TomTom 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

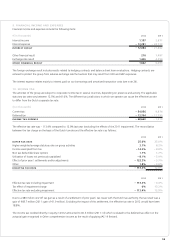

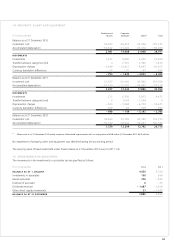

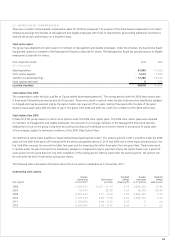

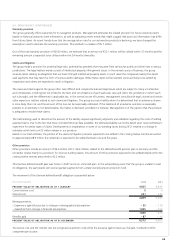

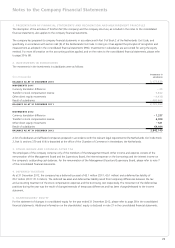

23. NON-CONTROLLING INTERESTS (MINORITY INTERESTS)

The movements in the non-controlling interests were as follows:

(€ in thousands) 2012 2011

Opening balance at 1 January 2,451 5,416

Non-controlling interest in the net result of subsidiaries 469 – 1,107

Dividends paid – 317 – 542

Change in share of non-controlling interests 0– 960

Currency translation differences 39 – 356

CLOSING BALANCE AT 31 DECEMBER 2,642 2,451

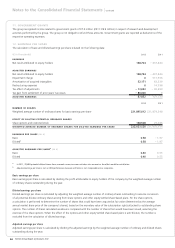

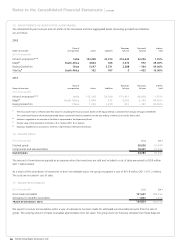

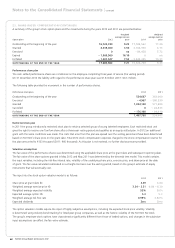

24. BORROWINGS

(€ in thousands) 2012 2011

Non-current 173,437 0

Current 73,703 383,810

TOTAL BORROWINGS 247,140 383,810

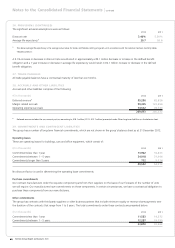

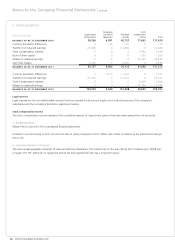

On 31 December 2012 our borrowings amounted to €250 million. This is made up of a term loan which was drawn down under the

forward start facility entered into in April 2011. This replaced our previous loan facility which was fully repaid in December 2012. In

addition to the €250 million term loan, the new facility also includes a revolving credit facility of €150 million which was unutilised at the

end of 2012. The total amount repaid in 2012 amounted to €388 million.

The carrying amount of the borrowings is denominated in euro and includes transaction costs of €2.9 million which will be amortised over

the term of the loan. The interest is in line with market conditions and is based on Euribor plus a spread that depends on certain leverage

covenants.

The average interest percentage paid on the borrowings in 2012 was 1.9% (2011: 3.1%).

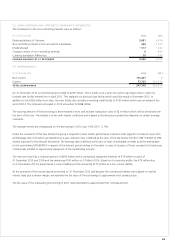

Under the covenants of the new facility the group is required to meet certain performance indicators with regard to its interest cover (4.0)

and leverage ratio (3.0) which are tested twice a year. Interest cover is defi ned as the ratio of the last twelve months (‘LTM’) EBITDA to LTM

interest expense for the relevant test period. The leverage ratio is defi ned as the ratio of total consolidated net debt as at the testing date

to the consolidated LTM EBITDA in respect of the relevant period ending on that date. In case of a breach of these covenants the banks are

contractually entitled to request early repayment of the outstanding amount.

The new term loan has a notional amount of €250 million with a contractual repayment schedule of €75 million on each of

31 December 2013 and 2014 and the remaining €100 million on 31 March 2016. Based on this maturity profi le, the €75 million due

on 31 December 2012 is presented as a current liability and the remaining €175 million as a non-current liability.

As the proceeds of the borrowings were received on 31 December 2012 and because the contractual interest rate is based on market

interest rates plus a certain margin, we estimate the fair value of the borrowings to approximate their carrying value.

The fair value of the outstanding borrowings in 2011 were estimated to approximate their notional amount.