Thrifty Car Rental 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In May 2007, the FASB issued FASB Staff Position (“FSP”) No. FIN 48-1, “Definition of Settlement in

FASB Interpretation No. 48” (“FSP No. FIN 48-1”). This FSP amends FIN No. 48 to provide

guidance on how an enterprise should determine whether a tax position is effectively settled for the

purpose of recognizing previously unrecognized tax benefits under FIN No. 48. The Company

applied the provisions of FSP No. FIN 48-1 upon the initial adoption of FIN No. 48 on January 1,

2007, as required. The application of this FSP did not have a material impact on the Company’s

consolidated financial position or results of operations.

In December 2007, the FASB issued SFAS No. 141(R), “Business Combinations” (“SFAS No.

141(R)”) and SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an

amendment of ARB No. 51” (“SFAS No. 160”) which are both effective for fiscal years beginning

after December 15, 2008. SFAS No. 141(R) requires the acquirer to recognize assets and liabilities

and any noncontrolling interest in the acquiree at the acquisition date at fair value and requires the

acquirer in a step-acquisition to recognize the identifiable assets and liabilities at the full amounts of

their fair value. SFAS No. 160 amends ARB No. 51 to establish accounting and reporting standards

for the noncontrolling interest in a subsidiary and the deconsolidation of a subsidiary and changes

the layout of the consolidated income statement and classifies noncontrolling interests as equity in

the consolidated balance sheet. The Company plans to adopt the provisions of SFAS No. 141(R)

and SFAS No. 160 as required on January 1, 2009. The Company is currently evaluating the impact

SFAS No. 141(R) and SFAS No. 160 will have on its consolidated financial position and results of

operations.

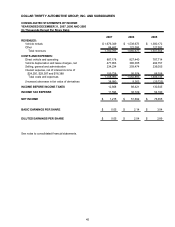

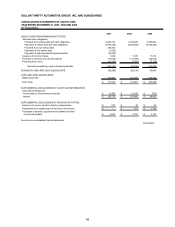

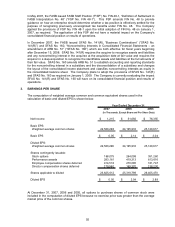

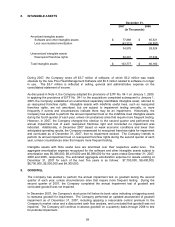

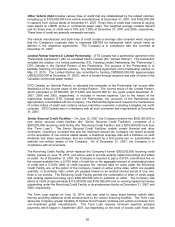

3. EARNINGS PER SHARE

The computation of weighted average common and common equivalent shares used in the

calculation of basic and diluted EPS is shown below:

2007 2006 2005

(In Thousands, Except Share and Per Share Data)

Net Income 1,215$ 51,692$ 76,355$

Basic EPS:

Weighted average common shares 22,580,298 24,195,933 25,120,617

Basic EPS 0.05$ 2.14$ 3.04$

Diluted EPS:

Weighted average common shares 22,580,298 24,195,933 25,120,617

Shares contingently issuable:

Stock options 168,075 264,098 351,260

Performance awards 283,161 419,313 613,616

Employee compensation shares deferred 414,518 270,085 181,747

Director compensation shares deferred 179,560 169,370 138,230

Shares applicable to diluted 23,625,612 25,318,799 26,405,470

Diluted EPS 0.05$ 2.04$ 2.89$

Year Ended December 31,

At December 31, 2007, 2006 and 2005, all options to purchase shares of common stock were

included in the computation of diluted EPS because no exercise price was greater than the average

market price of the common shares.

55