Thrifty Car Rental 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

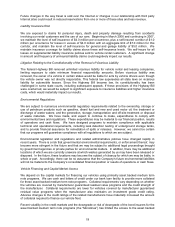

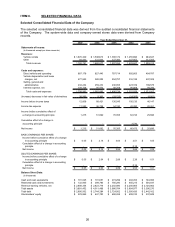

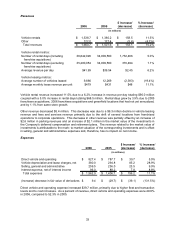

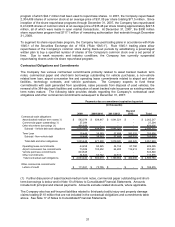

Results of Operations

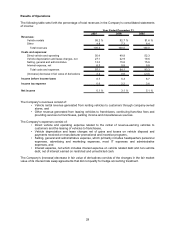

The following table sets forth the percentage of total revenues in the Company’s consolidated statements

of income:

2005

Revenues:

Vehicle rentals 95.2 % 92.7 % 91.6 %

Other 4.8 7.3 8.4

Total revenues 100.0 100.0 100.0

Costs and expenses:

Direct vehicle and operating 50.4 49.8 52.3

Vehicle depreciation and lease charges, net 27.1 22.9 19.6

Selling, general and administrative 13.3 15.6 15.6

Interest expense, net 6.3 5.8 5.8

Total costs and expenses 97.1 94.1 93.3

(Increase) decrease in fair value of derivatives 2.2 0.6 (2.0)

Income before income taxes 0.7 5.3 8.7

Income tax expense 0.6 2.2 3.6

Net income 0.1 % 3.1 % 5.1 %

Year Ended December 31,

2007 2006

The Company’s revenues consist of:

• Vehicle rental revenue generated from renting vehicles to customers through company-owned

stores, and

• Other revenue generated from leasing vehicles to franchisees, continuing franchise fees and

providing services to franchisees, parking income and miscellaneous sources.

The Company’s expenses consist of:

• Direct vehicle and operating expense related to the rental of revenue-earning vehicles to

customers and the leasing of vehicles to franchisees,

• Vehicle depreciation and lease charges net of gains and losses on vehicle disposal and

payments received on manufacturer promotional and incentive programs,

• Selling, general and administrative expense, which primarily includes headquarters personnel

expenses, advertising and marketing expenses, most IT expenses and administrative

expenses, and

• Interest expense, net which includes interest expense on vehicle related debt and non-vehicle

debt, net of interest earned on restricted and unrestricted cash.

The Company’s (increase) decrease in fair value of derivatives consists of the changes in the fair market

value of its interest rate swap agreements that did not qualify for hedge accounting treatment.

29