Tesco 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

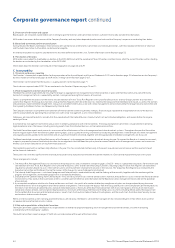

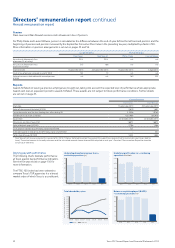

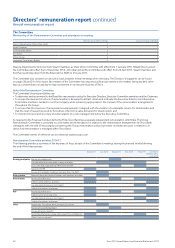

Shares held by Executive Directors at 28 February 2015

This table has been audited.

Share category (see notes below)

Director Shareholding

guidelines

(% of salary)

Shareholding

guideline

(number

of shares)*

Actual net

number/value

of shares

counted

towards

shareholding

guideline*

Guideline met? Ordinary shares

held at

28 February

2015

Share Incentive

Plan shares,

subject to

conditions at

28 February

2015

Interests in

vested options,

not subject

to performance

conditions, at

28 February

2015

Interests in

unvested

options, not

subject to

performance

conditions,

at 28 February

2015

Interests in

options,

subject to

performance

conditions, at

28 February

2015

Dave Lewis 400% 2,385,785 885,256

£1.9m

(1.5xsalary)

On target 151 Nil 452,265*** 1,218,029*** Nil

Alan Stewart 300% 1,073,603 470,906

£1.0m

(1.3xsalary)

On target 44 Nil Nil 888,501*** Nil

Former Directors

Philip Clarke** 400% n/a 2,307,121

£4.8m

(4.2xsalary)

n/a 1,832,483 1,074 2,833,393*** 4,554 1,984,303***

Laurie McIlwee** 300% n/a 344,756

£0.7m

(0.8xsalary)

n/a 80,796 423 800,505*** 215,486*** 1,734,605***

* Based on a three-month average share price to 28 February 2015 of 209.6p.

** Figures on ceasing to be a Director of Tesco PLC (Philip Clarke – 1 September 2014, Laurie McIlwee – 4 April 2014). After ceasing to be Directors and before the end

of the financial year, Philip Clarke and Laurie McIlwee exercised vested nil cost options granted under the PSP and Executive Incentive Plan over 935,727 and 500,549

shares respectively. Shares held by Philip Clarke and Laurie Mcllwee under the Share Incentive Plan (SIP), 19,170 and 11,956 shares respectively, were transferred from the

SIP Trust and each Director forfeited 1,074 of these shares, and Laurie Mcllwee cancelled his Sharesave contracts lapsing options over 4,554 shares.

*** Includes dividend equivalents added since grant.

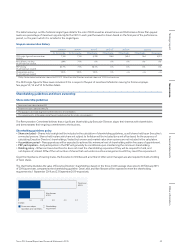

Share category Shares / options included

Ordinary shares • Shares in the all-employee Share Incentive Plan, not subject to forfeiture

• Ordinary shares held by Director and connected persons

Share Incentive Plan shares, subject to conditions • Shares in the all-employee Share Incentive Plan, subject to forfeiture

Interests in vested options, not subject to performance conditions • Vested awards in the deferred bonus plan

• Vested awards in the PSP

• Vested buyout awards granted under L.R. 9.4.2

• Vested market share options granted under the Discretionary Share Option Plan

Interests in unvested options, not subject to performance conditions • Share options granted under the Tesco Sharesave scheme

• Unvested awards in the deferred bonus plan

• Unvested buyout awards, granted under L.R. 9.4.2

Interests in options, subject to performance conditions • Unvested awards under the PSP, which remain subject to performance

Between 28 February 2015 and 4 May 2015, Dave Lewis acquired 95 and Alan Stewart acquired 95 partnership shares under the all-employee

Share Incentive Plan. On 22 April 2015, Philip Clarke’s discretionary share option granted in 2005 over 379,856 shares lapsed. There were no

other changes of interests.

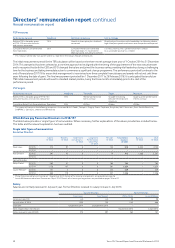

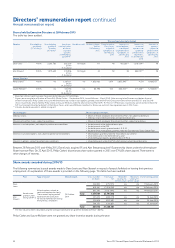

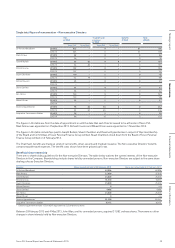

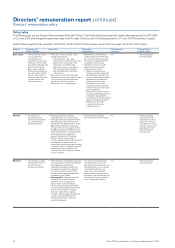

Share awards awarded during 2014/15

The following summarises buyout awards made to Dave Lewis and Alan Stewart in respect of awards forfeited on leaving their previous

employment. An explanation of these awards is provided on the following page. This table has been audited.

Plan Type of award Date of awards Gross number

of shares

Face value*

(£)

Threshold

vesting (%

of face value)

Maximum

vesting (%

of face value)

End of vesting period

Dave

Lewis

Awards were

granted under

listing rule 9.4.2

Nil cost options subject to

continued employment only.

These awards were granted

to compensate Executives

for awards forfeited on leaving

their previous employers

24 October

2014

448,933 £757,574 n/a n/a 17 February 2015

603,461 £1,018,340 n/a n/a 18 February 2016

605,595 £1,021,942 n/a n/a 14 February 2017

Total 1,657,989 £2 ,797, 8 56

Alan

Stewart

251,010 £423,579 n/a n/a 18 June 2015

324,676 £547,891 n/a n/a 24 June 2016

306,270 £516,831 n/a n/a 23 June 2017

Total 881,956 £1,488,301

* The face value has been calculated using the average market price on grant (24 October 2014) of 1.6875p.

Philip Clarke and Laurie McIlwee were not granted any share incentive awards during the year.

54 Tesco PLC Annual Report and Financial Statements 2015

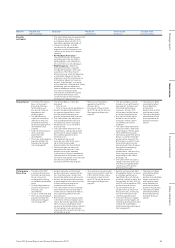

Directors’ remuneration report continued

Annual remuneration report