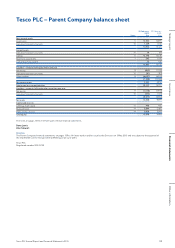

Tesco 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

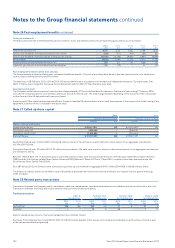

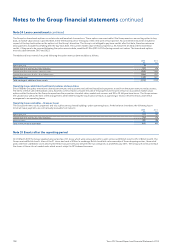

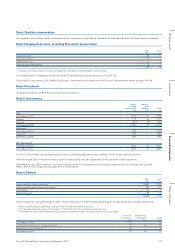

Note 31 Business combinations and other acquisitions

On 3 April 2014 the Group, through its subsidiary dunnhumby Ltd, acquired Sociomantic Labs (‘Sociomantic’), a Berlin-based global leader in digital

advertising solutions, for £124m which included £38m of deferred cash consideration. Sociomantic operates in 14 countries worldwide, with clients in retail,

financial services and travel services.

The Sociomantic acquisition generated goodwill of £87m and other acquisitions generated goodwill of £11m. The goodwill represents synergies within

the operating models and the economies of scale expected from incorporating the operations of the acquired entities within the Group.

Cash flows from acquisitions, net of cash acquired, were £(86)m (2014: £(52)m) and from disposals, net of cash disposed, were £(157)m (2014: £39m).

Note 32 Commitments and contingencies

Capital commitments

At 28 February 2015, there were commitments for capital expenditure contracted for, but not provided for of £182m (2014: £270m), principally relating

to store development.

Contingent liabilities

The Group recognises provisions for liabilities when it is more likely than not that a settlement will be required and the value of such a payment can be

reliably estimated.

On 22 September 2014, the Group announced that it had identified an overstatement of its expected profit for the first half of the year, as contained in

guidance it had issued in August. The Serious Fraud Office (‘SFO’) commenced an investigation into accounting practices at the Group on 29 October 2014.

It is not possible to predict the timescale or outcome of the SFO investigation, but the SFO could decide to prosecute individuals and the Group, and there

is the possibility of fines, or other consequences. The Group is cooperating with the SFO.

Class actions have been filed in the United States District Court for the Southern District of New York against the Group, its former Chairman, two former

Directors and the former Managing Director of its UK business for alleged violations of US federal securities laws. The Court has appointed the lead plaintiff

to take forward the claim on behalf of all investors and has ordered them to file their claim by the end of April 2015. The Group then intends to file a motion

to dismiss the complaint. All of the plaintiffs dealt through the American Depository Receipts (‘ADR’) programme which represents approximately 2% of the

Group’s issued share capital.

In addition, law firms in the UK have announced the intention of forming claimant groups to commence litigation against the Group for matters arising out

of or in connection with its overstatement, and purport to have secured third party funding for such litigation. No such litigation has yet been formally

threatened or commenced.

All such matters are periodically assessed with the assistance of external professional advisers, where appropriate, to determine the likelihood of the Group

incurring a liability and to evaluate the extent to which a reliable estimate of any liability can be made. However, the likely outcome on the Group of the SFO

investigation and any litigation relating to the above issues that either has been or may potentially be brought against the Group is subject to a number of

significant uncertainties. These cannot currently be determined, although they could have a material and adverse impact on the Group’s financial condition

and/or results. Accordingly, no provision has been made in respect of these matters.

For details of assets held under finance leases, which are pledged as security for the finance lease liabilities, see Note 11. There are a number of contingent

liabilities that arise in the normal course of business which if realised are not expected to result in a material liability to the Group.

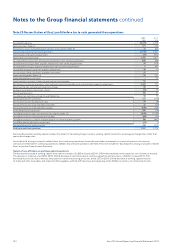

Tesco PLC has irrevocably guaranteed the liabilities of the following Irish subsidiary undertakings, which undertakings have been exempted pursuant

to section 17(1) of the Companies (Amendment) Act 1986 of Ireland from the provisions of section 7 (other than subsection (1)(b)) of that Act:

Monread Developments Limited; Edson Properties Limited; Edson Investments Limited; Cirrus Finance (2009) Limited; Commercial Investments Limited;

Chirac Limited, Clondalkin Properties Limited; Golden Island Management Services Limited; Tesco Ireland Pension Trustees Limited; Orpingford; Tesco

Trustee Company of Ireland Limited; WSC Properties Limited; Thundridge; Pharaway Properties Limited; R.J.D. Holdings; Nabola Development Limited; PEJ

Property Investments Limited; Cirrus Finance Limited; Tesco Ireland Limited; Wanze Properties (Dundalk) Limited; Valiant Insurance Company; Tesco Ireland

Holdings Limited.

Tesco Bank

At 28 February 2015, Tesco Bank had commitments of formal standby facilities, credit lines and other commitments to lend, totalling £11.5bn (2014: £9.7bn).

The amount is intended to provide an indication of the potential volume of business and not of the underlying credit or other risks.

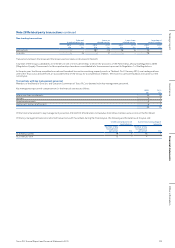

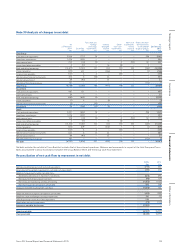

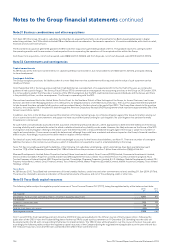

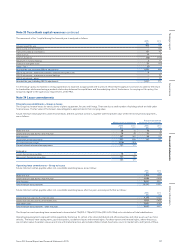

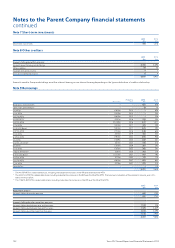

Note 33 Tesco Bank capital resources

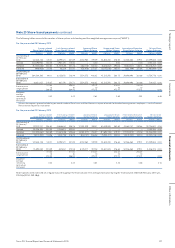

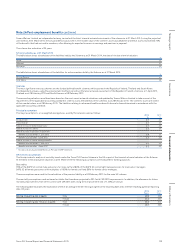

The following tables analyse the regulatory capital resources of Tesco Personal Finance PLC (‘TPF’), being the regulated entity at the balance sheet date:

2015

£m

2014

£m

Tier 1 capital:

Shareholders’ funds and non-controlling interests, net of tier 1 regulatory adjustments 1,041 913

Tier 2 capital:

Qualifying subordinated debt 235 235

Other interests 36 33

Total tier 2 regulatory adjustments (24) (21)

Total regulatory capital 1,288 1,160

On 27 June 2013 the final Capital Requirements Directive (‘CRD’) IV rules were published in the Official Journal of the European Union. Following the

publication of the CRD IV rules the Prudential Regulation Authority (‘PRA’) issued a policy statement on 19 December 2013 detailing how the rules will

be enacted within the UK with corresponding timeframes for implementation. The CRD IV rules will be phased in over the course of the next five years and,

accordingly, the following tables analyse the regulatory capital resources of the Company (being the regulated entity) applicable as at the year end and also

the “end point” position, once all of the rules contained within CRD IV have come into force.

136 Tesco PLC Annual Report and Financial Statements 2015

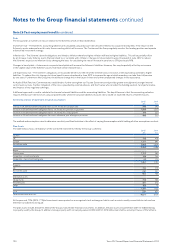

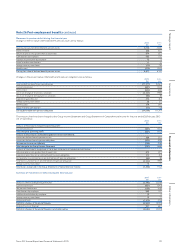

Notes to the Group financial statements continued