Singapore Airlines 2004 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

SIA Annual Report 03/04

Notes to the Financial Statements

31 March 2004

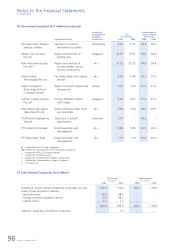

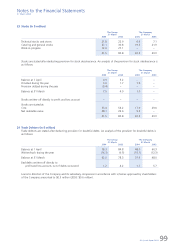

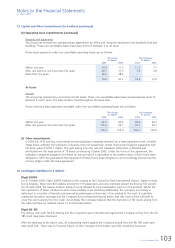

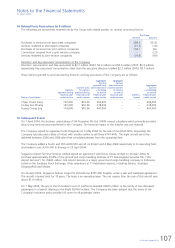

33 Financial Instruments (in $ million) (continued)

(g) Liquidity risk

At 31 March 2004, the Group had at its disposal cash and short-term deposits amounting to $1,518.5 million

(2003: $819.9 million). In addition, the Group had available short-term credit facilities of about $1,565.8 million

(2003: $1,550.0 million). The Group also has an alternative facility to issue notes up to $1,500.0 million (2003:

$300.0 million) under the Medium Term Note Programme. The notes issued by the Company have maturities as may

be agreed with the relevant financial institutions and the notes issued by one of its subsidiary company have

maturity dates between one month to ten years.

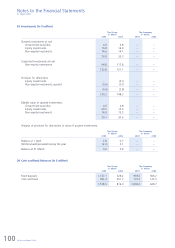

The Group’s holdings of cash and short-term deposits, together with committed funding facilities and net cash flow

from operations, are expected to be sufficient to cover the cost of all firm aircraft deliveries due in the next financial

year. It is expected that any shortfall would be met by bank borrowings or public market funding. Due to the

necessity to plan aircraft orders well in advance of delivery, it is not economical for the Group to have committed

funding in place at present for all outstanding orders, many of which relate to aircraft which will not be delivered

for several years. The Group’s policies in this regard are in line with the funding policies of other major airlines.

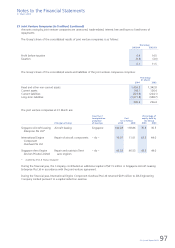

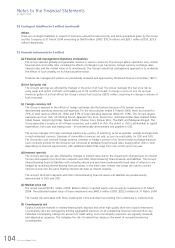

(h) Derivative financial instruments

The Group’s policy is to use derivatives to hedge specific exposures.

As part of its management of treasury risks, the Group has entered into a number of forward foreign exchange

contracts to cover a portion of the surplus position in a variety of currencies. The Group uses forward contracts

purely as a hedging tool. It does not take positions in currencies with a view to make speculative gains from

currency movements. Similarly, the Group enters into interest rate swaps to manage interest rate costs on its

financial assets and liabilities, with the prior approval of the BFC or Boards of Subsidiaries. Other treasury derivative

instruments are considered on their merits as valid and appropriate risk management tools, and they require the

BFC’s approval before adoption.

The Group’s strategy for managing the risk on fuel price, as defined by BFC, aims to provide the Group with

protection against sudden and significant increases in jet fuel prices. In meeting these objectives, the fuel risk

management programme allows for the judicious use of approved instruments such as swaps and options with

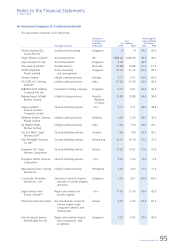

approved counterparties and within approved credit limits.

As derivatives are used for the purpose of risk management, they do not expose the Group to market risk because

gains and losses on the derivatives offset losses and gains on the matching asset, liability, revenues or costs being

hedged. Moreover, counterparty credit risk is generally restricted to any hedging gain from time to time, and not the

principal amount hedged. Therefore the possibility of material loss arising in the event of non-performance by a

counterparty is considered to be unlikely.

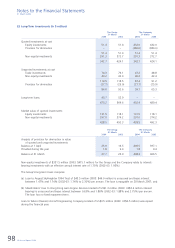

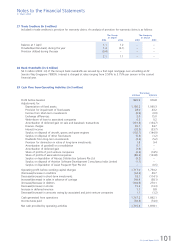

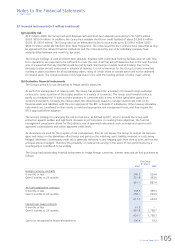

The Group had outstanding financial instruments to hedge foreign currencies, interest rates and jet fuel purchases as

follows:

The Group

31 March

2004 2003

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Foreign currency contracts

6 months or less 249.3 524.4

Over 6 months to 24 months 231.8 363.0

––––––––––––––––––––––––––––––––

481.1 887.4

––––––––––––––––––––––––––––––––

Jet fuel swap/option contracts

6 months or less 358.9 399.5

Over 6 months to 24 months 258.1 233.9

––––––––––––––––––––––––––––––––

617.0 633.4

––––––––––––––––––––––––––––––––

Interest rate swap contracts

6 months or less 61.3 –

Over 6 months to 24 months 867.8 1,758.7

––––––––––––––––––––––––––––––––

929.1 1,758.7

––––––––––––––––––––––––––––––––

Gains not recognized in financial statements 106.9 19.2

––––––––––––––––––––––––––––––––