Shutterfly 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

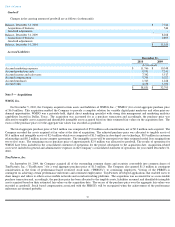

Purchase obligations consist of non-cancelable marketing and service agreements and co-

location services that expire at various dates

through the year 2014. As of December 31, 2010, the Company’s purchase obligations totaled $16,127,000.

Indemnifications

In the normal course of business, the Company enters into contracts and agreements that contain a variety of representations and warranties

and provide for general indemnifications. The Company’

s exposure under these agreements is unknown because it involves future claims that

may be made against the Company, but have not yet been made. To date, the Company has not paid any claims or been required to defend any

action related to its indemnification obligations. However, the Company may record charges in the future as a result of these indemnification

obligations.

Contingencies

From time to time, the Company may have certain contingent liabilities that arise in the ordinary course of its business activities. The

Company accrues contingent liabilities when it is probable that future expenditures will be made and such expenditures can be reasonably

estimated.

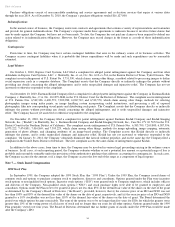

Legal Matters

On October 1, 2010, Express Card Systems, LLC filed a complaint for alleged patent infringement against the Company and four other

defendants in Express Card Systems, LLC. v. Shutterfly, Inc. et. al., Civ. No. 6:10-cv-

514, in the Eastern District of Texas, Tyler Division. The

complaint asserts infringement of U.S. Patent No. 5,751,590, which claims, among other things, a method related to processing images to define

social expression cards in a computer database. The Complaint asserts that the Company directly or indirectly infringes the patents without

providing any details concerning the alleged infringement, and it seeks unspecified damages and injunctive relief. The Company has not yet

answered or otherwise responded to the complaint.

On December 10, 2010, Eastman Kodak Company filed a complaint for alleged patent infringement against the Company in Eastman Kodak

Company v. Shutterfly, Inc., C.A. No. 10-1079-

SLR, in the U.S. District Court for the District of Delaware. The complaint asserts infringement

of U.S. Patents Nos. 6,549,306; 6,600,572; 7,202,982; 6,069,712; and 6,512,570, which claim among other things, methods for selecting

photographic images using index prints, an image handling system incorporating coded instructions, and processing a roll of exposed

photographic film into corresponding visual prints and distributing such prints. The Complaint asserts that the Company directly or indirectly

infringes the patents without providing any details concerning the alleged infringement, and it seeks unspecified damages and injunctive

relief. The Company has not yet answered or otherwise responded to the complaint.

On December 13, 2010, the Company filed a complaint for patent infringement against Eastman Kodak Company and Kodak Imaging

Network, Inc. (

“Kodak”)

in Shutterfly, Inc. v. Eastman Kodak Company and Kodak Imaging Network, Inc., Case No. CV 10 5672 in the U.S.

District Court for the Northern District of California. The complaint asserts infringement of U.S. Patents Nos. 6,583,799; 7,269,800; 6,587,596;

6,973,222; 7,474,801; 7,016,869; and 7,395,229, which claim among other things, methods for image uploading, image cropping, automatic

generation of photo albums, and changing attributes of an image-

based product. The Complaint asserts that Kodak directly or indirectly

infringes the patents, and it seeks unspecified damages and injunctive relief. Kodak has not yet answered or otherwise responded to the

complaint.

On January 31, 2011, the Company voluntarily dismissed that lawsuit without prejudice, and on the same day the Company filed a

complaint in the United States District of Delaware. The new complaint asserts the same claims of infringement against Kodak.

In addition to the above cases, from time to time, the Company may be involved in various legal proceedings arising in the ordinary course

of business. In all cases, at each reporting period, the Company evaluates whether or not a potential loss amount or a potential range of loss is

probable and reasonably estimable under the provisions of the authoritative guidance that addresses accounting for contingencies. In such cases,

the Company accrues for the amount, or if a range, the Company accrues the low end of the range as a component of legal expense.

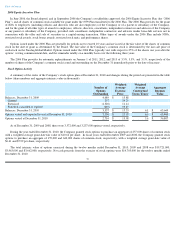

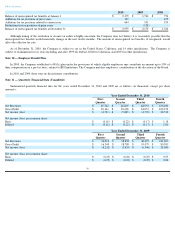

Note 7 — Stock Based Compensation

1999 Stock Plan

In September 1999, the Company adopted the 1999 Stock Plan (the “1999 Plan”).

Under the 1999 Plan, the Company issued shares of

common stock and options to purchase common stock to employees, directors and consultants. Options granted under the Plan were incentive

stock options or non-qualified stock options. Incentive stock options (“ISO”)

were granted only to Company employees, which includes officers

and directors of the Company. Non-qualified stock options (“NSO”)

and stock purchase rights were able to be granted to employees and

consultants. Options under the Plan were to be granted at prices not less than 85% of the deemed fair value of the shares on the date of the grant

as determined by the Company’s Board of Directors (“the Board”),

provided, however, that (i) the exercise price of an ISO and NSO was not

less than 100% and 85% of the deemed fair value of the shares on the date of grant, respectively, and (ii) the exercise price of an ISO and NSO

granted to a 10% stockholder was not less than 110% of the deemed fair value of the shares on the date of grant. The Board determined the

period over which options became exercisable. The term of the options was to be no longer than five years for ISOs for which the grantee owns

greater than 10% of the voting power of all classes of stock and no longer than ten years for all other options. Options granted under the 1999

Plan generally vested over four years. The Board of Directors determined that no further grants of awards under the 1999 Plan would be made

after the Company’s IPO.

Table of Contents

54