Shutterfly 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

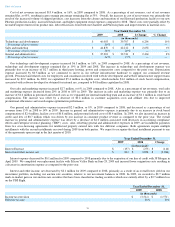

Interest expense decreased by $0.1 million or 73% for 2010 compared to 2009 primarily due to the expiration of our $20.0 million line of

credit facility with Silicon Valley Bank on June 23, 2010, which was not renewed.

Interest and other income, net decreased by $0.3 million for 2010 compared to 2009. The decrease was primarily due to the liquidation of

our ARS investments on July 1, 2010, which yielded higher returns and were subsequently invested in Treasury securities, which yielded lower

returns.

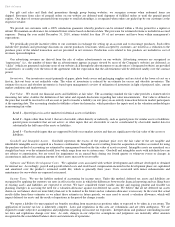

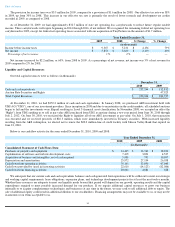

The provision for income taxes was $8.1 million for 2010, compared to a provision of $3.5 million for 2009. Our effective tax rate was 32%

in 2010, down from 38% in 2009. This decrease in our effective tax rate is primarily the result of disqualifying dispositions of incentive stock

option awards.

At December 31, 2010, we had approximately $32.7 million of state net operating loss carryforwards to reduce future regular taxable

income, of which $10.3 million is associated with windfall tax benefits that will be recorded as additional paid-

in capital when realized. These

carryforwards will expire beginning in 2016, if not utilized. We recognized the remaining federal net operating loss carryforward in 2010,

except for federal net operating losses associated with our acquisition of TinyPictures in the amount of $1.5 million.

Net income increased by $11.3 million, or 193%, from 2009 to 2010. As a percentage of net revenue, net income was 6% of net revenue for

2010 compared to 3% for 2009.

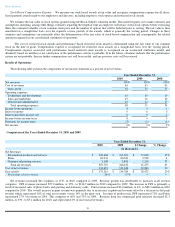

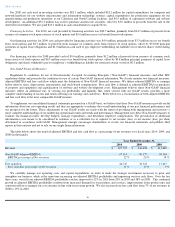

Comparison of the Years Ended December 31, 2009 and 2008

Net revenues increased $33.0 million, or 15%, in 2009 compared to 2008. Revenue growth was primarily attributable to an increase in

personalized products and services revenues and revenue from our commercial print initiative, offset by a decrease in print revenue. PPS

revenues increased $32.1 million, or 25%, to $161.7 million in 2009 compared to 2008. The increase in PPS is primarily a result of increased

sales of photo books, stationery cards and calendars. Print revenue decreased $2.7 million, or 3%, to $80.9 million in 2009 compared to

2008. 4x6 print revenue represented 14% of total net revenues versus 19% in the prior year. The decrease in overall print revenue was primarily

due to a lower average sales price for 4x6 prints which is a result of our price change in September 2008, offset partially by continued stable

growth in unit volumes. In terms of product mix, PPS represented 66% and Prints represented 33% of revenue in 2009. This compares to 61%

and 39% in 2008. Revenue from our commercial print initiative totaled $3.8 million for 2009, and represented 1% of our total net revenues.

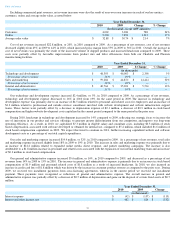

Excluding commercial print revenues, net revenue increases were also the result of year-over-

year increases in each of our key metrics:

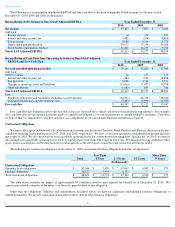

customers, orders and average order value, as noted below:

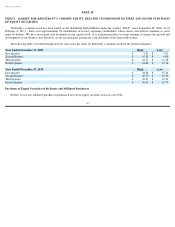

Table of Contents

Year Ended December 31,

2010

2009

(in thousands)

Income tax provision

$

(8,088

)

$

(3,514

)

Effective tax rate

32

%

38

%

Year Ended December 31,

2010

2009

$ Change

% Change

(in thousands)

Income before income taxes

$

25,215

$

9,367

$

15,848

169

%

Net income

$

17,127

$

5,853

$

11,274

193

%

Percentage of net revenues

6

%

3

%

—

—

Year Ended December 31,

2009

2008

$ Change

% Change

(in thousands)

Net revenues

Personalized products and services

$

161,650

$

129,523

$

32,127

25

%

Prints

80,941

83,609

(2,668

)

(3

)

Commercial printing services

3,841

348

3,493

1004

Total net revenues

246,432

213,480

32,952

15

Cost of net revenues

111,648

96,214

15,434

16

Gross profit

$

134,784

$

117,266

$

17,518

15

%

Percentage of net revenues

55

%

55

%

—

—

Year Ended December 31,

2009

2008

Change

% Change

(in thousands, except AOV amounts)

Customers

3,281

2,789

493

18

%

Orders

7,891

7,569

322

4

%

Average order value

$

30.74

$

28.16

$

2.58

9

%