Singapore Airlines 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

SIA Annual Report 03/04

Notes to the Financial Statements

31 March 2004

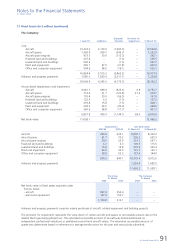

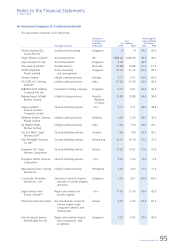

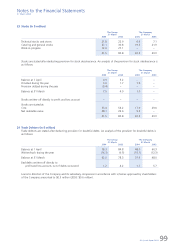

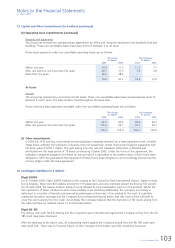

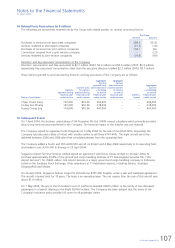

27 Trade Creditors (in $ million)

Included in trade creditors is provision for warranty claims. An analysis of provision for warranty claims is as follows:

The Group The Company

31 March 31 March

2004 2003 2004 2003

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 1.1 1.2 – –

Provided/(written-back) during the year 1.4 (0.1) – –

Provision utilized during the year (0.4) – – –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

2.1 1.1 – –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

28 Bank Overdrafts (in $ million)

$2.3 million (2003: nil) of the Group’s bank overdrafts are secured by a first legal mortgage over a building at 22

Senoko Way Singapore 758095. Interest is charged at rates ranging from 3.50% to 3.75% per annum in the current

financial year.

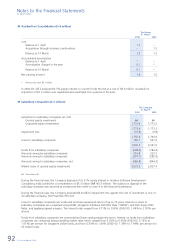

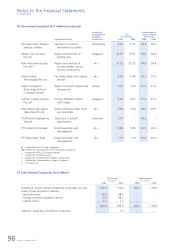

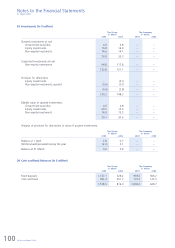

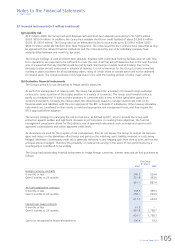

29 Cash Flow from Operating Activities (in $ million)

The Group

2003-04 2002-03

––––––––––––––––––––––––––––––––

Profit before taxation 820.9 976.8

Adjustments for:

Depreciation of fixed assets 1,180.2 1,090.3

Provision for impairment of fixed assets 28.0 43.2

Income from short-term investments (0.9) (0.9)

Exchange differences 2.0 15.0

Write-down of loan to associated companies 0.5 0.2

Amortization of deferred gain on sale and leaseback transactions (131.8) (134.7)

Finance charges 65.1 54.7

Interest income (32.5) (33.7)

Surplus on disposal of aircraft, spares and spare engines (102.7) (144.9)

Surplus on disposal of other fixed assets (5.5) (1.2)

Dividends from long-term investments (3.6) (5.2)

Provision for diminution in value of long-term investments 1.8 9.4

Amortization of goodwill on consolidation 0.1 –

Amortization of deferred gain (1.6) –

Share of profits of joint venture companies (6.4) (14.5)

Share of profits of associated companies (86.3) (123.8)

Surplus on liquidation of Abacus Distribution Systems Pte Ltd (9.2) –

Surplus on disposal of Aviation Software Development Consultancy India Limited (1.1) –

Surplus on liquidation of Asian Frequent Flyer Pte Ltd – (0.5)

––––––––––––––––––––––––––––––––

Operating profit before working capital changes 1,717.0 1,730.2

(Decrease)/increase in creditors (34.2) 49.7

Decrease/(increase) in short-term investments 18.1 (114.1)

Increase/(decrease) in sales in advance of carriage 149.4 (38.1)

(Increase)/decrease in debtors (104.6) 270.1

Decrease/(increase) in stocks 19.3 (13.3)

Increase in deferred revenue 1.1 8.8

Decrease/(increase) in amounts owing by associated and joint venture companies 1.1 (1.2)

––––––––––––––––––––––––––––––––

Cash generated from operations 1,767.2 1,892.1

Income taxes paid (50.8) (74.0)

––––––––––––––––––––––––––––––––

Net cash provided by operating activities 1,716.4 1,818.1

––––––––––––––––––––––––––––––––