Tesco 2015 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

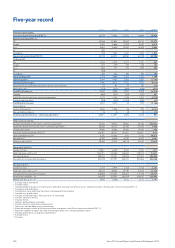

Financial year end 2014/15 28 February 2015

Annual General Meeting/1Q interim management statement 26 June 2015

Half-year end 2015/16 29 August 2015

Interim results 7 October 2015

3Q and Christmas interim management statement 14 January 2016

Financial year end 2015/16 27 February 2016

Please note that these dates are provisional and subject to change, with the exception of the financial year end.

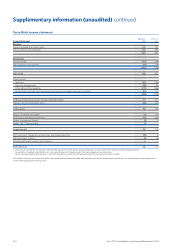

Capex % of sales

Capital expenditure as defined below, divided by Group sales including

VAT and excluding IFRIC 13.

Capital expenditure

The additions to property, plant and equipment, investment property and

intangible assets (excluding assets acquired under business combinations).

Constant tax rate

Using the prior year’s effective tax rate.

EBITDAR

Operating profit before depreciation, amortisation, rent and movements

in impairments of property, plant and equipment, investment property and

intangible assets.

Fixed charge cover

The ratio of EBITDAR (excluding Tesco Bank EBITDAR) divided by financing

costs (net interest including capitalised interest and excluding IAS 32 and 39

impacts and pension finance costs) plus operating lease expenses.

Free cash flow

Free cash flow is net cash generated from/(used in) operating activities less

capital expenditure on property, plant and equipment, investment property

and intangible assets.

Gearing

Net debt divided by total equity.

Growth in sales

The YoY% movement in sales for continuing operations excluding VAT

excluding PFS and excluding IFRIC 13 for 52 weeks at constant fx rates.

Growth in trading profit

The YoY% movement in trading profit for continuing operations for 52 weeks

at constant fx rates.

Loyal customers

Loyal customers are defined based on their frequency of spend and average

weekly spend in our stores and online shopping over eight weeks.

Net debt

Net debt excludes the net debt of Tesco Bank but includes that of the

discontinued operations. Net debt comprises bank and other borrowings,

finance lease payables, net derivative financial instruments, joint venture

loans and other receivables and net interest receivables/payables, offset by

cash and cash equivalents and short-term investments.

Net indebtedness

The ratio of total indebtedness divided by EBITDAR (excluding Tesco Bank

EBITDAR) from continuing operations.

Retail cash flow

Cash generated from/(used in) operations for retail activities.

Return on capital employed

Return divided by the average of opening and closing capital employed.

Return

Profit (excluding the impact of one-off items) before interest after tax

(applied at effective rate of tax).

Capital employed

Net assets (excluding the impact of one-off items) plus net debt plus

dividend creditor less net assets held for resale and discontinued operations.

Total indebtedness

Net debt plus the IAS19 deficit in the pension schemes (net of associated

deferred tax) plus the present value of future minimum rentals payable under

non-cancellable operating leases.

Total shareholder return

The notional annualised return from a share, measured as the percentage

change in the share price, plus the dividends paid with the gross dividends

reinvested in Tesco shares. This is measured over both a one and five-year

period. For example, five-year total shareholder return for 2013/14 is the

annualised growth in the share price from 2008/09 and dividends paid and

reinvested in Tesco shares, as a percentage of the 2008/09 share price.

Trading profit

Trading profit is an adjusted measure of operating profit and measures the

performance of each segment before profits/losses arising on property-related

items, the impact on leases of annual uplifts in rent and rent-free periods,

intangible asset amortisation charges and costs arising from acquisitions, and

goodwill impairment and restructuring and other one-off costs. The IAS 19

pension charge is replaced with the ‘normal’ cash contributions for pensions.

An adjustment is also made for the fair value of customer loyalty awards.

Underlying diluted earnings per share

Underlying profit less tax at the effective tax rate and non-controlling interest

divided by the diluted weighted average number of shares in issue during

the year.

Underlying net interest

Underlying net interest, as included in underlying profit, excludes net pension

finance costs and IAS 39 ‘Finance Instruments’ – fair value measurements.

Underlying profit before tax

Underlying profit before tax excludes the impact of non-cash elements of IAS

17, 19, 32 and 39 (principally the impact of annual uplifts in rents and rent-free

periods, pension costs, and the marking to market of financial instruments);

the amortisation charge on intangible assets arising on acquisition and

acquisition costs, and the non-cash impact of IFRIC 13. It also excludes profits/

losses on property-related items and restructuring and other one-off costs.

Glossary

155Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report

Financial calendar