TomTom 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

In 2012 a macro-economic headwind continued

to infl uence business conditions in Europe. In

particular, weak consumer sentiment negatively

impacted demand for consumer electronics and

new car sales, a ecting our sales of PNDs and

automotive products. However, we were able to

maintain our profi tability at the anticipated level

in this challenging environment through strong

gross margins and tight control of operating

costs.

Financial and Business Review

Overview

—

TomTom generated revenue of €1.1 billion in 2012; this represented

a decline of 17% compared to revenue of €1.3 billion in 2011.

Our gross margin increased by 2 percentage points to 52%.

During 2012 TomTom made signifi cant progress on costs to align

them with the decline in revenue. Excluding the impairment and

restructuring charges recorded in 2011, the operating expenses

reduced by 10% or €53 million. These savings were ahead of

the target to reduce operating expenses to around €500 million.

Total operating costs for the group in 2012 were €484 million.

The operating result was €70 million (2011: €102 million

excluding impairment and restructuring charges) and the adjusted

earnings per share were €0.40 (2011: €0.55)

Net debt decreased from €194 million at the beginning of the year

to €86 million as of 31 December 2012.

Business Review

—

Consumer

The Consumer business unit was confronted early in the year

with a malfunctioning component that had been supplied by a

third party and integrated in a number of our products. TomTom

moved quickly to offer a fi x, but the resultant decline in our North

American market share only began to recover later in the year.

In North America our market share for the year was 22%, down

fi ve percentage points compared to 2011. This was also partly due

to the decision not to participate in large promotional activities in

the Christmas holiday season. In Europe our market share for the

year was 46%, which was one percentage point up compared to

2011.

Consumer revenue decreased year-on-year by €194 million to

€639 million mainly due to decline in PND revenue. Revenue

from LIVE Services and the SportWatch that we developed in

partnership with Nike grew strongly year-on-year. However,

growth in these areas did not compensate for the decline in PND

sales.

Management Board Report

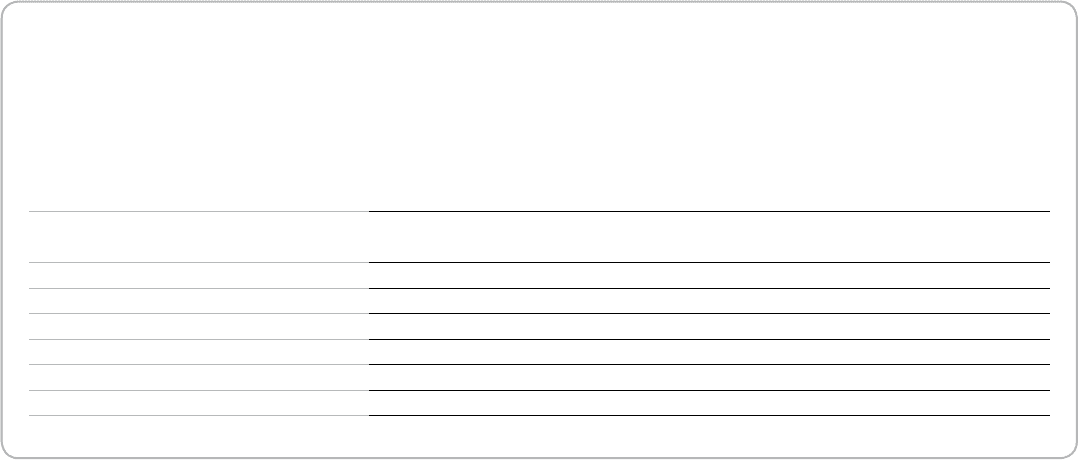

Key fi gures (in € millions)

2012

% of

revenue

2011

% of

revenue

2010

% of

revenue

Consumer 639 60% 833 66% 1,158 76%

Automotive 212 20% 235 18% 179 12%

Licensing 133 13% 142 11% 131 9%

Business Solutions 73 7% 64 5% 53 3%

Hardware 657 62% 867 68% 1,164 77%

Content & Services 400 38% 407 32% 357 23%

TOTAL REVENUE 1,057 100% 1,273 100% 1,521 100%

GROSS RESULT 555 52% 640 50% 744 49%

OPERATING EXPENSES1484 46% 1,064 558 37%

OPERATING RESULT 70 7% – 425 186 12%

EBITDA 181 17% 206 295 19%

NET RESULT 129 12% – 439 108 7%

1 Operating expenses include a €512 million impairment charge in 2011 and restructuring expenses of €15 million in 2011 and €3.3 million in 2010.