Tesco 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 Tesco PLC Annual Report and Financial Statements 2013

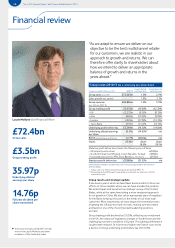

Financial review

£72.4bn

Group sales

£3.5bn

Group trading profit

35.97p

Underlying diluted

earnings per share

14.76p

Full year dividend per

share maintained

Laurie McIlwee Chief Financial Officer

“ As we adapt to ensure we deliver on our

objective to be the best multichannel retailer

for our customers, we are realistic in our

approach to growth and returns. We can

therefore offer clarity to shareholders about

how we intend to deliver an appropriate

balance of growth and returns in the

years ahead.”

Group results 2012/13 (on a continuing operations basis)

52 weeks ended 23 February 2013 2012/13

Growth (actual

exchange rates)

Growth (constant

exchange rates)

Group sales (inc. VAT)*£72,363m 1.3% 2.5%

Sales growth exc. petrol 1.8% 3.1%

Group revenue

(exc. VAT, inc. IFRIC 13)

£64,826m 1.4% 2.5%

Group trading profit £3,453m (13.0)% (12.3)%

– UK £2,272m (8.3)% (8.3)%

– Asia £661m (10.3)% (9.8)%

– Europe £329m ( 37. 8)% (33.3)%

– Tesco Bank £191m (15.1)% (15.1)%

Underlying profit before tax £3,549m (14.5)% (14.0)%

Underlying diluted earnings

per share

35.97p (14.0)%** n/a

ROCE (adjusted for one-off items) 12.7% (200)bp n/a

Capex £3.0bn down

19.0%

down

18.1%

Statutory profit before tax includes the following one-off items:

– UK property write-down £(804)m

– Goodwill impairment (Poland, Czech Republic, Turkey) £(495)m

– Increased provision for PPI (Tesco Bank) (inc. H1 £(30)m) £(115)m

Statutory profit before tax £1,960m (51.5)% n/a

United States treated as discontinued, with restructuring and other one-off costs

of £(1.0) billion.

* Group sales (inc. VAT) exclude the accounting impact of IFRIC 13.

** Underlying diluted EPS growth calculated on a constant tax rate basis; (10.8)%

at actual tax rates.

Group results and strategic update

It has been a year in which we have taken decisive action to focus our

efforts on those markets where we can have a leadership position.

We exited Japan and launched our strategic review of the United

States, while at the same time taking a more measured approach

to our growth in China. We also set an appropriate pace of migration

for the Bank, keeping it focused on the needs of our most loyal

customers. Most importantly, we have begun the essential process

of getting the UK business back on track, making sure we protect

and build on one of the most important leadership positions

we have.

Group trading profit declined by (13.0)%, reflecting our investment

in the UK, the impact of regulatory changes in South Korea and the

challenging economic conditions in Europe. This trading performance

coupled with reduced JV income and higher net finance costs led to

a decline in Group underlying profit before tax of (14.5)%.

Visit www.tescoplc.com/ar2013 to hear

more from Laurie McIlwee and other

members of the leadership team.