Thrifty Car Rental 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

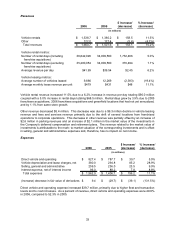

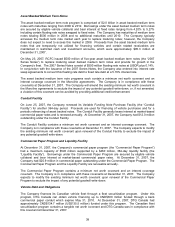

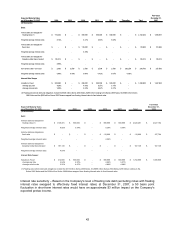

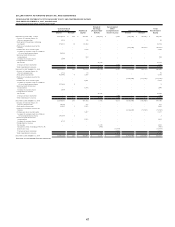

Fair Value

Expected Maturity Dates December 31,

as of December 31, 2007 2008 2009 2010 2011 2012 Thereafter Total 2007

(in thousands)

Debt:

Vehicle debt and obligations-

floating rates (1) 772,454$ -$ 390,000$ 500,000$ 500,000$ -$ 2,162,454$ 1,990,667$

Weighted average interest rates 5.12% - 4.41% 4.83% 5.08% -

Vehicle debt and obligations-

fixed rates -$ -$ 110,000$ -$ -$ -$ 110,000$ 101,856$

Weighted average interest rates - - 4.59% - - -

Vehicle debt and obligations-

Canadian dollar denominated 135,512$ -$ -$ -$ -$ -$ 135,512$ 135,512$

Weighted average interest rates 5.98% - - - - -

Non-vehicle debt - term loan 2,500$ 2,500$ 2,500$ 2,500$ 2,500$ 236,250$ 248,750$ 237,556$

Weighted average interest rates 5.88% 5.49% 6.04% 6.42% 6.67% 6.86%

Interest Rate Swaps:

Variable to Fixed 500,000$ -$ 390,000$ 500,000$ 500,000$ -$ 1,890,000$ 1,937,825$

Average pay rate 4.20% - 4.89% 5.27% 5.16% -

Average receive rate 3.88% - 4.04% 4.42% 4.67% -

(1) Floating rate vehicle debt and obligations include the $500 million Series 2004 Notes, $290 million relating to the Series 2005 Notes, the $600 million Series

2006 Notes and the $500 million Series 2007 Notes swapped from floating interest rates to fixed interest rates.

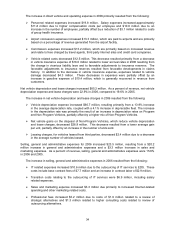

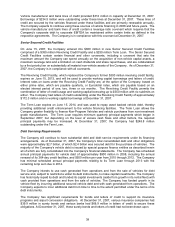

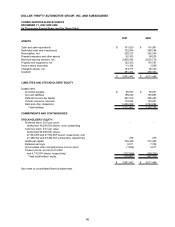

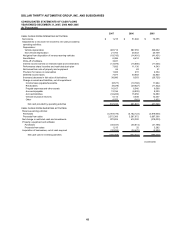

Fair Value

Expected Maturity Dates December 31,

as of December 31, 2006 2007 2008 2009 2010 2011 Total 2006

(in thousands)

Debt:

Vehicle debt and obligations-

floating rates (1) 1,138,491$ 500,000$ -$ 390,000$ 500,000$ 2,528,491$ 2,527,154$

Weighted average interest rates 6.02% 5.34% - 5.26% 5.39%

Vehicle debt and obligations-

fixed rates -$ -$ -$ 110,000$ -$ 110,000$ 107,794$

Weighted average interest rates - - - 4.59% -

Vehicle debt and obligations-

Canadian dollar denominated 107,130$ -$ -$ -$ -$ 107,130$ 107,130$

Weighted average interest rates 4.63% - - - -

Interest Rate Swaps:

Variable to Fixed 312,500$ 500,000$ -$ 390,000$ 500,000$ 1,702,500$ 1,690,960$

Average pay rate 3.64% 4.20% - 4.89% 5.27%

Average receive rate 5.25% 4.87% - 4.89% 4.98%

(1) Floating rate vehicle debt and obligations include the $313 million Series 2003 Notes, the $500 million Series 2004 Notes, $290 million relating to the

Series 2005 Notes and the $600 million Series 2006 Notes swapped from floating interest rates to fixed interest rates.

Interest rate sensitivity – Based on the Company’s level of floating rate debt (excluding notes with floating

interest rates swapped to effectively fixed interest rates) at December 31, 2007, a 50 basis point

fluctuation in short-term interest rates would have an approximate $3 million impact on the Company’s

expected pretax income.

43