TomTom 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

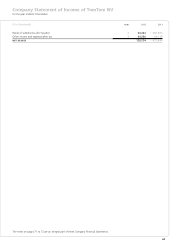

71

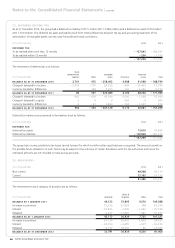

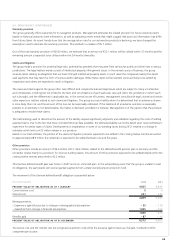

1. PRESENTATION OF FINANCIAL STATEMENTS AND RECOGNITION AND MEASUREMENT PRINCIPLES

The description of the activities of TomTom NV (the company) and the company structure, as included in the notes to the consolidated

fi nancial statements, also applies to the company fi nancial statements.

The company has prepared its company fi nancial statements in accordance with Part 9 of Book 2 of the Netherlands Civil Code, and

specifi cally, in accordance with section 362 (8) of the Netherlands Civil Code. In doing so it has applied the principles of recognition and

measurement as adopted in the consolidated fi nancial statements (IFRS). Investments in subsidiaries are accounted for using the equity

method. For more information on the accounting policies applied, and on the notes to the consolidated fi nancial statements, please refer

to page 39 to 68.

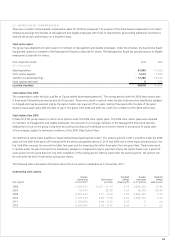

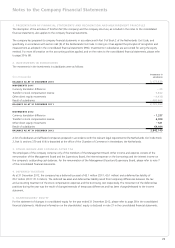

2. INVESTMENTS IN SUBSIDIARIES

The movements in the Investments in subsidiaries were as follows:

(€ in thousands)

Investments in

subsidiaries

BALANCE AS AT 31 DECEMBER 2010 3,173,829

MOVEMENTS 2011

Currency translation difference – 25

Transfer to stock compensation reserve 7,562

Other direct equity movements – 4,438

Result of subsidiaries – 403,665

BALANCE AS AT 31 DECEMBER 2011 2,773,263

MOVEMENTS 2012

Currency translation difference – 1,337

Transfer to stock compensation reserve 6,300

Other direct equity movements – 521

Result of subsidiaries 64,444

BALANCE AS AT 31 DECEMBER 2012 2,842,149

A list of subsidiaries and affi liated companies prepared in accordance with the relevant legal requirements (the Netherlands Civil Code Book

2, Part 9, sections 379 and 414) is deposited at the offi ce of the Chamber of Commerce in Amsterdam, the Netherlands.

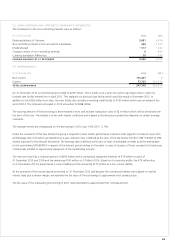

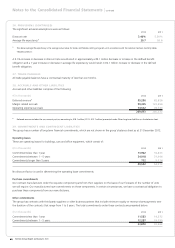

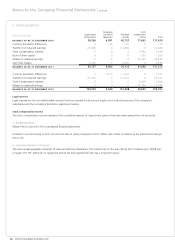

3. OTHER INCOME AND EXPENSES AFTER TAX

The employees of the company comprise only of the members of the Management Board. Other income and expense consists of the

remuneration of the Management Board and the Supervisory Board, the interest expense on the borrowings and the interest income on

the company’s outstanding cash balances. For the remuneration of the Management Board and Supervisory Board, please refer to note 7

of the consolidated fi nancial statements.

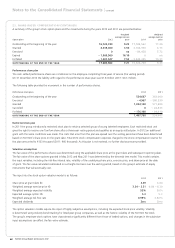

4. DEFERRED TAXATION

As at 31 December 2012, the company has a deferred tax asset of €0.1 million (2011: €0.1 million) and a deferred tax liability of

€0.7 million (2011: €1.0 million). The deferred tax asset and deferred tax liability result from temporary differences between the tax

and accounting treatment of the stock compensation expenses and the borrowing cost respectively. The movement of the deferred tax

positions during the year was the result of changes/reversals of temporary differences and has been charged/released to the income

statement.

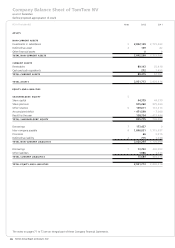

5. SHAREHOLDERS’ EQUITY

For the statement of changes in consolidated equity for the year ended 31 December 2012, please refer to page 38 in the consolidated

fi nancial statements. Additional information on the shareholders’ equity is disclosed in note 21 in the consolidated fi nancial statements.

Notes to the Company Financial Statements