Thrifty Car Rental 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

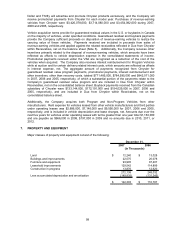

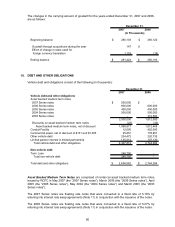

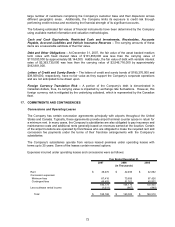

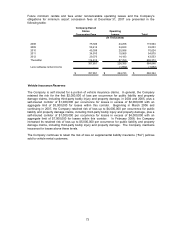

other factors, the required principal payments may be increased. At December 31, 2007, the

Company had $248,750,000 outstanding under the Term Loan.

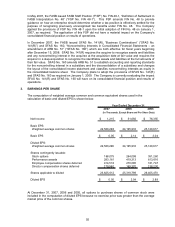

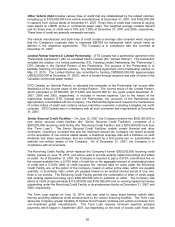

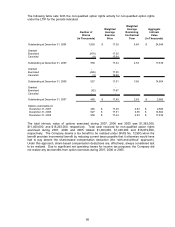

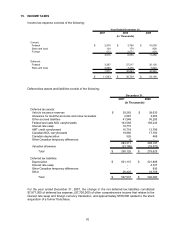

Expected repayments of debt and other obligations outstanding at December 31, 2007 are as

follows:

2008 2009 2010 2011 2012 Thereafter

Asset backed medium term notes 500,000$ -$ 500,000$ 500,000$ 500,000$ -$

Conduit Facility 12,000 - - - - -

Commercial paper 25,982 - - - - -

Other vehicle debt 234,472 - - - - -

Limited partner interest 135,512 - - - - -

Term Loan 2,500 2,500 2,500 2,500 2,500 236,250

Total 910,466$ 2,500$ 502,500$ 502,500$ 502,500$ 236,250$

(In Thousands)

11. DERIVATIVE FINANCIAL INSTRUMENTS

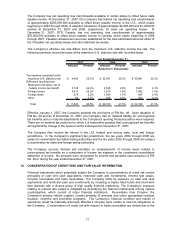

The Company is exposed to market risks, such as changes in interest rates. Consequently, the

Company manages the financial exposure as part of its risk management program, by striving to

reduce the potentially adverse effects that the volatility of the financial markets may have on the

Company’s operating results. The Company has used interest rate swap agreements, for each

related new asset backed medium term note issuance in 2003 through 2007, to effectively convert

variable interest rates on a total of $1.9 billion in asset backed medium term notes to fixed interest

rates. These swaps have termination dates through July 2012. The Company reflects these swaps

on its balance sheet at fair market value, which totaled approximately $47,825,000 at December 31,

2007, comprised of liabilities, included in accrued liabilities, of approximately $48,903,000 and

assets, included in receivables, of approximately $1,078,000. At December 31, 2006, these swaps

totaled $11,540,000 comprised of assets, included in receivables, of approximately $14,271,000,

and liabilities, included in accrued liabilities, of approximately $2,731,000.

The interest rate swap agreements related to the asset backed medium term note issuances in

2003, 2004, 2005 and 2006 do not qualify for hedge accounting treatment under SFAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities”, as amended (“SFAS No. 133”);

therefore, the change in the interest rate swap agreements’ fair values must be recognized as an

(increase) decrease in fair value of derivatives in the consolidated statement of income. For the

years ended December 31, 2007 and 2006, the Company recorded the related change in the fair

value of the swap agreements of $38,990,000 and $9,363,000, respectively, as a net decrease in

fair value of derivatives in its consolidated statements of income.

The interest rate swap agreement entered into in May 2007 related to the 2007 asset backed

medium term note issuance (“2007 Swap”) constitutes a cash flow hedge and satisfies the criteria

for hedge accounting under the “long-haul” method. Related to the 2007 Swap, the Company

recorded a loss of $11,978,000, which is net of income taxes, in total comprehensive income for the

year ended December 31, 2007. Deferred gains and losses are recognized in earnings as an

adjustment to interest expense over the same period in which the related interest payments being

hedged are recognized in earnings. Based on projected market interest rates, the Company

estimates that approximately $2,900,000 of net deferred loss related to the 2007 Swap will be

reclassified into earnings within the next twelve months.

12. STOCKHOLDERS’ RIGHTS PLAN

On July 23, 1998, the Company adopted a stockholders’ rights plan. The rights were issued on

August 3, 1998, to stockholders of record on that date, and will expire on August 3, 2008, unless

earlier redeemed, exchanged or amended by the Board of Directors.

63