Tesco 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

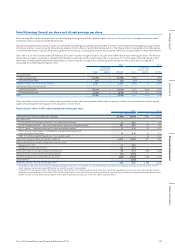

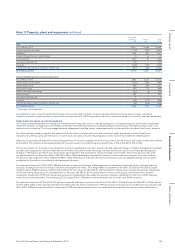

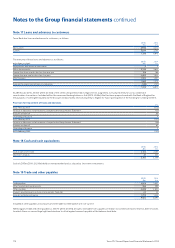

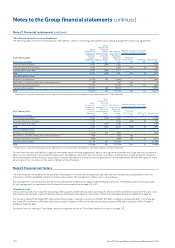

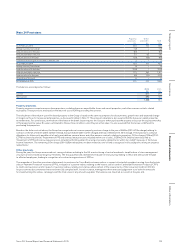

Note 20 Borrowings

Current

Par value

Maturity

year

2015

£m

2014

£m

Commercial paper, bank loans and overdrafts – – 1,982 830

Loans from joint ventures (Note 28) – – 16 16

5% MTN £600m 2014 –628

2% USD Bond $500m 2014 –300

Other MTNs – – –130

Finance leases (Note 34) – – 10 6

2,008 1,910

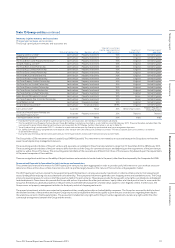

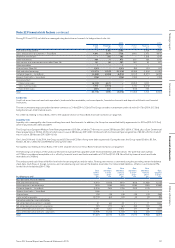

Non-current

Par value

Maturity

year

2015

£m

2014

£m

5.125% MTN €600m 2015 –528

4% RPI MTN*£307m 2016 313 304

5.875% MTN €1,039m 2016 872 1,011

2.7% USD Bond $500m 2017 325 299

1.250% MTN €500m 2017 362 411

5.5% USD Bond $850m 2017 625 595

5.2% Tesco Bank Retail Bond £125m 2018 135 139

3.375% MTN €750m 2018 548 620

LIBOR + 0.45% Tesco Bank Bond £150m 2019 149 –

1.375% MTN €1,250m 2019 911 –

5.5% MTN £350m 2019 353 352

1% RPI Tesco Bank Retail Bond £60m 2019 60 60

2.125% MTN €500m 2020 362 411

5% Tesco Bank Retail Bond £200m 2020 205 197

LIBOR + 0.65% Tesco Bank Bond £350m 2021 349 –

6.125% MTN £900m 2022 895 948

5% MTN £389m 2023 407 401

2.5% MTN €750m 2024 547 –

3.322% LPI MTN** £315m 2025 318 310

6% MTN £200m 2029 261 242

5.5% MTN £200m 2033 262 241

1.982% RPI MTN*** £261m 2036 263 256

6.15% USD Bond $1,150m 2037 917 792

4.875% MTN £173m 2042 175 174

5.125% MTN €600m 2047 631 605

5.2% MTN £279m 2057 275 274

Other loans – – –18

Finance leases (Note 34) – – 131 115

10,651 9,303

* The 4% RPI MTN is redeemable at par, including indexation for increases in the Retail Price Index (‘RPI’) over the life of the MTN.

** The 3.322% Limited Price Inflation (‘LPI’) MTN is redeemable at par, including indexation for increases in the RPI over the life of the MTN. The maximum indexation of the

principal in any one year is 5%, with a minimum of 0%.

*** The 1.982% RPI MTN is redeemable at par, including indexation for increases in the RPI over the life of the MTN.

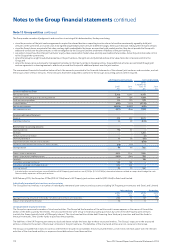

Borrowing facilities

The Group has the following undrawn committed facilities available at 28 February 2015, in respect of which all conditions precedent had been met as at that date:

2015

£m

2014

£m

Expiring in less than one year 132 –

Expiring between one and two years 200 125

Expiring in more than two years 4,800 2,600

5,132 2,725

The current year undrawn committed facilities include £2.2bn of bilateral facilities and a £2.6bn revolving credit facility.

All facilities incur commitment fees at market rates and would provide funding at floating rates.

115Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report