Tesco 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

Tesco PLC Annual Report and Financial Statements 2013

OVERVIEW BUSINESS REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS

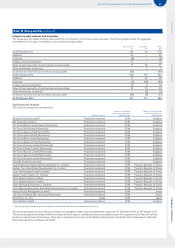

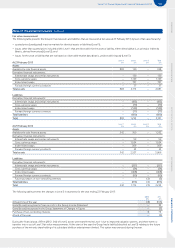

Note 21 Financial instruments continued

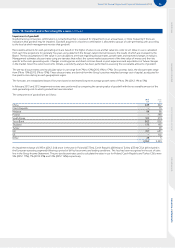

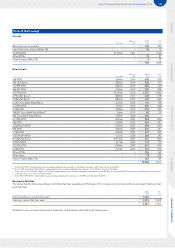

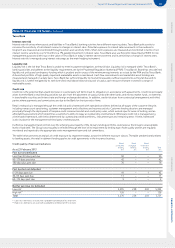

The fair value and notional amounts of derivatives analysed by hedge type are as follows:

2013 2012

Asset Liability Asset Liability

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value hedges

Interest rate swaps and similar instruments 125 1,601 (59) 1,924 96 1,751 (68) 2,031

Cross currency swaps 890 2,749 (34) 249 818 2,686 (8) 269

Cash flow hedges

Interest rate swaps and similar instruments 560 (126) 480 – – (132) 400

Cross currency swaps 237 642 (32) 531 233 304 (41) 988

Index-linked swaps 80 833 – – 30 809 – –

Forward foreign currency contracts 43 1,138 (19) 697 23 733 (21) 1,211

Net investment hedges

Forward foreign currency contracts – – – – – – (7) 969

Cash flow hedges and net investment hedges

Cross currency swaps – – (10) 325 – – (1) 318

Derivatives not in a formal hedge relationship

Interest rate swaps and similar instruments – – – – 3 25 (1) 25

Cross currency swaps 249 (3) 89 3 146 (4) 56

Index-linked swaps 627 3,604 (539) 3,589 539 3,149 (468) 3,149

Forward foreign currency contracts 14 397 (58) 1,121 22 923 (62) 1,282

Future purchases of non-controlling interests – – – – – – (3) –

Total 2,023 11,073 (880) 9,005 1,767 10,526 (816) 10,698

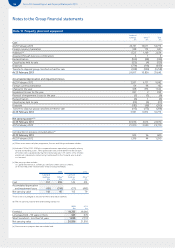

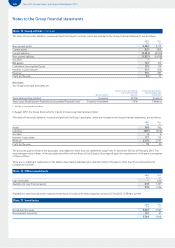

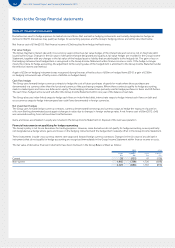

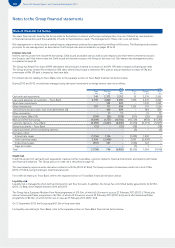

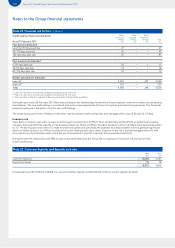

The carrying value and fair value of financial assets and liabilities are as follows:

2013 2012

Carrying

value

£m

Fair

value

£m

Carrying

value

£m

Fair

value

£m

Assets

Cash and cash equivalents 2,512 2,512 2,305 2,305

Loans and advances to customers – Tesco Bank 5,559 5,581 4,403 4,440

Short-term investments 522 522 1,243 1,243

Other investments – Tesco Bank 818 818 1,526 1,524

Joint venture and associates loan receivables (Note 28) 459 459 384 384

Other receivables 17 17 10 10

Derivative financial assets:

Interest rate swaps and similar instruments 130 130 99 99

Cross currency swaps 1,129 1,129 1,054 1,054

Index-linked swaps 707 707 569 569

Forward foreign currency contracts 57 57 45 45

Total financial assets 11,910 11,932 11,638 11,673

Liabilities

Short-term borrowings:

Amortised cost (535) (535) (1,806) (1,841)

Bonds in fair value hedge relationships (225) (221) – –

Long-term borrowings:

Amortised cost (4,450) (4,899) (4,575) (4,966)

Bonds in fair value hedge relationships (5,496) (5,114) (5,202) (5,140)

Finance leases (Note 34) (128) (128) (166) (166)

Customer deposits – Tesco Bank (6,000) (5,997) (5,387) (5,410)

Deposits by banks – Tesco Bank (15) (15) (78) (78)

Derivative and other financial liabilities:

Interest rate swaps and similar instruments (185) (185) (201) (201)

Cross currency swaps (79) (79) (54) (54)

Index-linked swaps (539) (539) (468) (468)

Forward foreign currency contracts (77) (77) (90) (90)

Future purchases of non-controlling interests – – (3) (3)

Total financial liabilities (17,729) (17,789) (18,030) (18,417)

Total (5,819) (5,857) (6,392) (6,744)