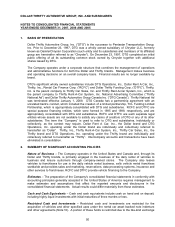

Thrifty Car Rental 2007 Annual Report Download - page 62

Download and view the complete annual report

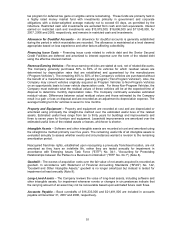

Please find page 62 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2007, the total compensation cost related to nonvested performance share awards

not yet recognized is estimated at approximately $6,400,000 depending upon the Company’s

performance against targets specified in the performance share agreement. This estimated

compensation cost is expected to be recognized over the weighted-average period of 1.7 years.

On November 10, 2005, the FASB issued FASB Staff Position (“FSP”) No. FAS 123(R)-3 “Transition

Election Related to Accounting for the Tax Effects of Share-Based Payment Awards” (“FSP No.

123(R)-3”). As discussed in Note 13, the Company adopted the alternative transition method

provided in FSP No. 123(R)-3 for calculating the tax effects of stock-based compensation pursuant

to SFAS No. 123(R) effective January 1, 2006. The alternative transition method allows the use of a

simplified method to establish the beginning balance of the additional paid-in capital pool (“APIC

pool”) related to the tax effects of stock-based compensation, and to determine the subsequent

impact on the APIC pool and consolidated statements of cash flows of the tax effects of stock-based

compensation awards that are outstanding upon adoption of SFAS No. 123(R). The adoption did not

have a material impact on the Company’s consolidated financial position or results of operations.

In June 2006, the FASB ratified the consensus reached by the EITF in EITF Issue No. 06-3, “How

Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in

the Income Statement (That Is, Gross versus Net Presentation)” (“EITF No. 06-3”). The EITF

reached a consensus that the presentation of the types of taxes included in the scope of EITF No.

06-3 on either a gross or a net basis is an accounting policy decision that should be disclosed. The

Company reports revenues net of these taxes in its consolidated statements of income.

In June 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes” (“FIN No. 48”), an interpretation of SFAS No. 109, “Accounting for Income Taxes”. FIN No.

48 clarifies the accounting for uncertainty in income taxes by prescribing a recognition threshold for

tax positions taken or expected to be taken in a tax return. FIN No. 48 is effective for fiscal years

beginning after December 15, 2006. The Company adopted the provisions of FIN No. 48 as required

on January 1, 2007. The adoption of FIN No. 48 had no material liability for unrecognized tax

benefits, no material adjustments to the Company’s opening financial position were required and

thus, no material impact on the Company’s consolidated financial position or results of operations.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS No. 157”),

which is effective for fiscal years beginning after November 15, 2007. This statement defines fair

value, establishes a framework for measuring fair value and expands the related disclosure

requirements. The Company adopted the provisions of SFAS No. 157 as required on January 1,

2008, except for nonfinancial assets and nonfinancial liabilities that are subject to delayed adoption.

The Company is currently evaluating the impact SFAS No. 157 will have on its consolidated financial

position and results of operations.

In September 2006, the Staff of the Securities and Exchange Commission issued Staff Accounting

Bulletin No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying

Misstatements in Current Year Financial Statements” (“SAB No. 108”). SAB No. 108 provides

guidance on the consideration of the effects of prior year misstatements in quantifying current year

misstatements for the purpose of determining whether the current year’s financial statements are

materially misstated. SAB No. 108 is effective for fiscal years ending after November 15, 2006. The

Company adopted the provisions of SAB No. 108 as of December 31, 2006, as required. Adoption

of SAB No. 108 did not have a material impact on the Company’s consolidated financial position or

results of operations.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities – including an amendment of FASB Statement No. 115” (“SFAS No. 159”). This

statement permits entities to make an irrevocable election to measure certain financial instruments

and other assets and liabilities at fair value on an instrument-by-instrument basis. Unrealized gains

and losses on items for which the fair value option has been elected should be recognized in

earnings at each subsequent reporting date. SFAS No. 159 is effective for fiscal years beginning

after November 15, 2007. The Company adopted the provisions of SFAS No. 159 as required on

January 1, 2008 and is currently evaluating the impact SFAS No. 159 will have on its consolidated

financial position and results of operations.

54