TomTom 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TomTom Annual Report and Accounts 2012

68

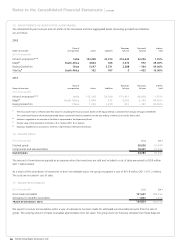

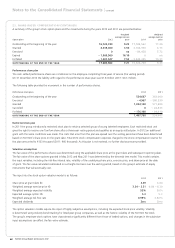

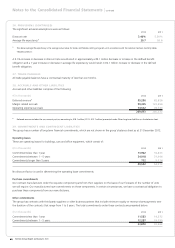

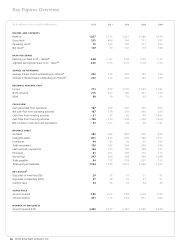

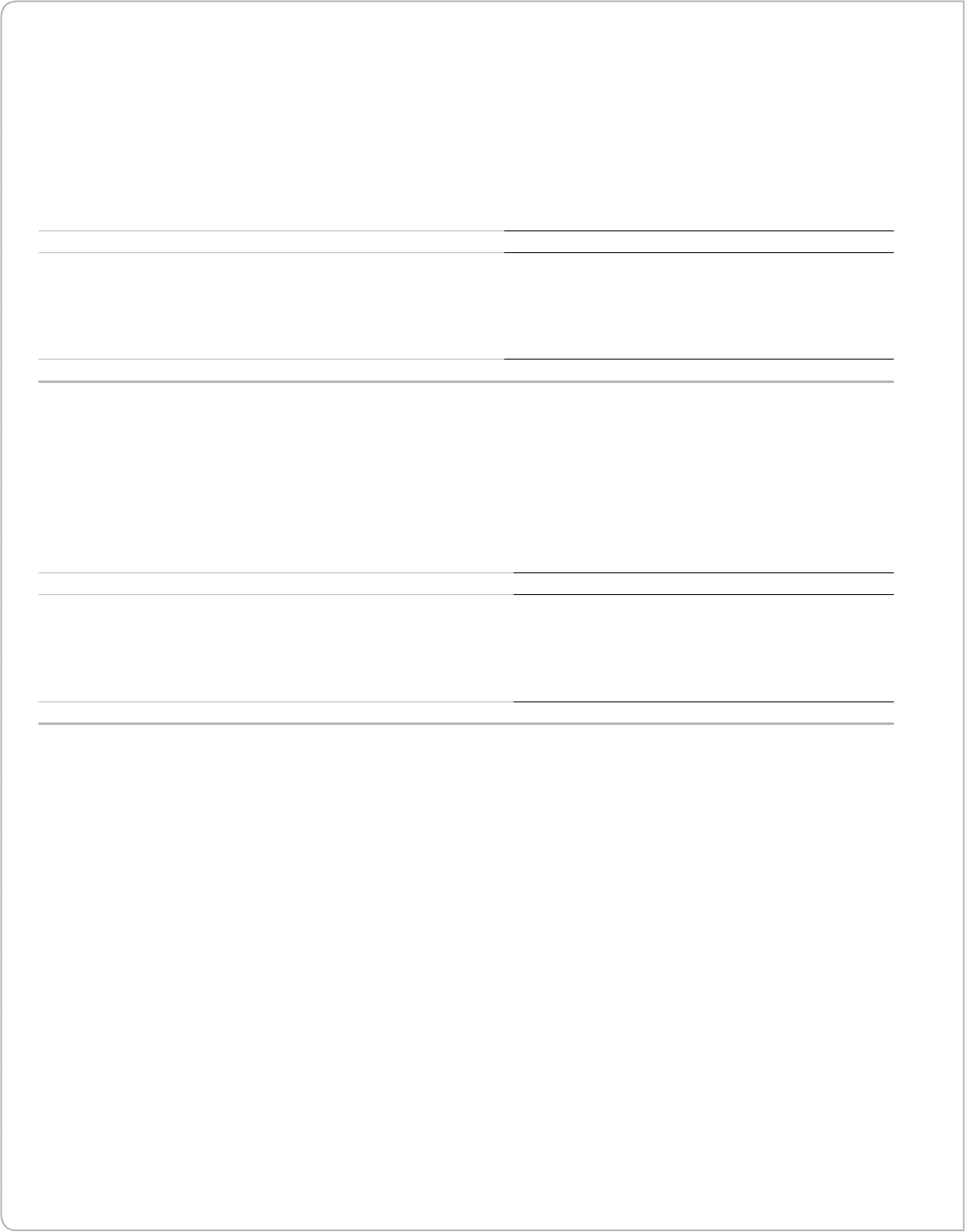

32. FINANCIAL INSTRUMENTS BY CATEGORY

The following table presents the group’s fi nancial instruments according to the categories as defi ned in IAS 39:

(€ in thousands)

Loans and

receivables

Assets/liabilities at

fair value through

profi t or loss

Other fi nancial

assets/liabilities

at amortised cost Total

31 DECEMBER 2012

ASSETS

Other fi nancial assets – derivatives 0 444 0 444

Trade receivables 149,834 0 0 149,834

Cash and cash equivalents 164,459 0 0 164,459

TOTAL 314,293 444 0 314,737

LIABILITIES

Trade payables 0 0 84,162 84,162

Other fi nancial liabilities – derivatives 085085

Borrowings 0 0 247,140 247,140

TOTAL 0 85 331,302 331,387

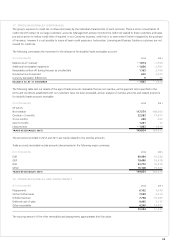

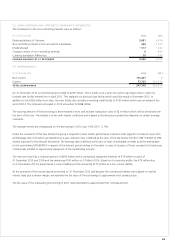

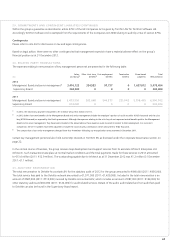

(€ in thousands)

Loans and

receivables

Assets/liabilities at

fair value through

profi t or loss

Other fi nancial

assets/liabilities

at amortised cost Total

31 DECEMBER 2011

ASSETS

Other fi nancial assets – derivatives 0 2,784 0 2,784

Trade receivables 184,939 0 0 184,939

Cash and cash equivalents 193,579 0 0 193,579

