Shutterfly 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

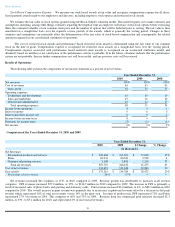

The provision for income taxes was $3.5 million for 2009, compared to a provision of $1.6 million for 2008. Our effective tax rate was 38%

in 2009, up from 30% in 2008. This increase in our effective tax rate is primarily the result of lower research and development tax credits

recorded in 2009, as compared to 2008.

As of December 31, 2009, we had approximately $32.7 million of state net operating loss carryforwards to reduce future regular taxable

income. These carryforwards will expire beginning in 2014 through 2016, if not utilized.

We recognized the remaining federal net operating loss

carryforward in 2009, except for federal net operating losses associated with our acquisition of TinyPictures in the amount of $1.7 million.

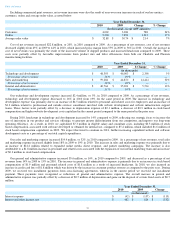

Net income increased by $2.2 million, or 60%, from 2008 to 2009. As a percentage of net revenue, net income was 3% of net revenue for

2009 compared to 2% for 2008.

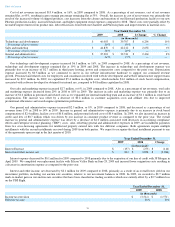

Liquidity and Capital Resources

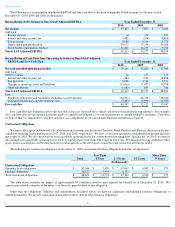

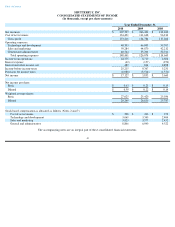

Our total capital resources were as follows (in thousands):

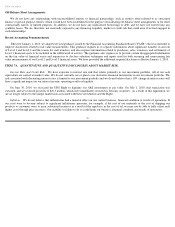

At December 31, 2010, we had $252.2 million of cash and cash equivalents. In January 2008, we purchased ARS investment held with

UBS AG ("UBS"), one of our investment providers. Since inception in 2008 and due to uncertainties in the credit markets, all scheduled auctions

began to fail and the investments were illiquid resulting in Level 3 financial asset classification. In November 2008, we accepted an offer (the

“Right”) from UBS entitling us to sell at par value ARS purchased from UBS at anytime during a two-

year period from June 30, 2010 through

July 2, 2012. On June 30, 2010, we exercised the Right to liquidate all of our ARS investments at par value. On July 1, 2010, that transaction

was executed and we received proceeds of $26.3 million, which were immediately invested in Treasury securities. With increased liquidity

resulting from the ARS redemption, we elected not to renew the $20.0 million line of credit facility with Silicon Valley Bank that expired on

June 23, 2010.

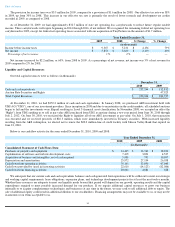

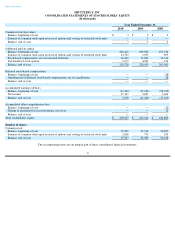

Below is our cash flow activity for the years ended December 31, 2010, 2009 and 2008:

We anticipate that our current cash and cash equivalents balances and cash generated from operations will be sufficient to meet our strategic

and working capital requirements, lease obligations, expansion plans, and technology development projects for at least the next twelve months.

Whether these resources are adequate to meet our liquidity needs beyond that period will depend on our growth, operating results and the capital

expenditures required to meet possible increased demand for our products. If we require additional capital resources to grow our business

internally or to acquire complementary technologies and businesses at any time in the future, we may seek to sell additional debt or equity. The

sale of additional equity could result in additional dilution to our stockholders. Financing arrangements may not be available to us, or may not be

in amounts or on terms acceptable to us.

Table of Contents

Year Ended December 31,

2009

2008

$ Change

% Change

(in thousands)

Income before income taxes

$

9,367

$

5,231

$

4,136

79

%

Net income

$

5,853

$

3,660

$

2,193

60

%

Percentage of net revenues

3

%

2

%

—

—

December 31,

2010

2009

Cash and cash equivalents

$

252,244

$

132,812

Auction Rate Securities and Rights

-

47,925

Total Capital Resources

$

252,244

$

180,737

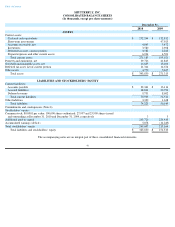

Year Ended December 31,

2010

2009

2008

(in thousands)

Consolidated Statement of Cash Flows Data:

Purchases of property and equipment

$

14,405

$

13,762

$

18,220

Capitalization of software and website development costs

7,405

3,891

4,527

Acquisition of business and intangibles, net of cash acquired

5,981

795

10,097

Depreciation and amortization

25,972

27,194

26,038

Cash flows from operating activities

76,161

53,890

47,040

Cash flows provided by (used in) investing activities

22,610

(14,123

)

(82,086

)

Cash flows from financing activities

20,661

4,881

628

34