Tesco 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 Tesco PLC Annual Report and Financial Statements 2013

Notes to the Group financial statements

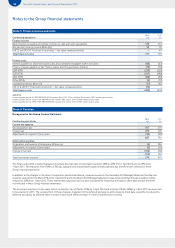

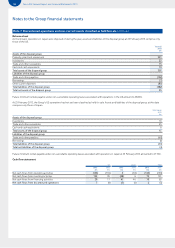

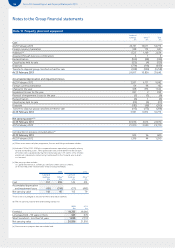

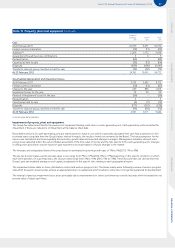

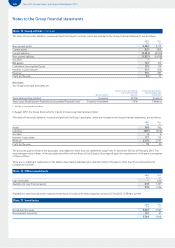

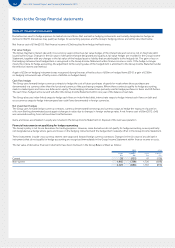

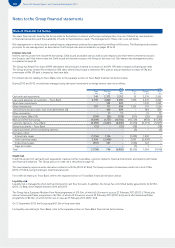

Note 12 Investment property

2013

£m

2012

£m

Cost

At beginning of the year 2,253 2,092

Foreign currency translation 80 (9)

Additions 43 14

Acquisitions through business combinations – 96

Reclassification 7 44

Classified as held for sale (21) 23

Disposals (45) (7)

At end of the year 2, 317 2,253

Accumulated depreciation and impairment losses

At beginning of the year 262 229

Foreign currency translation 10 (2)

Charge for the year 36 39

Impairment losses for the year 1 2

Reclassification 18 (6)

Classified as held for sale (6) –

Disposals (5) –

At end of the year 316 262

Net carrying value at end of the year 2,001 1,991

The estimated fair value of the Group’s investment property is £4.1bn (2012: £4.3bn). This fair value has been determined by applying an appropriate

rental yield to the rentals earned by the investment property. A valuation has not been performed by an independent valuer.

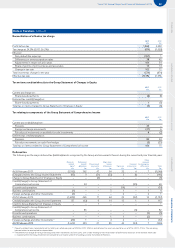

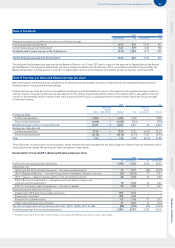

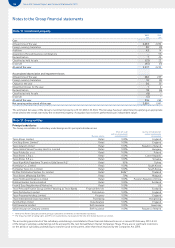

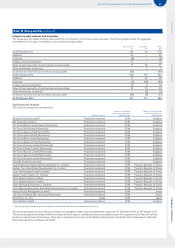

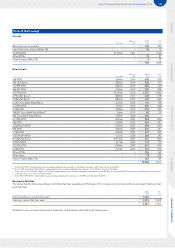

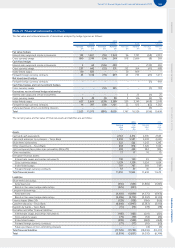

Note 13 Group entities

Principal subsidiaries

The Group consolidates its subsidiary undertakings and its principal subsidiaries are:

Business activity

Share of issued

ordinary share capital

and voting rights

Country of incorporation

and principal country

of operation

Tesco Stores Limited Retail 100% England

One Stop Stores Limited*Retail 100% England

Tesco Ireland Limited Retail 100% Republic of Ireland

Tesco-Global Stores Privately Held Co. Limited Retail 100% Hungary

Tesco Polska Sp. z o.o. Retail 100% Poland

Tesco Stores C R a.s. Retail 100% Czech Republic

Tesco Stores S R a.s. Retail 100% Slovakia

Tesco Kipa Kitle Pazarlama Ticaret ve Gida Sanayi A S¸.*Retail 95% Turkey

Homeplus Co., Limited Retail 100% South Korea

Homeplus Tesco Co., Limited Retail 100% South Korea

Ek-Chai Distribution System Co. Limited Retail 86%** Thailand

Tesco Stores (Malaysia) Sdn Bhn Retail 70% Malaysia

Tesco Holdings (China) Co. Limited Retail 100% People’s Republic of China

Dobbies Garden Centres Limited Retail 100% Scotland

Fresh & Easy Neighborhood Market Inc. Retail 100% US

Tesco Personal Finance Group Limited* (trading as Tesco Bank) Financial Services 100% Scotland

Tesco Distribution Limited Distribution 100% England

Tesco Property Holdings Limited Property 100% England

Tesco International Sourcing Limited Purchasing 100% Hong Kong

dunnhumby Limited Data Analysis 100% England

ELH Insurance Limited Self-insurance 100% Guernsey

Valiant Insurance Company Limited Self-insurance 100% Republic of Ireland

* Held by the Parent Company (all other principal subsidiaries are held by an intermediate subsidiary).

** The Group has 86% of voting rights and 39% of issued ordinary share capital in Ek-Chai Distribution System Co. Limited.

The accounting period ends of the subsidiary undertakings consolidated in these financial statements are on or around 23 February 2013. A list

of the Group’s subsidiary undertakings will be annexed to the next Annual Return filed at Companies House. There are no significant restrictions

on the ability of subsidiary undertakings to transfer funds to the parent, other than those imposed by the Companies Act 2006.