Tesco 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

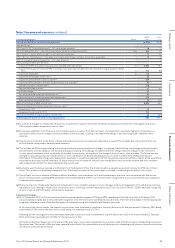

Note 1 Accounting policies continued

Provisions relating to Tesco Bank

The Group has provisions for potential customer redress. In 2010/11,

the Financial Conduct Authority (‘FCA’) formally issued Policy Statement

10/12 (‘PS 10/12’), which introduced new guidance in respect of Payment

Protection Insurance (‘PPI’) customer redress and evidential provisions to

the FCA Handbook with an implementation date of 1 December 2010.

TheGroup continues to handle complaints and redress customers in

accordance with PS 10/12.

During the course of the prior financial year the Group instigated a review

of certain historic operational issues that had resulted in instances where

certain of the requirements of the Consumer Credit Act (‘CCA’) for post

contract documentation had not been fully complied with. In November 2013

the Office of Fair Trading (‘OFT’) wrote to lenders in the industry seeking

confirmation of their compliance with the requirements of the CCA. The

Group extended its earlier investigation to undertake further assurance work

relating to compliance with the CCA. As a result, the Group determined that

it was appropriate to redress certain customers affected by these breaches.

Extensive analysis has been undertaken of the relevant issues to identify where

customers have been affected and to determine if the Group should take

further action. The requirements of the CCA in respect to these issues are not

straightforward and have not been subject to significant judicial consideration

to date. In arriving at the provision required, the Group considered the legal

and regulatory position with respect to these matters and has sought legal

advice which it took into account when it made its judgement. The provision

represents management’s best estimate at the reporting date of the cost

of providing redress to those loan and credit card customers. In making the

estimate, management have exercised judgement as to both the timescale

for implementing the redress campaign and the final scope of any amounts

payable. The OFT and the FCA have been advised of the Group’s approach

to determining the proposed customer redress. Oversight of CCA-related

matters passed from the OFT to the FCA on 1 April 2014. Customer redress

payments commenced in October 2014 and it is expected that these will

continue into the first half of the next financial year.

The Group is part of an industry-wide Scheme of Arrangement established

with the support of the relevant regulatory and customer protection bodies

to address customer redress relating to the historic sale of certain cardholder

protection products (‘CPP’) to credit card customers. Another industry-wide

Scheme of Arrangement has been established to compensate those customers

who were sold a similar product in earlier years. The level of provision held

is based on assumptions relating to the number and value of cases for which

compensation may be paid. In arriving at these assumptions management

have exercised their judgement based on earlier redress programmes

(including the CPP Scheme of Arrangement) and historic customer payment

information. The level of the provision allows for the repayment of charges

paid by the customer together with simple interest of 8.0%.

Inventories

An inventory provision is booked for cases where the realisable value from sale

of the inventory is estimated to be lower than the inventory carrying value. The

inventory provision is estimated taking into account various factors, including

prevailing sales prices of inventory item, the seasonality of the item’s sales

profile and losses associated with slow moving inventory items.

Post-employment benefit obligations

The present value of the post-employment benefit obligations depends on

a number of factors that are determined on an actuarial basis using anumber

of assumptions. The assumptions used in determining the netcost (income)

for pensions include the discount rate. Any changes in these assumptions

will impact the carrying amount of post-employment benefit obligations.

Key assumptions for post-employment benefit obligations are disclosed

in Note 26.

Adoption of new and amended International Financial Reporting

Standards

The Group has adopted the following new and amended standards as of

23 February 2014:

• IFRS 10 ‘Consolidated financial statements’ builds on existing principles

by identifying the concept of control as the determining factor in whether

an entity should be included within the consolidated financial statements

of the parent company. It also provides additional guidance to assist in the

determination of control where this is difficult to assess;

• IFRS 11 ‘Joint arrangements’ gives a more realistic reflection of joint

arrangements by focusing on the rights and obligations of the

arrangement rather than its legal form. There are now only two types

of joint arrangements: joint operations and joint ventures;

• IFRS 12 ‘Disclosures of interests in other entities, includes the disclosure

requirements for all forms of interests in other entities, including

subsidiaries, joint arrangements, associates and structured entities;

• IAS 32 (Amended) ‘Financial instruments: Presentation’ clarifies some

of the requirements for offsetting financial assets and financial liabilities

on the balance sheet; and

• IAS 36 (Amended) ‘Impairment of assets’ removed certain disclosures

of the recoverable amount of cash generating units which had been

included by the issue of IFRS 13.

Revenue

Revenue comprises the fair value of consideration received or receivable for

the sale of goods and services in the ordinary course of the Group’s activities.

Sale of goods

Revenue is recognised when the significant risks and rewards of ownership

of the goods have transferred to the buyer and the amount of revenue

can be measured reliably.

Revenue is recorded net of returns, discounts/offers and value added taxes.

Provision of services

Revenue from the provision of services is recognised when the service is

provided and the revenue can be measured reliably, based on the terms

of the contract.

Where the Group acts as an agent selling goods or services, only the

commission income is included within revenue.

Financial services

Revenue consists of interest, fees and income from the provision of insurance.

Interest income on financial assets that are classified as loans and

receivables is determined using the effective interest rate method.

Calculation of the effective interest rate takes into account fees receivable

that are an integral part of the instrument’s yield, premiums or discounts

on acquisition or issue, early redemption fees and transaction costs.

Fees in respect of services (credit card interchange fees, late payment and

ATM revenue) are recognised as the right to consideration accrues through

the provision of the service to the customer. The arrangements are generally

contractual and the cost of providing the service is incurred as the service

is rendered.

The Group generates commission from the sale and service of motor and

home insurance policies underwritten by Tesco Underwriting Limited, or in

a minority of cases by a third party underwriter. This is based on commission

rates which are independent of the profitability of underlying insurance

policies. Similar commission income is also generated from the sale of

white label insurance products underwritten by other third party providers.

Clubcard, loyalty and other initiatives

The cost of Clubcard and loyalty initiatives is part of the fair value of the

consideration received and is deferred and subsequently recognised over the

period that the awards are redeemed. The deferral is treated as a deduction

from revenue.

The fair value of the points awarded is determined with reference to the fair

value to the customer and considers factors such as redemption via Clubcard

deals versus money-off-in-store and redemption rate.

Rental income

Rental income is recognised in the period in which it is earned, in accordance

with the terms of the lease.

Commercial income

Consistent with standard industry practice, the Group has agreements with

suppliers whereby volume-related allowances, promotional and marketing

allowances and various other fees and discounts are received in connection

with the purchase of goods for resale from those suppliers. Most of the income

received from suppliers relates to adjustments to a core cost price of a product,

and as such is considered part of the purchase price for that product.

Sometimes receipt of the income is conditional on the Group performing

specified actions or satisfying certain performance conditions associated

with the purchase of the product. These include achieving agreed purchases

or sales volume targets and providing promotional or marketing materials

and activities or promotional product positioning. Whilst there is no standard

definition, these amounts receivable from suppliers in connection with

the purchase of goods for resale are generally termed commercial income.

89Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report