Thrifty Car Rental 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The year 2007 was a challenging year for the U.S. economy, the car rental business and Dollar Thrifty Automotive Group. Like many

companies, we were impacted by the volatility in the global financial and credit markets. Economic uncertainty and declining

consumer confidence led to softer customer demand, particularly in the fourth quarter, which eroded transaction volume, pricing

and fleet utilization. While these challenges adversely affected our financial performance, they also strengthened our resolve to

serve our customers even more effectively to inspire loyalty and retention to our brands. We believe that by consistently providing

customers with value, we will also build value for our shareholders over the long term.

In addition to these troubling issues, during the year we continued to be affected by changing automobile industry dynamics.

In 2007, we faced our second year in a row of substantially increased fleet costs. Also, during the second half of the year, we

experienced delays in shipments of new vehicles from our primary supplier and a softening in the used car market.

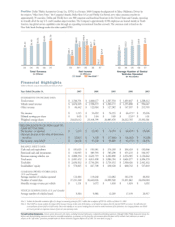

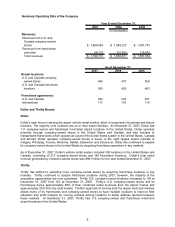

All of these items combined to negatively impact our financial performance in 2007. Total revenues rose 6%, primarily driven

by a 7% increase in revenue per day. Fleet utilization declined year-over-year and expenses increased at a faster rate than did

revenues. The increase in expenses was due primarily to higher vehicle depreciation, which more than offset the benefits of our

on-going cost reduction initiatives.

The bottom line for 2007 was that non-GAAP earnings were $1.02 per diluted share vs. $2.26 per diluted share in 2006.

Non-GAAP net income excludes the impact of changes in the fair value of derivatives, net of related tax impact, from reported

GAAP net income. GAAP earnings were $0.05 per diluted share for 2007 compared to $2.04 per diluted share in 2006.

Corporate EBITDA for 2007 was $107.5 million versus $139.5 million for 2006.

As we enter 2008, we are in the process of implementing a number of exciting initiatives to improve these results and

we have a clear strategy in place to grow our business, strengthen our operations, and build value for our shareholders.

The cornerstone of our strategy is to deliver “Value Every Time” to customers who rely on us for their rental car needs.

We believe we offer a clear competitive advantage to our core market of value-conscious travelers. And while we recognize

that consumer demand can be volatile over the short-term, we also believe that the long-term dynamics of our market are

positive. Domestic travel, for example, is expected to resume steady growth as the economy recovers.

To capture the opportunities ahead, we are focusing even more intensely on executing our revenue growth and cost-

management initiatives. This includes increasing our focus on the corporate business segment, specifically targeting small

and medium-sized corporate accounts. This segment represents a substantial component of the airport market, and we believe

that our value orientation will resonate well with this customer base, particularly in the current economic environment.

Another area we are targeting for growth is international sales (i.e. non-U.S. travelers coming to the U.S.) and, during 2007,

we dedicated additional resources to increase our inbound business from both of our brands, primarily from the U.K., Europe,

and the Latin American region. We also believe additional opportunities lie ahead in the sale of incremental products – such

as insurance and GPS units – as well as new offerings like our RoadSafe, TripSaver and Rent A Toll products. All of these

products are value added for our customers, and highly profitable.

TO OUR

Shareholders: