TomTom 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

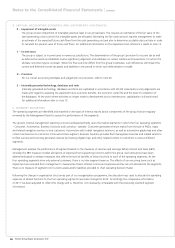

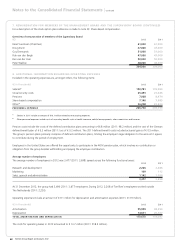

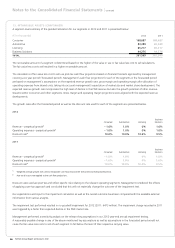

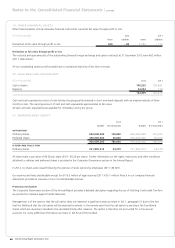

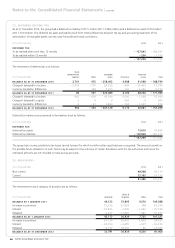

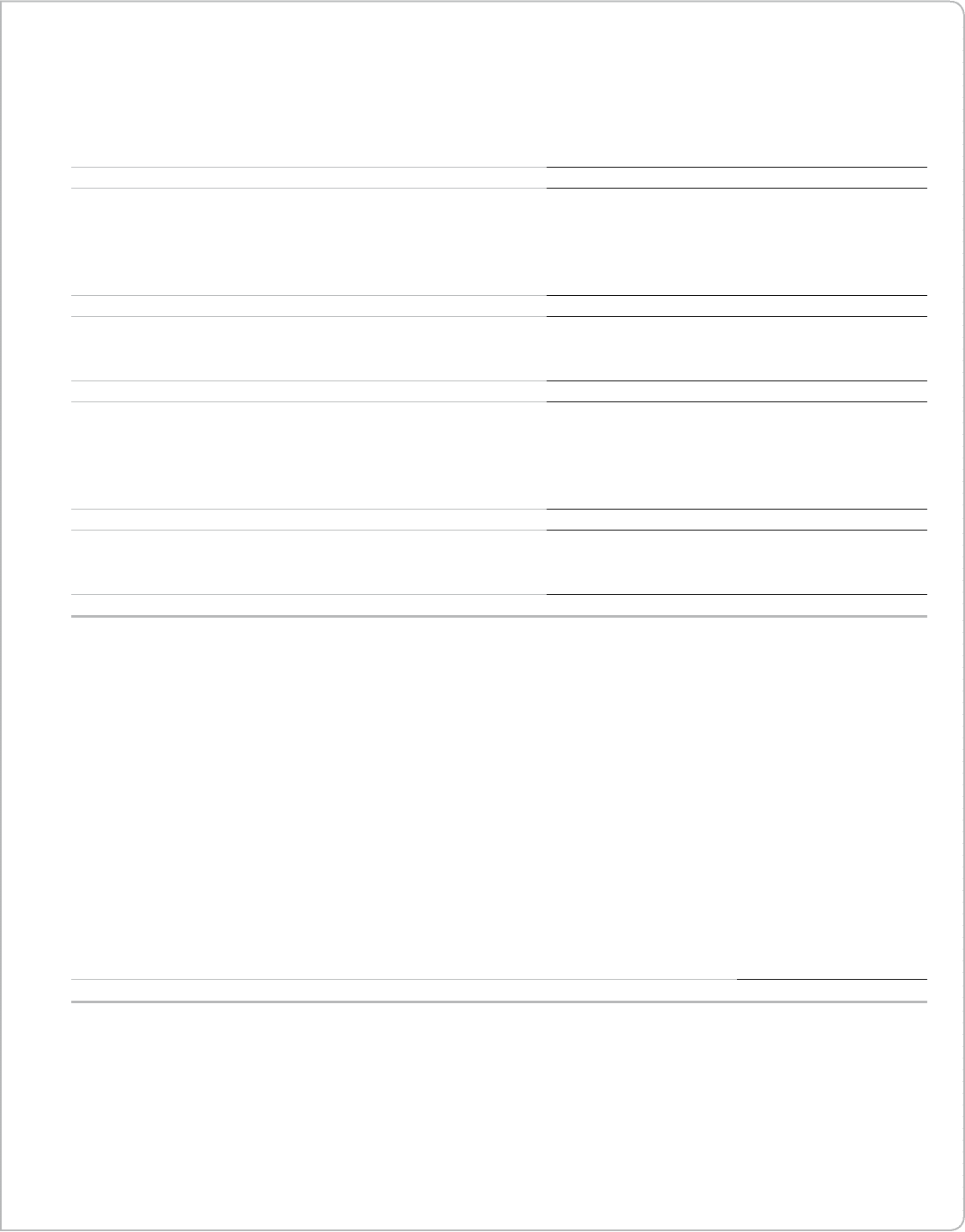

14. PROPERTY, PLANT AND EQUIPMENT

(€ in thousands)

Furniture and

fi xtures

Computer

hardware Other Total

Balance as at 31 December 2010

Investment cost 16,503 65,414 47,226 129,143

Accumulated depreciation – 13,522 – 51,326 – 25,318 – 90,166

2,981 14,088 21,908 38,977

MOVEMENTS

Investments 1,321 9,065 5,470 15,856

Transfer between categories (net) 0 2,175 – 3,785 – 1,610

Depreciation charges – 2,048 – 12,812 – 5,647 – 20,507

Currency translation differences – 27 – 73 – 61 – 161

– 754 – 1,645 – 4,023 – 6,422

Balance as at 31 December 2011

Investment cost 17,797 65,040 41,932 124,769

Accumulated depreciation – 15,570 – 52,597 – 24,047 – 92,214

2,227 12,443 17,885 32,555

MOVEMENTS

Investments 271 5,330 3,872 9,473

Transfer between categories (net) 0 1,504 – 1,504 0

Depreciation charges – 935 – 7,004 – 6,732 – 14,671