TOTAL 378,518 2,784 0 381,302

LIABILITIES

Trade payables 0 0 116,616 116,616

Other fi nancial liabilities – derivatives 0 116 0 116

Borrowings 0 0 383,810 383,810

TOTAL 0 116 500,426 500,542

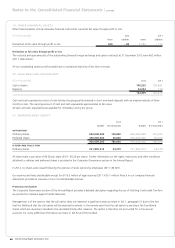

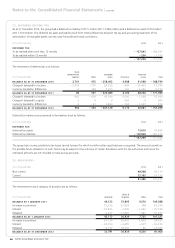

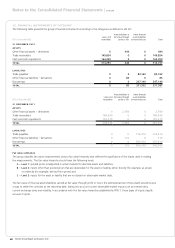

Fair value estimation

The group classifi es fair value measurements using a fair value hierarchy that refl ects the signifi cance of the inputs used in making

the measurements. The fair value hierarchy should have the following levels:

A – Level 1: quoted prices (unadjusted) in active markets for identical assets and liabilities;

B – Level 2: inputs other than quoted prices that are observable for the asset or liability, either directly (for example, as prices)

or indirectly (for example, derived from prices) and

C – Level 3: inputs for the asset or liability that are not based on observable market data.

The fair value of fi nancial assets/liabilities carried at fair value through profi t or loss is the estimated amount that a bank would receive

or pay to settle the contracts at the reporting date, taking into account current observable market inputs such as interest rates,

current exchange rates and volatility. In accordance with the fair value hierarchy established by IFRS 7, these types of inputs classify

as Level 2 inputs.

Notes to the Consolidated Financial Statements | continued