TomTom 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TomTom Annual Report and Accounts 2012

8

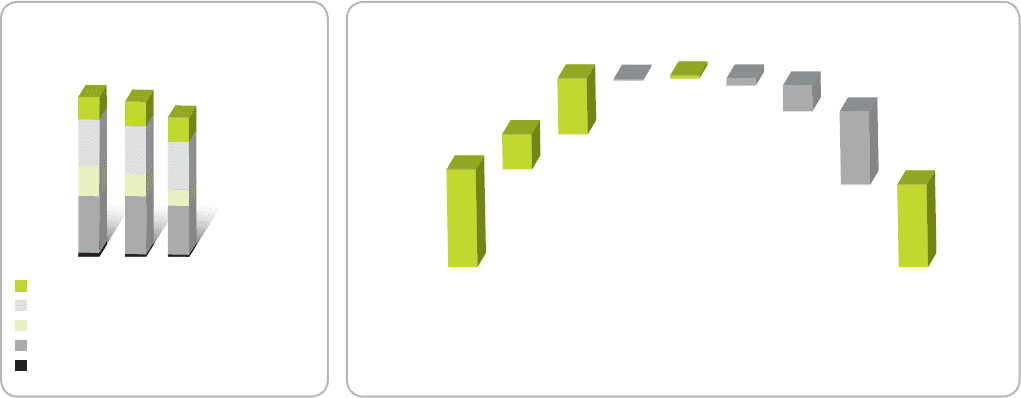

Through our cost saving initiatives we decreased our selling,

general and administrative expenses from €209 million in 2011

to €170 million in 2012, a decrease of 19% (2011: €202 million

excluding restructuring charges). We continued to simplify our

legal and operating structure and increased operational effi ciency.

The table below presents developments in our operating expenses

during 2010, 2011 and 2012.

Financial income and expenses

—

Net fi nancial expense for 2012 was €9.7 million (2011:

€16 million). This consisted mainly of net interest expense of

€12 million (2011: €22 million) and other fi nancial gains of

€1.6 million (2011: €6.1 million). The decline in the net interest

expense is mainly due to lower debt in 2012 as the result of

repayments at the end of 2011 and throughout 2012. Other

fi nancial gains consisted mainly of positive foreign currency

revaluation results on our balance sheet items.

Taxation

—

In 2012 we had an income tax gain of €69 million compared to

a charge of €13 million in 2011 (excluding the tax effect of the

impairment and restructuring charges). The income tax gain results

from a €80 million settlement we agreed upon with the Dutch tax

authority on prior years’ tax discussions. Excluding the impact of

this settlement, our effective tax rate in 2012 would have been

18.8%.

Net result

—

The net result for the year was €129 million, compared to a loss

of €439 million in 2011. Excluding the impact of impairment,

restructuring charges and the one-off tax gain the net result

decreased by €24 million.

Liquidity and capital resources

—

Cash fl ow from operations amounted to €187 million in 2012,

a decrease of 4% compared to €195 million in 2011. As a

percentage of revenue, cash fl ow from operations increased

from 15% in 2011 to 18% in 2012.

Capital expenditures amounted to €52 million in 2012. These

consisted mainly of €43 million in investments in intangible assets

and €9 million on property, plant and equipment.

On the fi nancing side, during 2012 we made a net repayment on

our borrowings of €138 million.

Our cash position was €164 million as at 31 December 2012.

Debt fi nancing

—

On 31 December 2012 we made the fi nal repayment on the

outstanding amount of the loan we entered into in 2008.

At the same time we drew down on the new €250 million term

loan.

Management Board Report | continued

600

500

400

300

200

100

201220112010

0

Research & development expenses

Amortisation of technology and databases

Marketing expenses

Selling, general and administrative expenses

Stock compensation

13 87

197 202

170

105 77

57

162 167

166

78 85

84

0

100

150

200

250

350

400

Cash position

31 December

2011

Operating

result

Depreciation

&

Amortisation

Working

capital

Other

non-

cash

items

Interest,

taxes and

other

Investments Financing Cash position

31 December

2012

194

70

111 10

– 4 – 20 – 51

– 146

164

Operating expenses1

(€ in millions)

Cash fl ow development

(€ in millions)

1 Excluding restructuring and impairment charges.