Currency translation differences 166 26 – 779 – 587

– 498 – 144 – 5,143 – 5,785

Balance as at 31 December 2012

Investment cost 18,069 70,703 43,383 132,155

Accumulated depreciation – 16,340 – 58,404 – 30,641 – 105,385

1,729 12,299 12,742 26,770

1 Other assets as at 31 December 2012 mainly comprises of leasehold improvements with a carrying value of €5.8 million (31 December 2011: €6.0 million).

No impairment of property, plant and equipment was identifi ed during the accounting period.

The carrying value of fi xed assets held under fi nance leases at 31 December 2012 was nil (2011: nil).

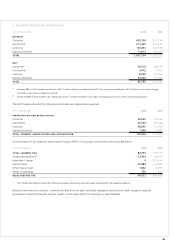

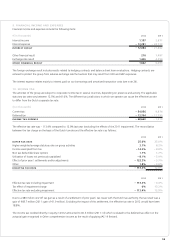

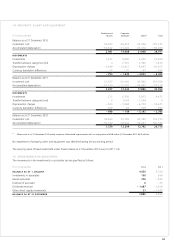

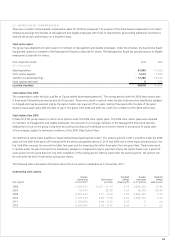

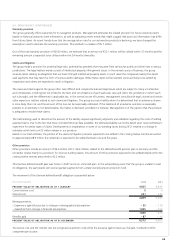

15. INVESTMENTS IN ASSOCIATES

The movements in the investments in associates can be specifi ed as follows:

(€ in thousands) 2012 2011

BALANCE AS AT 1 JANUARY 4,450 7,720

Investments in associates 160 364

Result associates 726 – 432

Disposal of associate 0– 29

Dividends received – 1,487 – 1,628

Other direct equity movements 31 – 1,545

BALANCE AS AT 31 DECEMBER 3,880 4,450

1