U-Haul 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 28

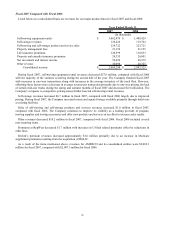

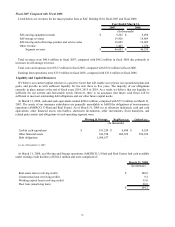

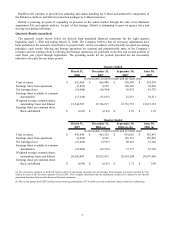

Total costs and expenses increased $50.3 million for fiscal 2007, compared with fiscal 2006. Increases in

depreciation, lease, licensing and freight costs resulting from the acquisition of new trucks and the rotation of the

fleet were partially offset by reductions in maintenance and repair.

As a result of the above mentioned changes in revenues and expenses, earnings from operations decreased to

$217.9 million in fiscal 2007, compared with $292.8 million for fiscal 2006.

Republic Western Insurance Company

2007 Compared with 2006

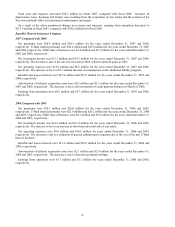

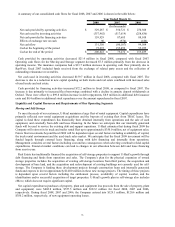

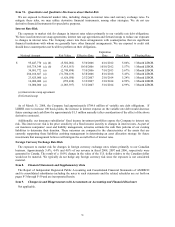

Net premiums were $28.4 million and $24.3 million for the years ended December 31, 2007 and 2006,

respectively. U-Haul related premiums were $26.4 million and $22.0 million for the years ended December 31, 2007

and 2006, respectively. Other lines of business were $2.0 million and $2.3 million for the years ended December 31,

2007 and 2006, respectively.

Net investment income was $12.1 million and $14.2 million for the years ended December 31, 2007 and 2006,

respectively. The decrease is due to the sale of real estate in 2006, which resulted in gains in 2006.

Net operating expenses were $12.0 million and $8.8 million for the years ended December 31, 2007 and 2006,

respectively. The increase is due to a $2.7 million increase in commissions on the additional liability program.

Benefits and losses incurred were $19.0 million and $21.9 million for the years ended December 31, 2007 and

2006, respectively.

Amortization of deferred acquisition costs were $0.2 million and $2.1 million for the years ended December 31,

2007 and 2006, respectively. The decrease is due to the termination of credit property business in March of 2006.

Earnings from operations were $9.2 million and $5.7 million for the years ended December 31, 2007 and 2006,

respectively.

2006 Compared with 2005

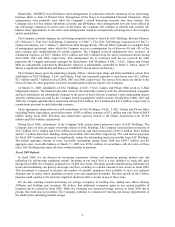

Net premiums were $24.3 million and $26.0 million for the years ended December 31, 2006 and 2005,

respectively. U-Haul related premiums were $22.0 million and $20.2 million for the years ended December 31, 2006

and 2005, respectively. Other lines of business were $2.3 million and $5.8 million for the years ended December 31,

2006 and 2005, respectively.

Net investment income was $14.2 million and $11.4 million for the years ended December 31, 2006 and 2005,

respectively. The increase is due to an increase in short-term rates and sale of real estate.

Net operating expenses were $8.8 million and $10.8 million for years ended December 31, 2006 and 2005,

respectively. The decrease is due to a reduction of general administrative expenses due to the exit of the non U-Haul

lines of business.

Benefits and losses incurred were $21.9 million and $22.6 million for the years ended December 31, 2006 and

2005, respectively.

Amortization of deferred acquisition costs were $2.1 million and $2.9 million for the years ended December 31,

2006 and 2005, respectively. The decrease is due to decreased premium writings.

Earnings from operations were $5.7 million and $1.1 million for years ended December 31, 2006 and 2005,

respectively.