsidiaries.

Recoverability of Property, Plant and Equipment

Property, plant and equipment are stated at cost. Interest expense incurred during the initial construction of

buildings and rental equipment is considered part of cost. Depreciation is computed for financial reporting purposes

using the straight-line or an accelerated method based on a declining balance formula over the following estimated

useful lives: rental equipment 2-20 years and buildings and non-rental equipment 3-55 years. The Company follows

the deferral method of accounting based in the AICPA’ s Airline Guide for major overhauls in which engine

overhauls are capitalized and amortized over five years and transmission overhauls are capitalized and amortized

over three years. Routine maintenance costs are charged to operating expense as they are incurred. Gains and losses

on dispositions of property, plant and equipment are netted against depreciation expense when realized. Equipment

depreciation is recognized in amounts expected to result in the recovery of estimated residual values upon disposal,

i.e., minimize gains or losses. In determining the depreciation rate, historical disposal experience, holding periods

and trends in the market for vehicles are reviewed.