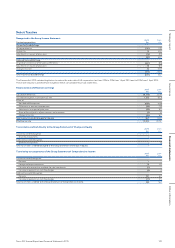

Tesco 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

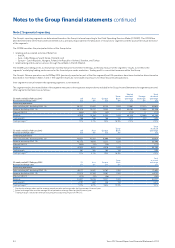

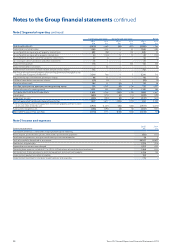

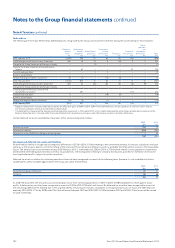

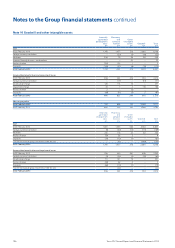

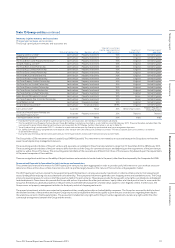

Recognised in the Group Income Statement

Continuing operations

2015

£m

2014

£m

Current tax (credit)/charge

UK corporation tax (141) 519

Foreign tax 73 203

Adjustments in respect of prior years (16) (50)

(84) 672

Deferred tax (credit)/charge

Origination and reversal of temporary differences (641) (93)

Adjustments in respect of prior years 36 (85)

Change in tax rate 32 (147)

(573) (325)

Total income tax (credit)/charge (657) 347

The Finance Act 2013 included legislation to reduce the main rate of UK corporation tax from 23% to 21% from 1 April 2014 and to 20% from 1 April 2015.

These rate reductions are therefore included in these consolidated financial statements.

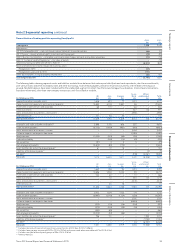

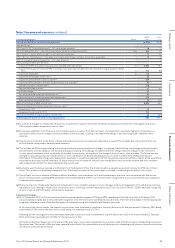

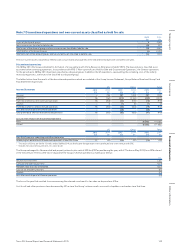

Reconciliation of effective tax charge

2015

£m

2014

£m

(Loss)/profit before tax (6,376) 2,259

Tax credit/(charge) at 21.2% (2014: 23.1%) 1,352 (522)

Effect of:

Non-deductible expenses (604) (109)

Differences in overseas taxation rates (36) (12)

Adjustments in respect of prior years (20) 135

Share of (losses)/profits of joint ventures and associates (3) 14

Change in tax rate (32) 147

Total income tax credit/(charge) for the year 657 (347)

Effective tax rate 10.3% 15.4%

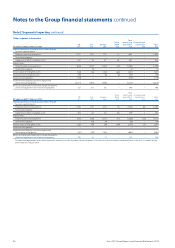

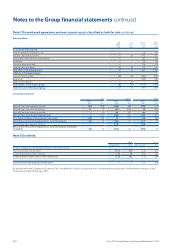

Tax on items credited directly to the Group Statement of Changes in Equity

2015

£m

2014

£m

Current tax credit/(charge) on:

Share-based payments –1

Deferred tax credit/(charge) on:

Share-based payments –(1)

Total tax on items credited/(charged) to the Group Statement of Changes in Equity ––

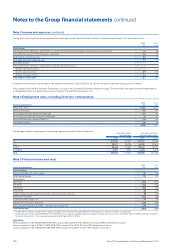

Tax relating to components of the Group Statement of Comprehensive Income

2015

£m

2014

£m

Current tax credit/(charge) on:

Pensions ––

Foreign exchange movements 14 58

Fair value of movement on available-for-sale investments (1) –

Fair value movements on cash flow hedges (3) 4

Deferred tax credit/(charge) on:

Pensions 291 67

Fair value movements on cash flow hedges (17) 35

Total tax on items credited to the Group Statement of Comprehensive Income 284 164

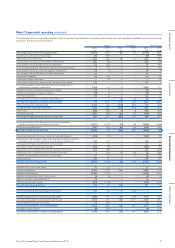

Note 6 Taxation

101Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report