Tesco 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 Tesco PLC Annual Report and Financial Statements 2013

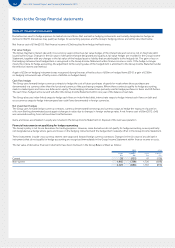

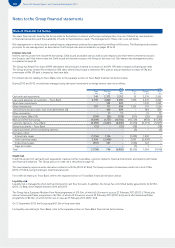

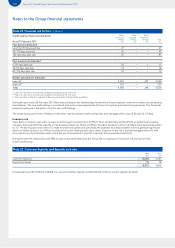

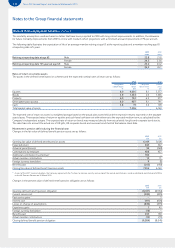

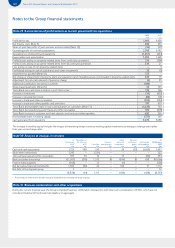

Note 25 Share-based payments

For continuing operations, the Group Income Statement charge for the year recognised in respect of share-based payments is £89m (2012: £151m),

which is made up of share option schemes and share bonus payments. Of this amount, £65m (2012: £124m) will be settled in equity and £24m

(2012:£27m) in cash.

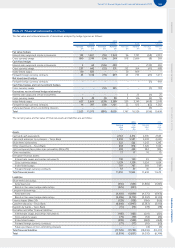

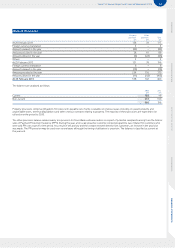

Share option schemes

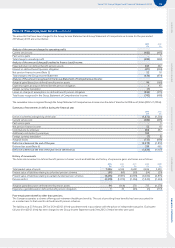

The Company had ten share option schemes in operation during the financial year, all of which are equity-settled schemes:

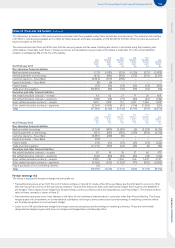

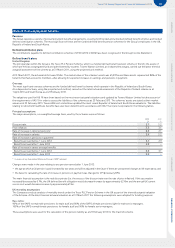

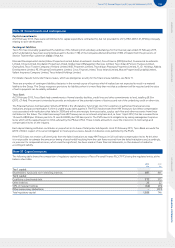

i) The Savings-related Share Option Scheme (1981) permits the grant to employees of options in respect of ordinary shares linked to a building

society/bank save-as-you-earn contract for a term of three or five years with contributions from employees of an amount between £5 and £250

per four-weekly period. Options are capable of being exercised at the end of the three- or five-year period at a subscription price of not less than

80% of the average of the middle-market quotations of an ordinary share over the three dealing days immediately preceding the offer date.

ii) The Irish Savings-related Share Option Scheme (2000) permits the grant to Irish employees of options in respect of ordinary shares linked to a

building society/bank save-as-you-earn contract for a term of three or five years with contributions from employees of an amount between €12 and

€500 per four-weekly period. Options are capable of being exercised at the end of the three- or five-year period at a subscription price of not less

than 80% of the average of the middle-market quotations of an ordinary share over the three dealing days immediately preceding the offer date.

iii) The Approved Executive Share Option Scheme (1994) was adopted on 17 October 1994. The exercise of options granted under this scheme

will normally be conditional upon the achievement of a specified performance target related to the growth in earnings per share over a three-year

period. Nofurther options will be granted under this scheme and it has been replaced by the Discretionary Share Option Plan (2004). There were

no discounted options granted under this scheme.

iv) The Unapproved Executive Share Option Scheme (1996) was adopted on 7 June 1996. The exercise of options granted under this scheme

will normally be conditional upon the achievement of a specified performance target related to the growth in earnings per share over a three-year

period. Nofurther options will be granted under this scheme and it has been replaced by the Discretionary Share Option Plan (2004). There were

no discounted options granted under this scheme.

v) The International Executive Share Option Scheme (1994) was adopted on 20 May 1994. This scheme permits the grant to selected non-UK

executives of options to acquire ordinary shares on substantially the same basis as their UK counterparts. The exercise of options granted under

this scheme will normally be conditional upon the achievement of a specified performance target related to the growth in earnings per share over

a three-year period. Nofurther options will be granted under this scheme and it has been replaced by the Discretionary Share Option Plan (2004).

There were no discounted options granted under this scheme.

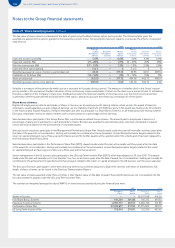

vi) The Executive Incentive Plan (2004) was adopted on 5 July 2004. This scheme permits the grant of options in respect of ordinary shares to

selected senior executives. Options are normally exercisable between three and ten years from the date of grant for nil consideration. Full details

of this plan can be found in the Directors’ Remuneration Report.

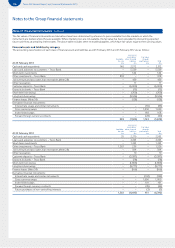

vii) The Performance Share Plan (2004) was adopted on 5 July 2004 and amended on 29 June 2007. This scheme permits the grant of options

in respect of ordinary shares to selected executives. Options granted before 29 June 2007 are normally exercisable between four and ten years from

the date of grant for nil consideration. Options granted after 29 June 2007 are normally exercisable between three and ten years from the date of

grant for nil consideration. The exercise of options will normally be conditional upon the achievement of specified performance targets related

to the return on capital employed over a three-year period. No further options will be granted under this scheme and it has been replaced by the

Performance Share Plan(2011).

viii) The Performance Share Plan (2011) was adopted on 1 July 2011 and amended on 4 July 2011. This scheme permits the grant of options

in respect of ordinary shares to selected executives. Options are normally exercisable between three and ten years from the date of grant for nil

consideration. The exercise of options will normally be conditional upon the achievement of specified performance targets related to the return

on capital employed and earnings per share over a three-year period.

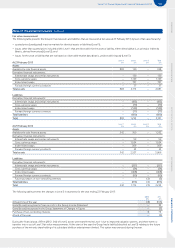

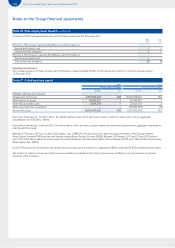

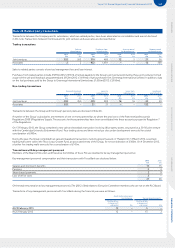

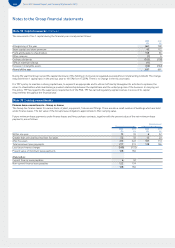

Notes to the Group financial statements