U-Haul 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

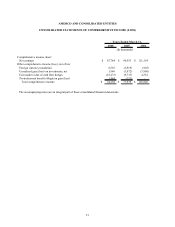

F-5

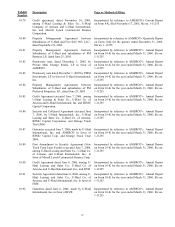

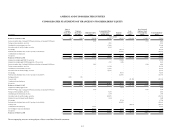

Description

Balance as of M

Increase in ma

Foreign curren

Unrealized loss o

Fair market va

Net earnings

Preferred stock di

Contribution fr

Net activity

Balance as of M

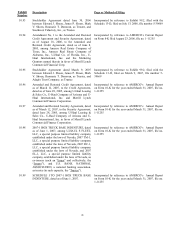

Adjustment to i

Adjustment to i

Increase in ma

Foreign curren

Unrealized loss o

Fair market va

Net earnings

Preferred stock di

Exchange of sh

Treasury stock

Contribution fr

Net activity

Balance as of M

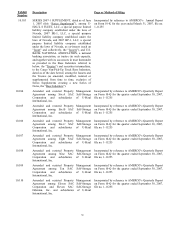

Adjustment to in

Increase in ma

Foreign curren

Unrealized gai

Fair market va

Adjustment to p

Net earnings

Preferred stock di

Treasury stock

Contribution fr

SAC Holding II C

Net activity

Balance as of M

Series A

Common

Stock, $0.25

Par Value

Common

Stock, $0.25

Par Value

Additional Paid-In

Capital

Accumulated Other

Comprehensive

Income (Loss)

Retained

Earnings

Less:

Treasury

Stock

Less: Unearned

Employee Stock

Ownership Plan

Shares

Total Stockholders'

Equity

arch 31, 2005 $ 929 $ 9,568 $ 350,344 $ (24,612) $ 665,593 $ (418,092) $ (10,891) $ 572,839

rket value of released ESOP shares and release of unearned ESOP shares - - 2,955 - - - 1,553 4,508

cy translation, net of tax - - - (903) - - - (903)

n investments, net of tax - - - (7,968) - - - (7,968)

lue of cash flow hedges, net of tax - - - 4,581 - - - 4,581

- - - - 121,154 - - 121,154

vidends: Series A ($2.13 per share for fiscal 2006) - - - - (12,963) - - (12,963)

om related party - - 14,356 - - - - 14,356

- - 17,311 (4,290) 108,191 - 1,553 122,765

arch 31, 2006 $ 929 $ 9,568 $ 367,655 $ (28,902) $ 773,784 $ (418,092) $ (9,338) $ 695,604

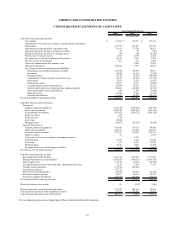

nitially apply SAB 108, net of tax - - - - (1,926) - - (1,926)

nitially apply FASB Statement No. 158, net of tax - - - (153) (148) - - (301)

rket value of released ESOP shares and release of unearned ESOP shares - - 3,265 - - - 1,204 4,469

cy translation, net of tax - - - (1,919) - - - (1,919)

n investments, net of tax - - - (1,072) - - - (1,072)

lue of cash flow hedges, net of tax - - - (9,733) - - - (9,733)

- - - - 90,553 - - 90,553

vidends: Series A ($2.13 per share for fiscal 2007) - - - - (12,963) - - (12,963)

ares (929) 929 - - - - - -

- - - - - (49,106) - (49,106)

om related party - - 4,492 - - - - 4,492

(929) 929 7,757 (12,877) 75,516 (49,106) 1,204 22,494

arch 31, 2007 $ - $ 10,497 $ 375,412 $ (41,779) $ 849,300 $ (467,198) $ (8,134) $ 718,098

itially apply FIN 48 - - - - 6,826 - - 6,826

rket value of released ESOP shares and release of unearned ESOP shares - - 2,379 - - - 1,239 3,618

cy translation, net of tax - - - 8,583 - - - 8,583

n on investments, net of tax - - - 1,946 - - - 1,946

lue of cash flow hedges, net of tax - - - (25,473) - - - (25,473)

ost retirement benefit obligation - - - 1,444 - - - 1,444

- - - - 67,784 - - 67,784

vidends: Series A ($2.13 per share for fiscal 2008) - - - - (12,963) - - (12,963)

- - - - - (57,479) - (57,479)

om related party - - 46,071 - - - - 46,071

orporation distribution - - (4,492) - 4,468 - - (24)

- - 43,958 (13,500) 66,115 (57,479) 1,239 40,333

arch 31, 2008 $ - $ 10,497 $ 419,370 $ (55,279) $ 915,415 $ (524,677) $ (6,895) $ 758,431

(In thousands)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

AMERCO AND CONSOLIDATED ENTITIES

The accompanying notes are an integral part of these consolidated financial statements.