Thrifty Car Rental 2007 Annual Report Download - page 73

Download and view the complete annual report

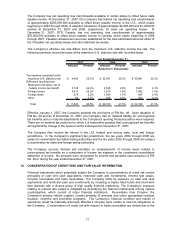

Please find page 73 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.“Accounting for Stock-Based Compensation” (“SFAS No. 123”). The Company previously adopted

the fair value based method of recording stock options consistent with SFAS No. 123 and accounted

for the change in accounting principle using the prospective method in accordance with SFAS No.

148, “Accounting for Stock-Based Compensation – Transition and Disclosure”, an amendment of

SFAS No. 123. Under the prospective method, the Company expensed all stock-based

compensation granted since January 1, 2003 over the vesting period based on the fair value at the

date of grant. The fair value recognition provisions of SFAS No. 123 and SFAS No. 123(R) are

materially consistent; therefore, the adoption of SFAS No. 123(R) did not have a material impact on

the Company’s consolidated statements of financial condition, results of operations or cash flows.

SFAS No. 123(R) requires the Company to estimate forfeitures in calculating the expense relating to

share-based compensation as opposed to recognizing these forfeitures and the corresponding

reduction in expense as they occur, as was allowed under SFAS No. 123.

Long-Term Incentive Plan

The Company has a long-term incentive plan (“LTIP”) for employees and non-employee directors

under which the Human Resources and Compensation Committee of the Board of Directors of the

Company (the “Committee”) is authorized to provide for grants in the form of incentive option rights,

non-qualified option rights, tandem appreciation rights, free-standing appreciation rights, restricted

stock, restricted stock units, performance shares, performance units and other awards to key

employee and non-employee directors that may be payable or related to common stock or factors

that may influence the value of common stock. The Company’s policy is to issue shares of

remaining authorized common stock to satisfy option exercises and grants under the LTIP. At

December 31, 2007, the Company’s common stock authorized for issuance under the LTIP was

1,756,834 shares. The Company has 271,210 shares available for future LTIP awards at December

31, 2007 after reserving for the maximum potential shares that could be awarded under existing

LTIP grants.

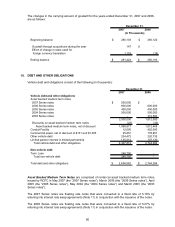

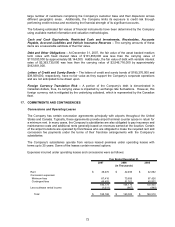

The Company recognized compensation costs of $7,682,000, $11,130,000 and $4,543,000 during

2007, 2006 and 2005, respectively, related to LTIP awards. The total income tax benefit recognized

in the income statement for share-based compensation payments was $3,107,000, $4,220,000 and

$1,719,000 for 2007, 2006 and 2005, respectively.

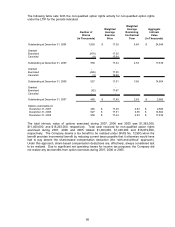

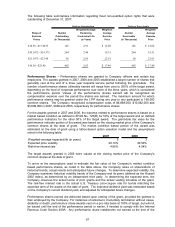

Option Rights Plan – Under the LTIP, the Committee may grant non-qualified option rights to key

employees and non-employee directors. The exercise prices for non-qualified option rights are

equal to the fair market value of the Company’s common stock at the date of grant, except for the

initial grant, which was made at the initial public offering price. The non-qualified option rights vest in

three equal annual installments commencing on the first anniversary of the grant date and have a

term not exceeding ten years from the date of grant. The maximum number of shares for which

option rights may be granted under the LTIP to any participant during any calendar year is 285,000.

65