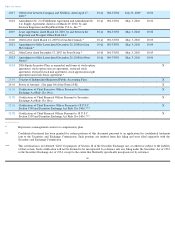

Shutterfly 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8.3 Form of Payment to Participant

. The Stock Bonus Award will be paid to the Participant currently. Payment may

be made in the form of cash, whole Shares, or a combination thereof, based on the Fair Market Value of the Shares earned under a Stock Bonus

Award on the date of payment.

8.4 Termination of Participant . In the event of a Participant’

s Termination during a Performance Period or vesting

period, for any reason, then such Participant will be entitled to payment (whether in Shares, cash or otherwise) with respect to the Stock Bonus

Award only to the extent earned as of the date of Termination in accordance with the Stock Bonus Agreement, unless the Committee determines

otherwise.

9. STOCK APPRECIATION RIGHTS .

9.1 Awards of SARs . A Stock Appreciation Right (“ SAR ”)

is an award to an eligible person that may be settled in

cash, or Shares (which may consist of Restricted Stock), having a value equal to the value determined by multiplying the difference between the

Fair Market Value on the date of exercise over the Exercise Price and the number of Shares with respect to which the SAR is being settled

(subject to any maximum number of Shares that may be issuable as specified in a SAR Agreement). The SAR may be granted for services to be

rendered or for past services already rendered to the Company, or any Parent or Subsidiary. All SARs shall be made pursuant to a SAR

Agreement, which shall be in substantially a form (which need not be the same for each Participant) that the Committee has from time to time

approved, and will comply with and be subject to the terms and conditions of this Plan.

9.2 Terms of SARs

. The Committee will determine the terms of each SAR including, without limitation: (a) the

number of Shares deemed subject to the SAR; (b) the Exercise Price and the time or times during which the SAR may be settled; (c) the

consideration to be distributed on settlement of the SAR; and (d) the effect on each SAR of the Participant’

s Termination. The Exercise Price of

the SAR will be determined by the Committee when the SAR is granted but, may not be less than Fair Market Value on the date of grant. A

SAR may be awarded upon satisfaction of such performance goals based on Performance Factors during any Performance Period as are set out

in advance in the Participant’

s individual SAR Agreement. If the SAR is being earned upon the satisfaction of performance goals, then the

Committee will: (x) determine the nature, length and starting date of any Performance Period for each SAR; and (y) select from among the

Performance Factors to be used to measure the performance, if any. Prior to settlement of any SAR earned upon the satisfaction of performance

goals pursuant to a SAR Agreement, the Committee shall determine the extent to which such SAR has been earned. Performance Periods may

overlap and Participants may participate simultaneously with respect to SARs that are subject to different performance goals and other criteria.

9.3 Exercise Period and Expiration Date

. A SAR will be exercisable within the times or upon the occurrence of events

determined by the Committee and set forth in the SAR Agreement governing such SAR. The SAR Agreement shall set forth the expiration date;

provided that no SAR will be exercisable after the expiration of ten (10) years from the date the SAR is granted. The Committee may also

provide for SARs to become exercisable at one time or from time to time, periodically or otherwise (including, without limitation, upon the

attainment during a Performance Period of performance goals based on Performance Factors), in such number of Shares or percentage of the

Shares subject to the SAR as the Committee determines.

9.4 Form and Timing of Settlement

. The portion of a SAR being settled may be paid currently or on a deferred basis

with such interest or dividend equivalent, if any, as the Committee determines, provided that the terms of the SAR and any deferral satisfy the

requirements of Section 409A of the Code.

10. RESTRICTED STOCK UNITS .

10.1 Awards of Restricted Stock Units . A Restricted Stock Unit (“ RSU ”)

is an award to an eligible person covering a

number of Shares that may be settled in cash, or by issuance of those Shares (which may consist of Restricted Stock) for services to be rendered

or for past services already rendered to the Company or any Parent or Subsidiary. All RSUs shall be made pursuant to a RSU Agreement, which

shall be in substantially a form (which need not be the same for each Participant) that the Committee has from time to time approved, and will

comply with and be subject to the terms and conditions of the Plan.

10.2 Terms of RSUs

. The Committee will determine the terms of a RSU including, without limitation: (a) the number

of Shares deemed subject to the RSU; (b) the time or times during which the RSU may be exercised; (c) the consideration to be distributed on

settlement, and the effect on each RSU of the Participant’

s Termination. A RSU may be awarded upon satisfaction of such performance goals

based on Performance Factors during any Performance Period as are set out in advance in the Participant’

s individual RSU Agreement. If the

RSU is being earned upon satisfaction of performance goals, then the Committee will: (x) determine the nature, length and starting date of any

Performance Period for the RSU; (y) select from among the Performance Factors to be used to measure the performance, if any; and

(z) determine the number of Shares deemed subject to the RSU. Prior to settlement of any RSU earned upon the satisfaction of performance

goals pursuant to a RSU Agreement, the Committee shall determine the extent to which such RSU has been earned. Performance Periods may

overlap and participants may participate simultaneously with respect to RSUs that are subject to different Performance Periods and different

performance goals and other criteria. The number of Shares may be fixed or may vary in accordance with such performance goals and criteria as

may be determined by the Committee.