TomTom 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

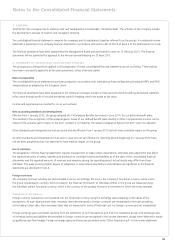

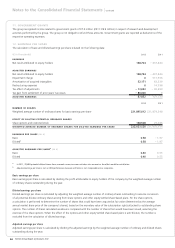

3. FINANCIAL RISK MANAGEMENT (CONTINUED)

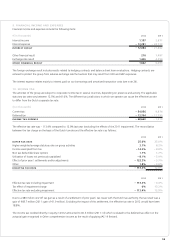

Interest rates

Our interest rate risk arises primarily from the existing long-term borrowings. These borrowings have a fl oating interest coupon based

on Euribor plus a spread which depends on leverage levels. Interest rate risk is hedged with appropriate hedging instruments whenever

deemed necessary in accordance with the Treasury Policy.

Based on our expectation of interest rate movements in the coming period and the acceptability of our potential exposure our current

strategy is not to hedge the interest rate of our current borrowings. Accordingly changes in Euribor may have an impact on the group’s

results for the coming year.

Market-related interest income is received on the cash balances. It is our intention to prioritise capital preservation to yield and earn a

reasonable interest income using vanilla investment instruments like bank deposits and money market fund investments. All transactions

and counterparty risk limits are governed by the Treasury Policy.

Capital risk management

The group’s fi nancing policy aims to maintain a capital structure that enables the group to achieve its strategic objectives and daily

operational needs, and to safeguard the group’s ability to continue as a going concern.

In order to maintain or adjust the capital structure, the group may issue new shares, adjust its dividend policy, return capital to shareholders

or sell assets to reduce debt taking into account relevant interest cover and leverage covenants of our external borrowings as disclosed in

note 24.

As of 31 December 2012 our net debt amounted to €86 million (31 December 2011: €194 million).

Further quantitative disclosures are included throughout these consolidated fi nancial statements.

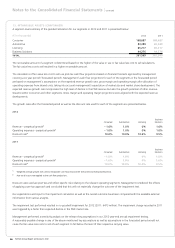

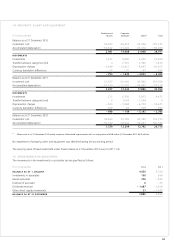

4. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The group makes estimates and assumptions concerning the future. The resulting accounting estimates will, by defi nition, seldom equal the

related actual results. The estimates and assumptions that have a signifi cant risk of causing a material adjustment to the carrying amounts

of assets and liabilities within the next fi nancial year are discussed below.

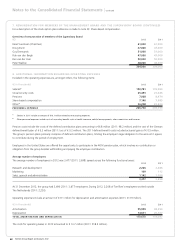

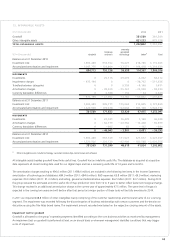

A – Revenue recognition

When returns are probable, an estimate is made of the expected fi nancial impact of these returns. The estimate is based upon

historical data on the return rates and information on the inventory levels in the distribution channel.

The group reduces revenue for estimates of sales incentives. We offer sales incentives, including channel rebates and end-user

rebates for our products. The estimate is based on our historical experience taking into account future expectations on rebate

payments.

If there is excess stock at retailers when a price reduction becomes effective, the group will compensate its customers on the price

difference for their existing stock. Customers are eligible for compensation if certain criteria are met. To refl ect the costs related

to known price reductions in the income statement, an accrual is created against revenue based on estimate of inventory levels

in the channel and future price reductions.

Multiple element arrangements require TomTom to deliver hardware and/or a number of services under one agreement and/or

a number of services under one agreement which is commercially linked. Revenue recognition must be determined separately for

each of the deliverables identifi ed, and for that purpose TomTom must estimate a reliable fair value to each deliverable. The fair

value is estimated based on the relative stand-alone selling price or using of a combination of estimation and allocation methods

allowed by IFRS such as cost plus reasonable margin or residual method if that combination best refl ects a transaction’s substance.

Total deferred revenue balance relating to the elements deferred under such multiple element arrangement as at 31 December

2012 amounted to €41 million (31 December 2011: €43 million).