Singapore Airlines 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

SIA Annual Report 03/04

Report by the Board of Directors

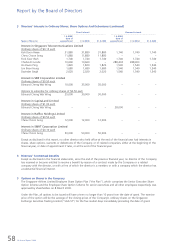

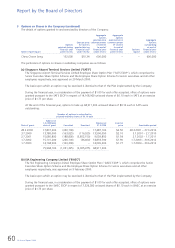

5 Options on Shares in the Company (continued)

(b) SIA Engineering Company Limited (“SIAEC”) (continued)

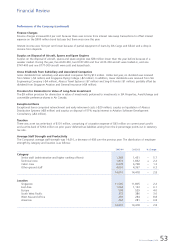

At the end of the financial year, options to take up 62,637,100 unissued shares of $0.10 each in SIAEC were

outstanding:

Number of options to subscribe for

unissued ordinary shares of $0.10 each

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at

1.4.2003/later Balance at Exercise

Date of grant date of grant Cancelled Exercised 31.3.2004 price Exercisable period

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

28.3.2000 14,704,750 (257,200) (3,600) 14,443,950 $2.05 28.3.2001 – 27.3.2010

3.7.2000 13,727,650 (173,200) (95,400) 13,459,050 $1.95 3.7.2001 – 2.7.2010

2.7.2001 15,337,000 (104,000) (4,095,900) 11,137,100 $1.41 2.7.2002 – 1.7.2011

1.7.2002 16,531,600 (361,900) – 16,169,700 $2.38 1.7.2003 – 30.6.2012

1.7.2003 7,526,300 (99,000) – 7,427,300 $1.75 1.7.2004 – 30.6.2013

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

67,827,300 (995,300) (4,194,900) 62,637,100

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

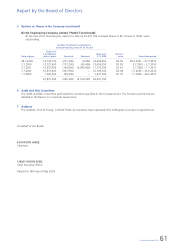

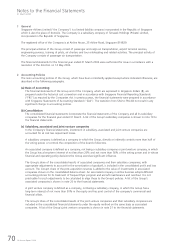

6 Audit And Risk Committee

The Audit and Risk Committee performed the functions specified in the Companies Act. The functions performed are

detailed in the Report on Corporate Governance.

7 Auditors

The auditors, Ernst & Young, Certified Public Accountants, have expressed their willingness to accept re-appointment.

On behalf of the Board,

KOH BOON HWEE

Chairman

CHEW CHOON SENG

Chief Executive Officer

Dated this 14th day of May 2004